By RoboForex Analytical Department

Aussie Dollar Faces Continued Decline Amid Cooling Inflation Data

Pressure mounts on the Australian dollar as AUD/USD slides further, reaching a low of 0.6539, the weakest level seen since August. This downward trend, which kicked off on October 1, shows little sign of easing.

Inflation Dynamics and Monetary Policy Insights

Recent statistics reveal that Australia’s annual inflation decreased to 2.8% in the third quarter, down from 3.8% in the previous quarter. This figure slightly underperformed expectations of 2.9%. While it falls within the Reserve Bank of Australia’s (RBA) target range of 2-3%, the core inflation rate remains elevated at 3.5% year-on-year in Q3. As core inflation persists, the RBA has no immediate reason to lower interest rates.

The central bank has indicated that it must see inflation stabilize before considering any monetary easing. The next RBA meeting, taking place next week, is not expected to adjust the current interest rate, which stands at 4.35% per annum. Forecasts suggest that reductions in rates are unlikely until at least May 2025.

Technical Outlook for AUD/USD

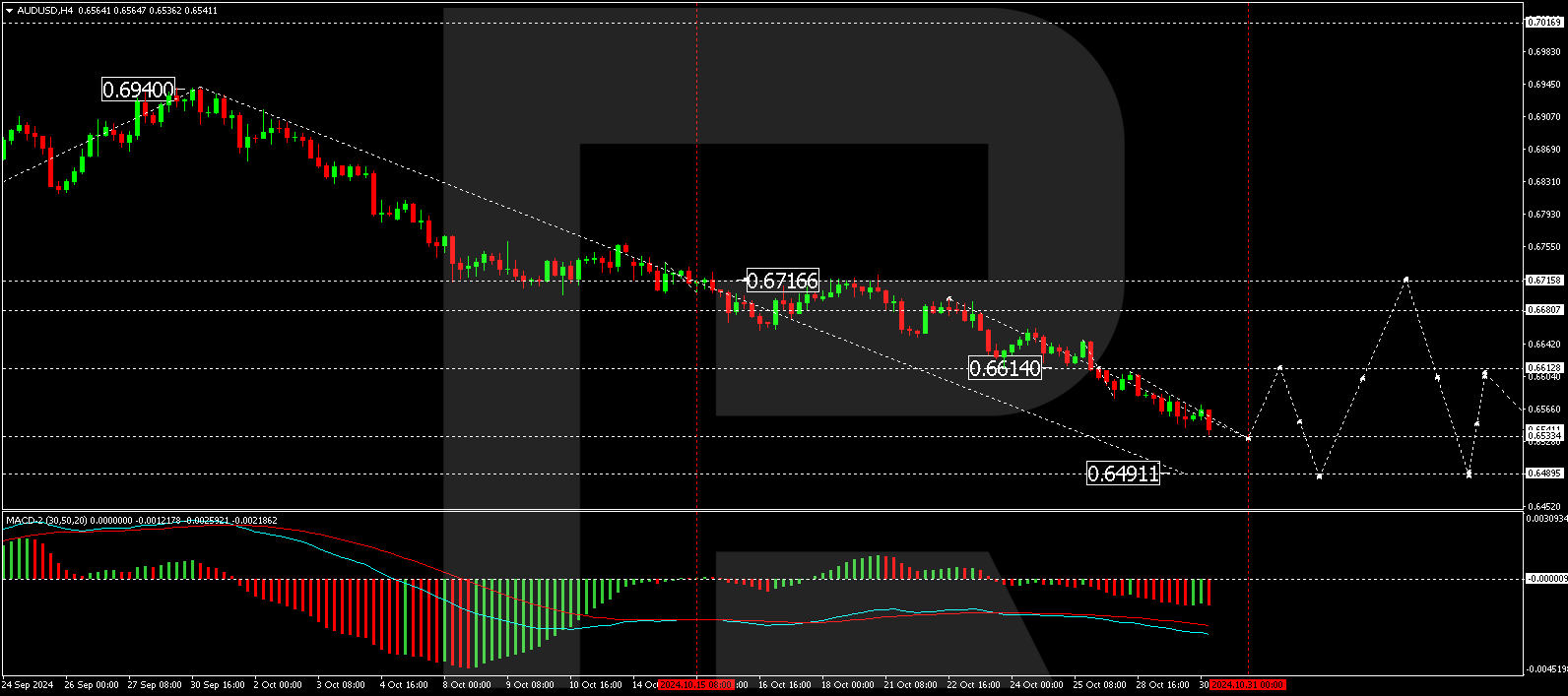

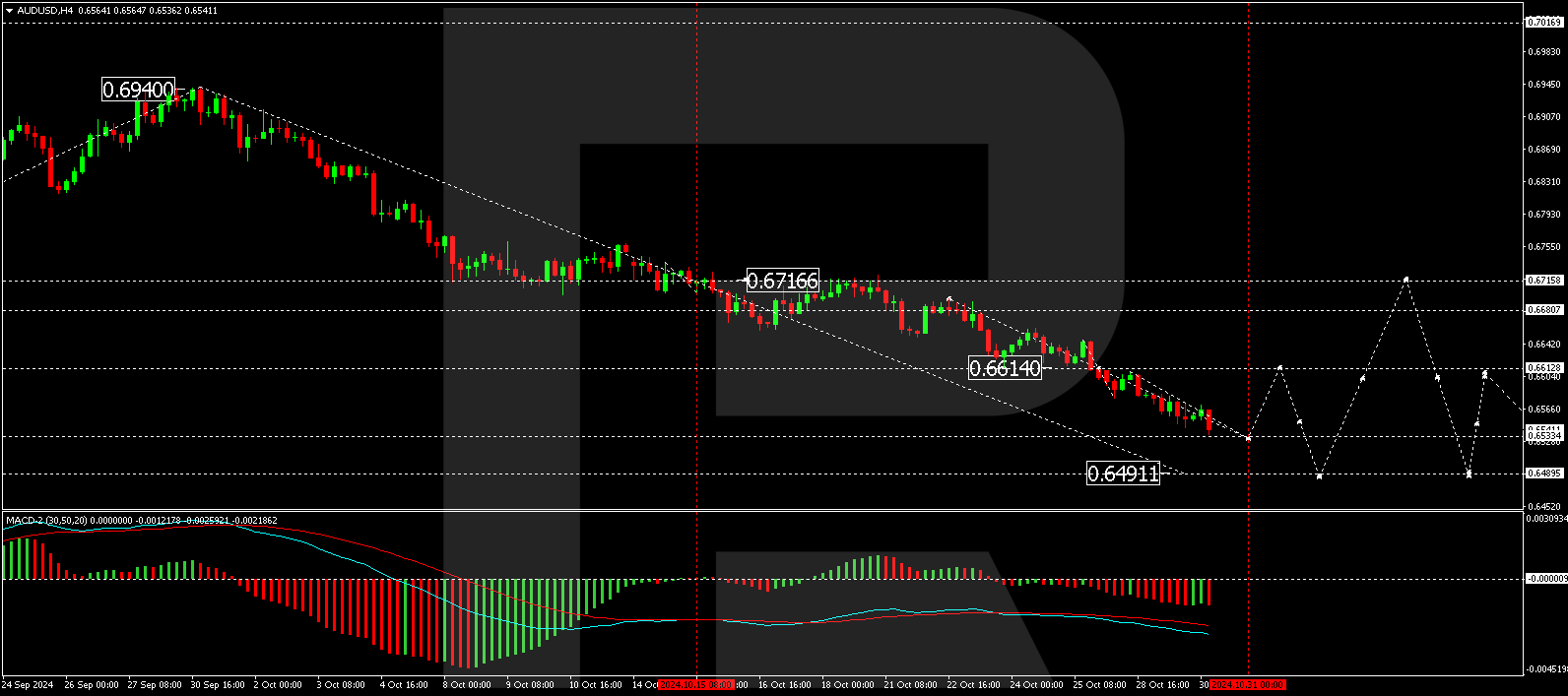

As the AUD/USD pair continues its downward trajectory, it is targeting the 0.6533 level. Should this point be reached, a corrective rally toward 0.6613 may occur before the downtrend resumes towards 0.6491. The MACD indicator supports this bearish sentiment, with its signal line situated well below zero, reflecting ongoing downward momentum.

