iShares 1-3 Year Treasury Bond ETF Sees Major Inflow of $455.1 Million

In the latest week-over-week analysis of shares outstanding across Exchange Traded Funds (ETFs), the iShares 1-3 Year Treasury Bond ETF (Symbol: SHY) has stood out with a substantial influx of approximately $455.1 million. This amounts to a 1.9% increase in outstanding units, rising from 285,800,000 to 291,300,000.

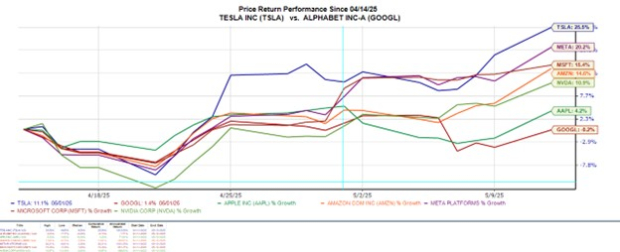

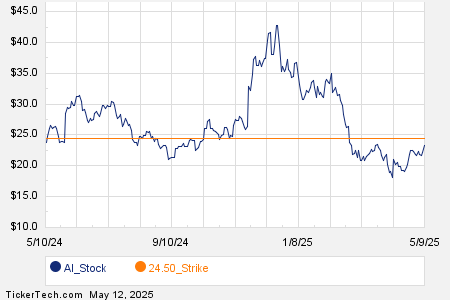

The accompanying chart illustrates SHY’s price performance over the last year compared to its 200-day moving average:

According to the chart, SHY’s 52-week trading range fluctuates between a low of $80.91 per share and a high of $83.30, with the last recorded trade at $82.85. Examining the latest share price in relation to the 200-day moving average can also offer insights for technical analysis, providing investors a deeper understanding of market trends.

Exchange traded funds operate similarly to stocks, where investors trade “units” rather than “shares.” These units can be bought or sold like stocks, and they can also be created or destroyed based on investor demand. Every week, we analyze the changes in shares outstanding to identify ETFs with significant inflows (indicating new units created) or outflows (indicating units that have been removed). An increase in units necessitates the purchase of the ETF’s underlying holdings, while a decrease involves selling these holdings, therefore creating potential impacts on the individual components of the ETF.

![]()

Click here to discover which 9 other ETFs had notable inflows »

Also see:

- Top Ten Hedge Funds Holding HSON

- BERY Stock Predictions

- Institutional Holders of SBND

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.