Ron Finklestien

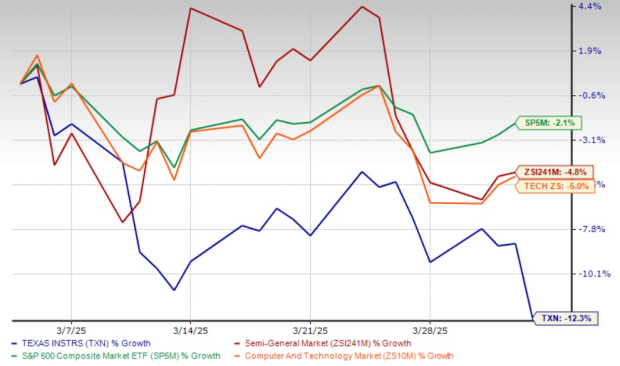

Is Now the Time to Buy or Sell TXN Stock After a 12% Decline This Month?

Texas Instruments Shares Drop: What Should Investors Do? Texas Instruments (TXN) has seen its shares decline by 12.3% in the last month. This performance ...

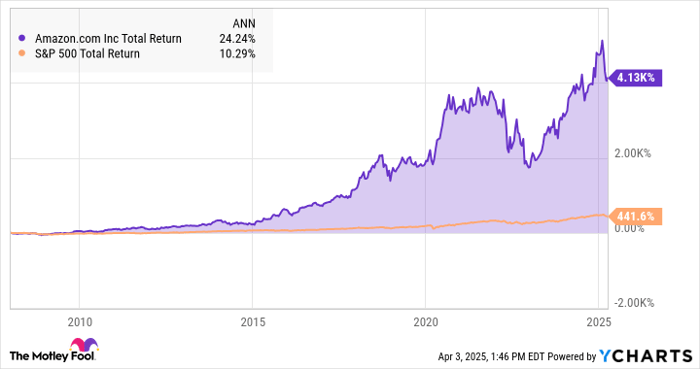

“Why I’m Holding Onto Amazon Stock Despite Tariff Challenges”

Market Turmoil: Amazon Faces Setback Amid New Tariffs On Thursday, the S&P 500 (SNPINDEX: ^GSPC) plummeted nearly 5% as President Trump’s tariffs impacted the ...

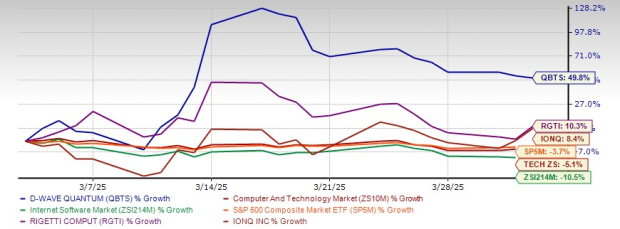

“Exploring the 38% Surge of D-Wave Quantum in March: Should You Invest in QBTS?”

Quantum Computing: D-Wave Quantum Inc. Gains Momentum in 2025 Quantum computing is on the verge of becoming a major technological revolution, with the potential ...

Will Nice’s AI-Driven Fraud Prevention Technology Boost Stock Prices?

NICE Actimize Unveils Next-Gen AI Platform for Fraud Prevention NICE has launched the advanced AI-powered platform X-Sight ActOne. This next-generation tool aims to revolutionize ...