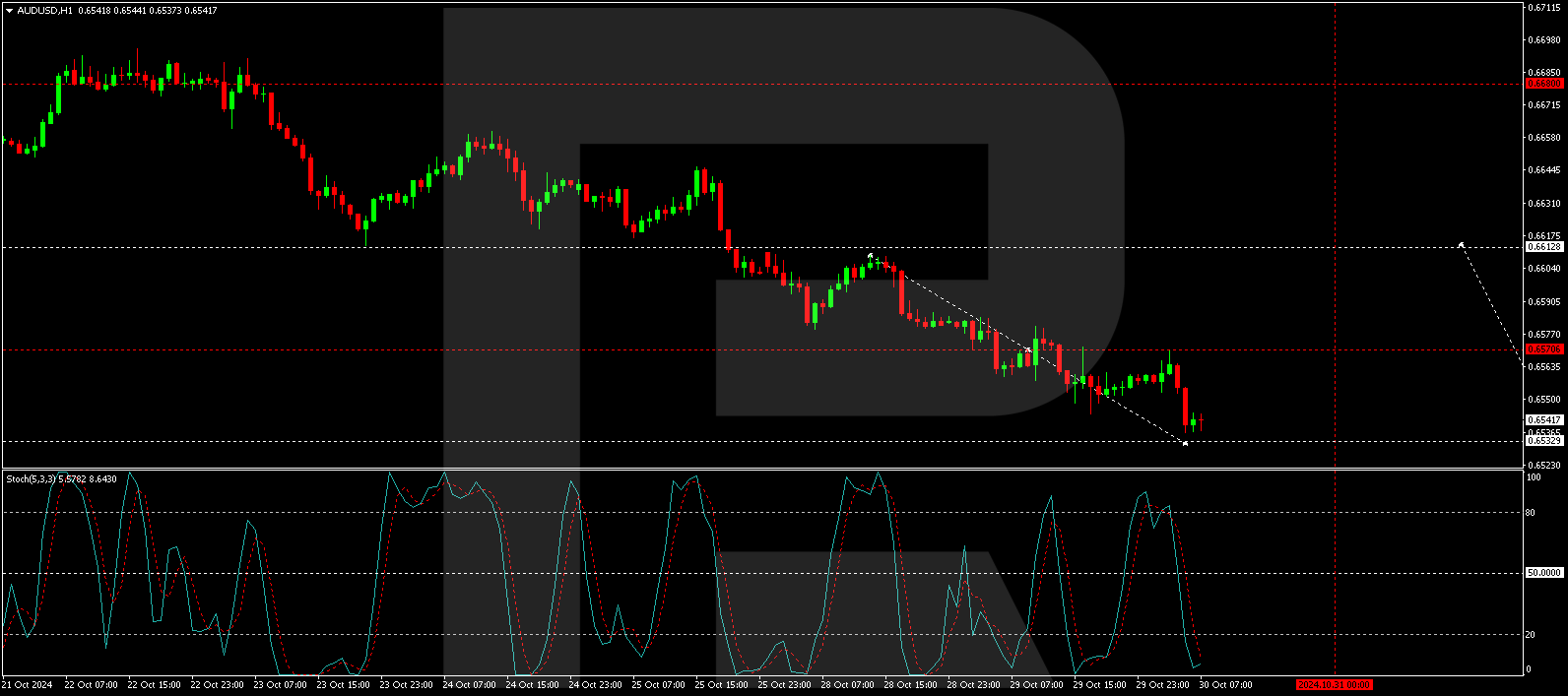

An hourly analysis shows the AUD/USD establishing a consolidation pattern around 0.6570, which has broken downward toward 0.6533. A correction towards 0.6613 may begin upon reaching this lower level, with an intermediate objective at 0.6570. This possible upward movement is bolstered by the Stochastic oscillator, whose signal line is currently below 20 but is positioned to rise to 80, indicating a potential short-term relief from selling pressures.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs