The winds of change are blowing in the world of Aurora Cannabis (NasdaqCM:ACB). Analysts have ratcheted up the target price to 6.05 per share, marking a staggering 788.29% surge from the previous estimate of 0.68 as of January 18, 2024.

This upward trajectory is no mere blip on the radar. The revised target is an amalgamation of numerous projections by industry experts, with the most recent figures spanning from a low of 4.48 to a high of 9.71 per share. Such optimism translates to an 86.69% increment from the latest recorded closing price of 3.24 per share.

The Pulse of Fund Sentiment

Analyze this: 233 funds or institutions have disclosed their stakes in Aurora Cannabis. This signals a decrease of 11 individual holders, constituting a 4.51% dip over the recent quarter. The average weight of ACB in all portfolios now stands at 0.05%, indicating a notable hike of 3.55%. Institutions collectively own 43,375K shares, showing a marginal decline of 0.76% in the past three months.

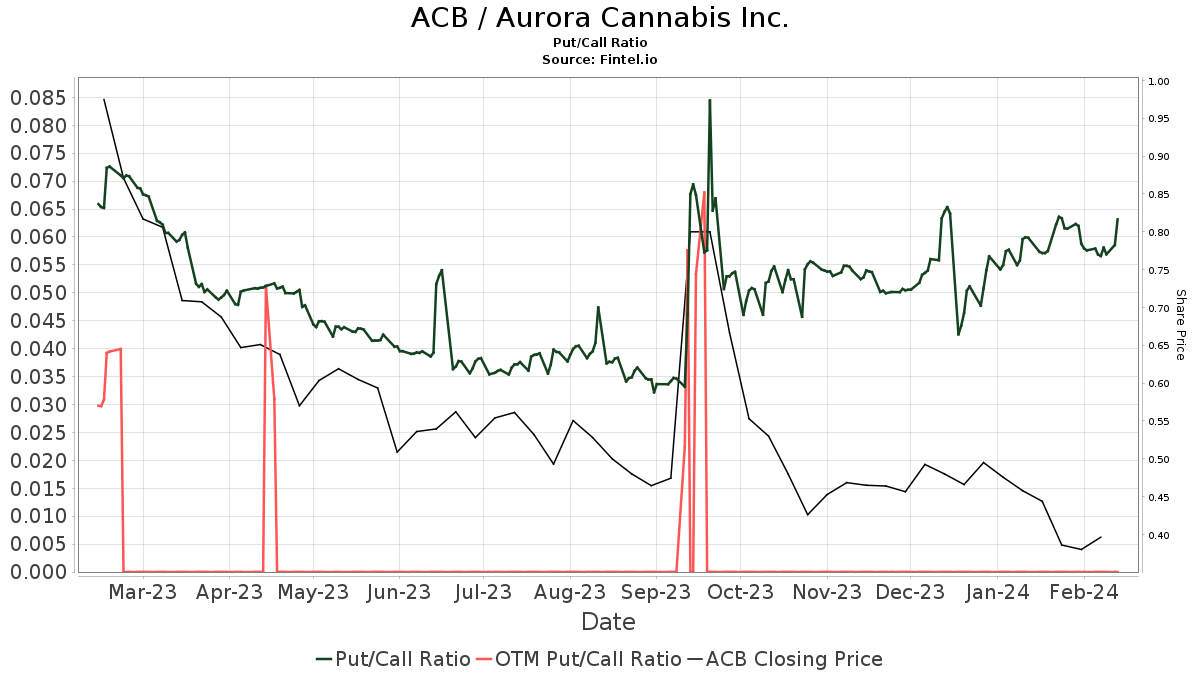

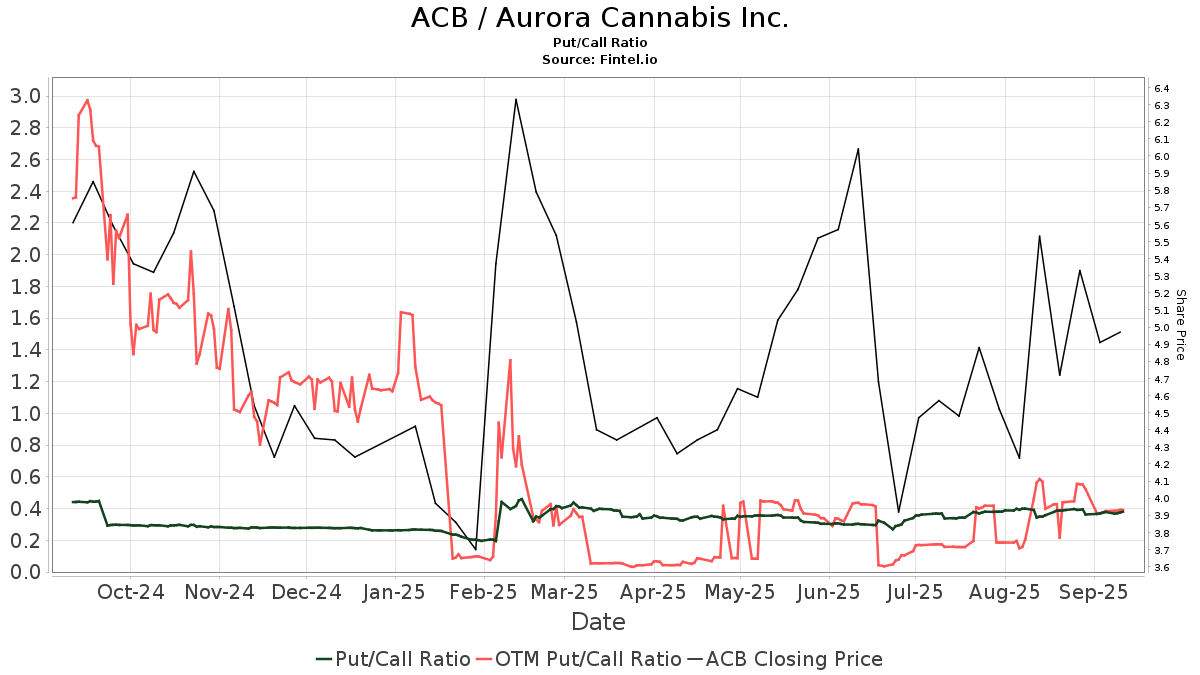

Behold! The put/call ratio of ACB stands at 0.06, painting a bullish vista.

Insights into Shareholder Movements

MJ – ETFMG Alternative Harvest ETF has upped its ownership stake by 25.05%, now holding 15,194K shares. Meanwhile, Renaissance Technologies boosted its ACB portfolio by 38.30%, encompassing 10,300K shares. Additionally, POTX – Global X Cannabis ETF has seen a 0.57% increase in ownership, and Mirae Asset Global Investments Co. has curtailed its ownership by 9.21% over the recent quarter.

