Ron Finklestien

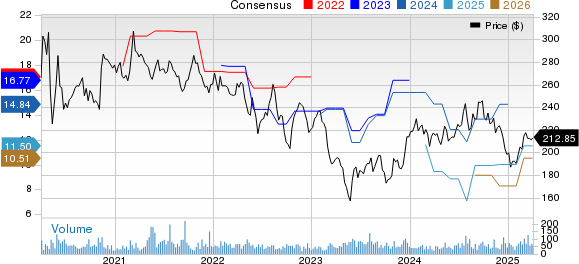

Comparing Norwegian Cruise Line’s Stock Performance to the Dow: An Analysis

Norwegian Cruise Line Holdings Faces Stock Setbacks Despite Strong Revenue Miami-based Norwegian Cruise Line Holdings Ltd. (NCLH) stands as a major player in the ...

2025 Stock Market Predictions: Wall Street Analysts Adjust Their Outlooks Amid Uncertainty

Wall Street Analysts Predict S&P 500 Growth Despite Uncertainty The S&P 500 (SNPINDEX: ^GSPC) surged after Donald Trump’s presidential election victory in November, leading ...

Top Dividend Stocks to Consider for April 3rd

Three Promising Stocks with Strong Income Characteristics Here are three stocks showing a buy rank and robust income features for investors to consider today, ...

“3 Undervalued Stocks Poised for Growth in the Upcoming Bull Market”

Top Tech Stocks to Buy After Market Pullback The recent market pullback has led to appealing investment opportunities in the technology sector. Here are ...

“Robinhood’s New Top Holding: A Company Predicted to Surge 900%, Ousting Nvidia, Says Leading Investor”

Retail Investors Shift Focus: Tesla Takes the Lead Over Nvidia Roughly three decades ago, the internet began going mainstream, democratizing access to information and ...

“Leverage Options to Secure Nuvalent at $55 with an 11.9% Annualized Return”

Nuvalent Inc (NUVL) Offers Attractive Put Options for Investors Investors eyeing Nuvalent Inc (Symbol: NUVL) shares, currently priced at $69.91 each, may find selling ...

“Maximize Your Returns: Invest in Astrana Health with a $22.50 Commitment for 12.5% Annualized Gain through Options”

Strategies for Investing in Astrana Health Inc: Selling Puts Explained Investors interested in Astrana Health Inc (Symbol: ASTH) Stock may find themselves hesitating to ...