iShares Core S&P Mid-Cap ETF Sees $454 Million Outflow This Week

Today, we examine the week-over-week changes in shares outstanding for various ETFs, highlighting the iShares Core S&P Mid-Cap ETF (Symbol: IJH). This ETF has experienced a significant outflow of approximately $454 million, which represents a 0.5% decrease in shares outstanding—from 1,535,400,000 to 1,527,050,000. Notably, some of the major components of IJH, such as RB Global Inc (Symbol: RBA), are up about 0.2%, EMCOR Group, Inc. (Symbol: EME) has risen by about 0.6%, and Fidelity National Financial Inc (Symbol: FNF) is higher by approximately 2.8%. For further details on its holdings, visit the IJH Holdings page.

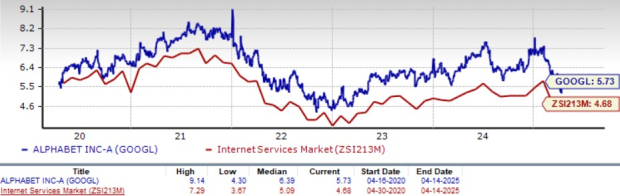

The chart below illustrates the one-year price performance of IJH compared to its 200-day moving average:

Analyzing the chart, IJH has a 52-week low of $50.15 per share and a high of $68.33, with the latest trading price at $55.02. Comparing the most recent share price to the 200-day moving average can provide valuable insights; to learn more about this analysis technique, visit the 200-day moving average page.

Exchange-traded funds (ETFs) operate similarly to stocks. However, when buying ETFs, investors acquire ”units” instead of ”shares”. These ”units” can be traded like stocks but can also be created or destroyed based on investor demand. Each week, we monitor changes in shares outstanding to identify ETFs experiencing significant inflows (indicating many new units are created) or outflows (referring to the destruction of units). The creation of new units necessitates the purchase of underlying holdings, while the destruction requires selling these holdings. Thus, large flows can also affect the individual components held within the ETFs.

![]() Click here for information on 9 other ETFs that have experienced notable outflows.

Click here for information on 9 other ETFs that have experienced notable outflows.

See also:

- BSM Average Annual Return

- CETX Insider Buying

- Institutional Holders of MHUA

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.