“`html

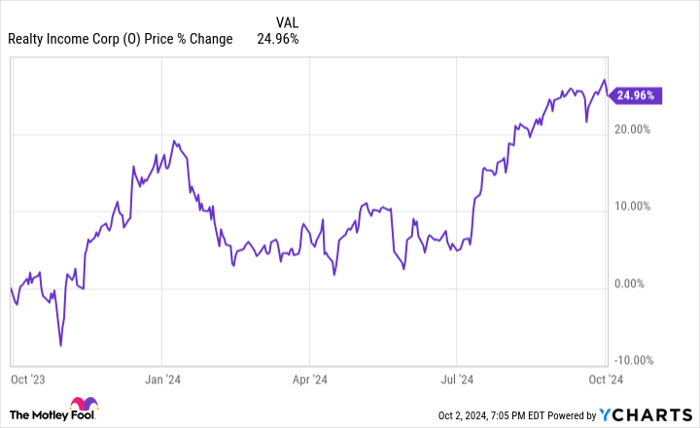

Realty Income (NYSE: O) has experienced a 25% drop since before the pandemic, a modest decline compared to other stocks but indicative of struggles amid high interest rates. Despite being up 25% over the last year, the stock battles with ongoing rate pressures.

Realty Income, a REIT specializing in net leased properties, owns nearly 15,500 properties across the U.S. and seven other countries, with an occupancy rate close to 99%. Its annual dividend now stands at $3.16 per share, yielding 5.1%, significantly surpassing the S&P 500 average yield of 1.25%. The company’s revenue reached $2.6 billion for the first half of 2024, a 32% increase driven by acquisitions like Spirit Realty, which added over 2,000 properties.

With a price-to-FFO ratio of around 15, Realty Income is considered reasonably priced given its growth potential and consistent dividend payouts since 1994.

“`