Astera Labs Listings Hit New Heights: A Look at Their Recent Success

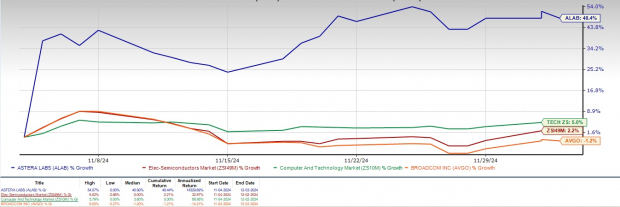

Astera Labs’ Recent Performance Compared to Industry Peers

Astera Labs (ALAB) shares have surged 48.4% over the past month, significantly outperforming the broader Zacks Computer & Technology sector, which saw a return of only 5%, and the Zacks Electronics – Semiconductors industry, which declined by 2.2%. In contrast, Broadcom (AVGO) has stumbled, losing 1.2% during the same period.

The rising performance of ALAB can be attributed to the growing demand for artificial intelligence servers and robust data center infrastructure.

Performance Snapshot Over the Past Month

Image Source: Zacks Investment Research

Astera Labs is also seeing positive contributions from its product lines, including Aries, Taurus, Leo, and the newly released Scorpio Smart Fabric Switches.

The company achieved a record revenue of $113.1 million in the third quarter of 2024, a remarkable increase of 47% from the previous quarter and a 206% spike year-over-year.

Innovative Portfolio Expansion Fuels Growth Potential

Astera Labs is a leader in technology innovation, particularly focusing on connectivity solutions essential for AI and cloud infrastructure. In the third quarter of 2024, they introduced the Scorpio Smart Fabric Switches, tailored for AI infrastructure at cloud scale, featuring P-Series for PCIe Gen 6 connectivity and X-Series for GPU clustering. This addition could substantially expand Astera Labs’ total market opportunity, which is expected to exceed $12 billion by 2028.

In June, Astera Labs showcased the industry’s first end-to-end PCIe optical connectivity solution for larger, disaggregated GPU clusters, enhancing their Aries family of Smart DSP Retimers and Smart Cable Modules for improved data center connectivity.

The success of their PCIe retimers in the Aries product line indicates significant growth potential for Astera Labs within the PCIe retimer market.

According to a recent report by Valuates, the global PCIe retimer market is anticipated to grow at a compound annual growth rate (CAGR) of 46.8% from 2024 to 2030, signaling substantial opportunities for ALAB.

Collaborations Enhance Market Positioning

Astera Labs has significantly impacted the AI industry through collaborations with major chipmakers, including NVIDIA (NVDA), Advanced Micro Devices (AMD), Micron Technology, and Intel.

Astera Labs products feature in NVIDIA’s GB200 product line, suggesting that PCIe switches may become vital in future NVIDIA offerings. This partnership highlights Astera Labs’ role in developing advanced AI technologies.

AMD collaborates with Astera Labs to improve the effectiveness and scalability of its AI-powered products, creating synergies that benefit both companies in the competitive AI market.

Positive Earnings Outlook for ALAB

Astera Labs anticipates continued growth due to the steady demand for their AI-related products and an expanding customer base.

Looking towards the fourth quarter of 2024, the company expects robust growth from its Aries product family across various AI platforms, along with increased production of Taurus SCM for 400-gig applications and preproduction shipments of Scorpio P-Series switches.

For this upcoming quarter, ALAB targets revenues between $126 million and $130 million, indicating a growth rate of 11% to 15% year-over-year. The Zacks Consensus Estimate places fourth-quarter revenues at $128.20 million.

In terms of non-GAAP earnings, ALAB forecasts earnings between 25 and 26 cents per share, with the Zacks Consensus Estimate sitting at 26 cents, reflecting a notable 36% increase in estimates over the past month.

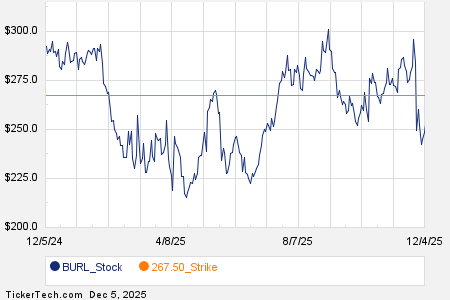

AlAB Price Trends and Consensus Analysis

Astera Labs, Inc. price-consensus-chart | Astera Labs, Inc. Quote

Check out the latest EPS estimates and surprises on Zacks Earnings Calendar.

Investment Insights on ALAB Stock

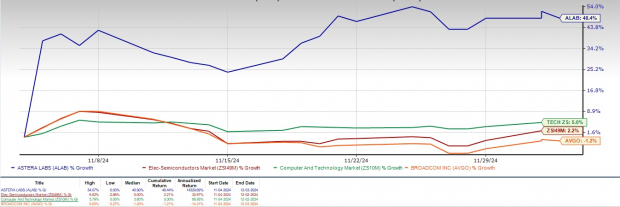

Currently, ALAB stock is considered somewhat expensive, with a Value Score of F.

In terms of projected 12-month Price/Sales ratio, ALAB is trading at 27.86X, far above the industry average of 6.2X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Despite a strong product portfolio, ALAB must contend with growing competition in the AI and cloud sectors, particularly from larger semiconductor companies enhancing their offerings for AI infrastructure.

Astera Labs currently holds a Zacks Rank #3 (Hold), suggesting that investors may want to hold off before buying more stocks until conditions improve for entry. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Access Zacks’ Top Buys for Just $1

Yes, it’s true.

Years ago, we surprised our members by offering 30 days of access to our recommendations for only $1, with no strings attached.

Many have benefitted, while others hesitated, thinking there must be a catch. There is a reason for this offer: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others that achieved significant gains in 2023.

Get Stocks Now >>

Want to discover the latest stock recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Astera Labs, Inc. (ALAB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.