Ron Finklestien

Comparing AI Stock Leaders: Nvidia vs. Broadcom

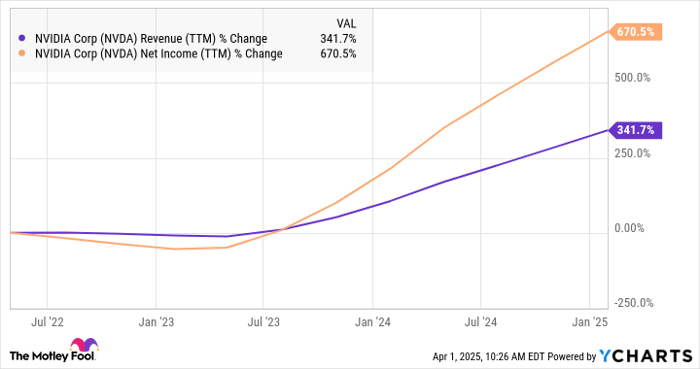

Investing Insights: Nvidia vs. Broadcom in AI Market Both Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) have significantly benefited from major investments in artificial ...

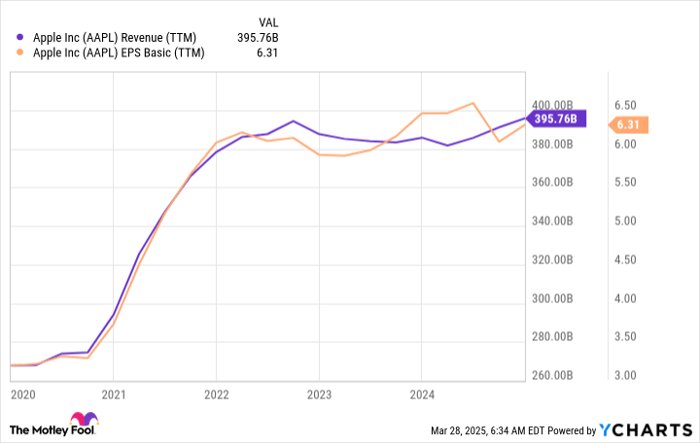

Four AI Stocks Poised to Outperform Apple by 2030: A Predictive Analysis

Four Companies Poised to Surpass Apple by 2030 Apple (NASDAQ: AAPL) currently holds the title of the world’s largest company by a significant margin, ...

The Incredible Growth of Tesla: A $10,000 Investment from a Decade Ago and Its Value Today

Tesla’s Ten-Year Journey: Record Returns and Future Prospects Let’s get to the numbers. If you had invested $10,000 in Tesla ten years ago, your ...

Google Negotiating Rental of Nvidia’s Blackwell Chips from CoreWeave, According to Reports

Google Collaborates with CoreWeave Amid Growing AI Demand Alphabet Inc.’s GOOG GOOGL Google is taking steps to enhance its artificial intelligence (AI) and computing ...