Ron Finklestien

Significant Thursday Options Trading Insights: ESTC, ROKU, VRT

Significant Options Trading Activity in Russell 3000 Components Today’s options trading reveals notable activity among several components of the Russell 3000 Index. Specifically, Elastic ...

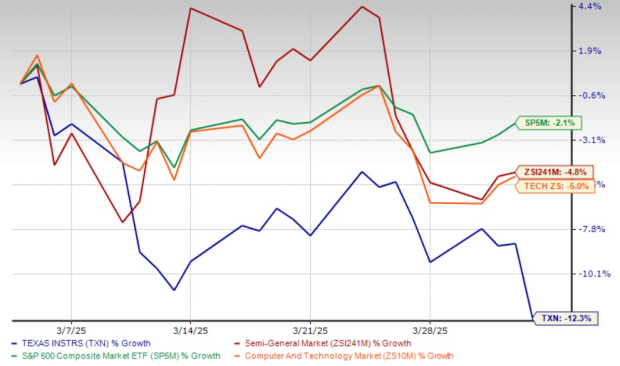

Is Now the Time to Buy or Sell TXN Stock After a 12% Decline This Month?

Texas Instruments Shares Drop: What Should Investors Do? Texas Instruments (TXN) has seen its shares decline by 12.3% in the last month. This performance ...

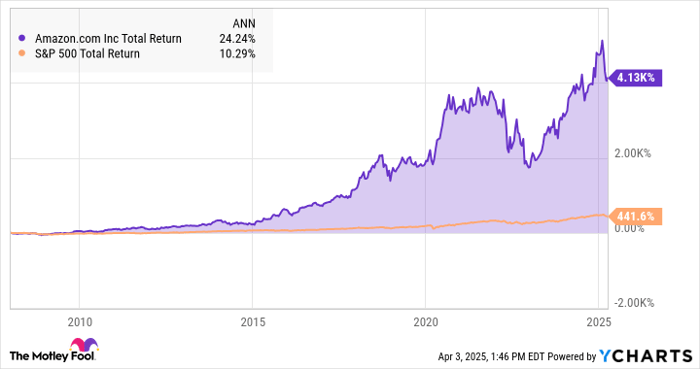

“Why I’m Holding Onto Amazon Stock Despite Tariff Challenges”

Market Turmoil: Amazon Faces Setback Amid New Tariffs On Thursday, the S&P 500 (SNPINDEX: ^GSPC) plummeted nearly 5% as President Trump’s tariffs impacted the ...

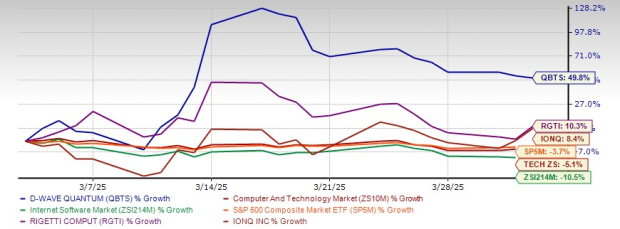

“Exploring the 38% Surge of D-Wave Quantum in March: Should You Invest in QBTS?”

Quantum Computing: D-Wave Quantum Inc. Gains Momentum in 2025 Quantum computing is on the verge of becoming a major technological revolution, with the potential ...