Ron Finklestien

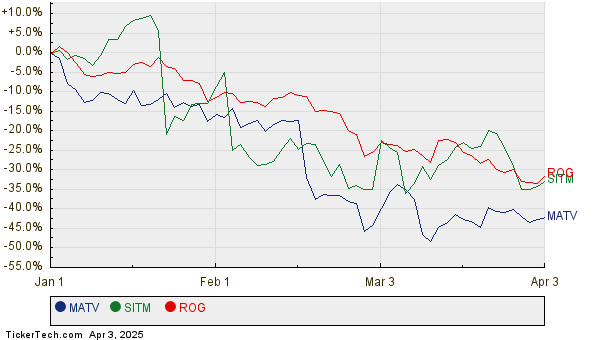

Analyzing Match Group’s Stock Performance Against Nasdaq Trends

—

Match Group Faces Challenges Amid Growing Competition in Dating Market Match Group, Inc. (MTCH), based in Dallas, Texas, leads the online dating sector. With ...

Evaluating INTC Stock: Is Continued Investment Justified Amid Positive Growth Signals?

—

Intel Outperforms Competitors Amid Industry Struggles Intel Corporation (INTC) experienced a 10.6% increase in share price over the past three months, standing in stark ...