Ron Finklestien

Analyzing MercadoLibre: A Clash of Bullish and Bearish Perspectives

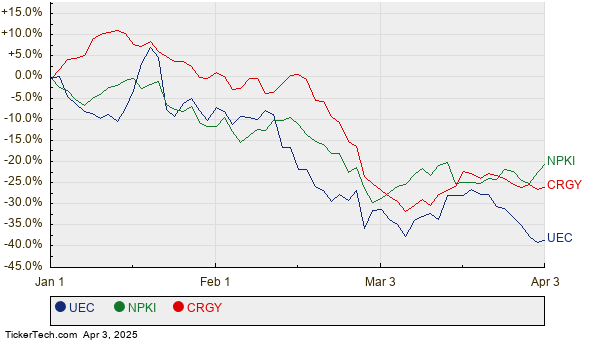

Assessing MercadoLibre’s Investment Potential: Risks and Rewards MercadoLibre (NASDAQ: MELI) has shown remarkable growth, yielding a staggering 342% return for investors over the past ...

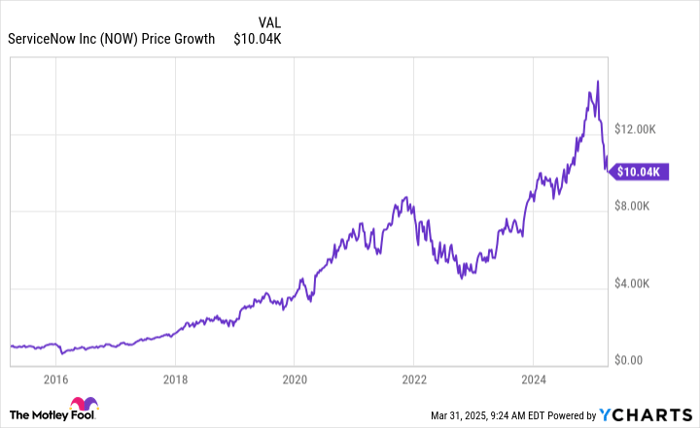

The Growth of a $1,000 Investment in ServiceNow Stock Over the Past Decade: A Financial Journey

ServiceNow Achieves Impressive Growth: Is It Still a Good Investment? ServiceNow (NYSE: NOW) specializes in cloud-based workflow management software. While the company has been ...

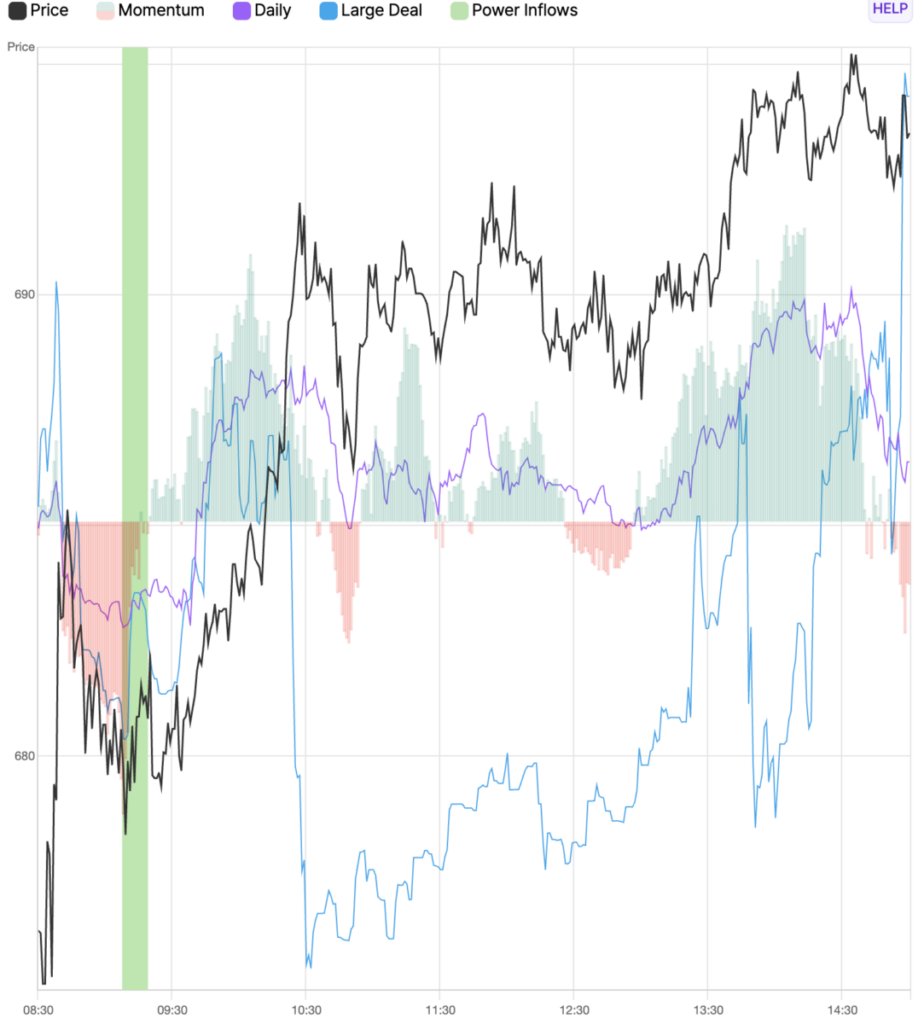

McKesson Stock Rises Over 2% Following Significant Indicator

McKesson Inc. Sees 14-Point Gain Following Power Inflow Signal McKesson Inc. (MCK) witnessed a notable increase, gaining over 14 points after a recent Power ...

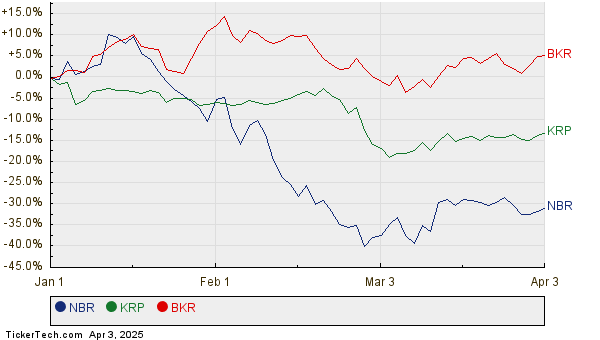

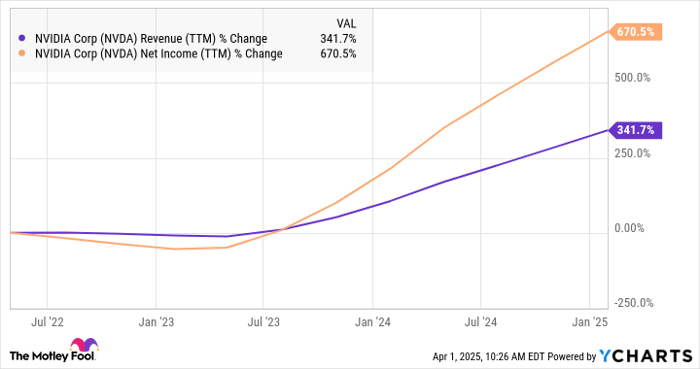

Comparing AI Stock Leaders: Nvidia vs. Broadcom

Investing Insights: Nvidia vs. Broadcom in AI Market Both Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) have significantly benefited from major investments in artificial ...