Core News Summary:

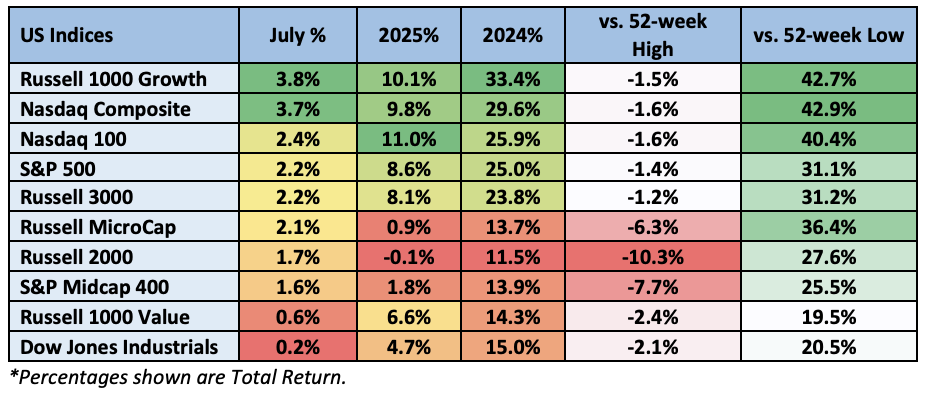

The U.S. stock market experienced significant gains in July, with both the S&P 500 and Nasdaq reaching new highs, fueled by easing trade tensions and a successful earnings season. Notably, approximately 83% of S&P 500 companies reported earnings above estimates. Trade agreements with the EU and Japan and ongoing talks with China, coupled with the Federal Reserve’s decision to hold interest rates steady, contributed to the economic optimism.

During “Crypto Week” from July 14-18, the U.S. House passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) with a vote of 308-122, which was signed into law on July 18. This legislation establishes a federal regulatory framework for stablecoins, requiring issuers to back coins with high-quality liquid assets. The Digital Asset Market Clarity (CLARITY Act) also advanced, passing with a 294-134 vote on July 18, while Texas established the first state-managed Bitcoin reserve, marking significant advancements in digital asset regulation.

Economic indicators showed mixed results, with June payrolls surpassing expectations, lowering the unemployment rate to 4.1%. However, job growth is anticipated to cool in July. CPI and PPI data were lower than expected, and the Federal Reserve remains cautious about future rate cuts amid ongoing uncertainty in trade relations and inflation.