Two Sigma Investments, in a bold move, has escalated its shares by 86.05%, marking a 398.10% increase in its ACB portfolio allocation.

Unveiling Aurora Cannabis

(As elucidated by the company itself.)

Aurora Cannabis shines as a global beacon in the cannabis realm, catering to both medical and consumer segments. Based in Canada, Aurora stands tall as a pioneer in the worldwide cannabis sphere, devoted to enhancing lives. With a brand array including Aurora, Aurora Drift, San Rafael ’71, Daily Special, AltaVie, MedReleaf, CanniMed, Whistler, and Reliva, the company vows to provide innovative, top-tier cannabis and hemp products. Aurora’s brands continue to blaze trails as market leaders across medical, recreational, wellness, and performance segments wherever they make landfall.

Looking for investment insights? Fintel is your go-to investing research platform, catering to individual investors, traders, financial advisors, and small hedge funds.

Delving into a treasure trove of data encompassing fundamentals, analyst reports, ownership intel, fund sentiment, options behavior, insider happenings, unusual trades, and much more, Fintel offers a springboard toward enhanced profits with its exclusive stock picks powered by advanced quantitative models.

Feel the Wall Street fever rising? Dive deeper into the story on Fintel.

Remember, the sentiments and viewpoints expressed here belong to the author and may not necessarily align with those of Nasdaq, Inc.