Ron Finklestien

S&P 500 Stock Highlights: Tesla and Dollar Tree Shine

Dollar Tree Outperforms While Tesla Struggles in Market Action In early trading on Wednesday, shares of Dollar Tree emerged as the best performer among ...

Highlighting Wednesday’s Significant Options Trading: NCNO, BA, TRTX

Significant Options Activity in Russell 3000 Components Today Today’s options trading activity within the Russell 3000 index highlights notable movements in several companies. nCino ...

Tesla’s Q1 Deliveries Miss Expectations Amid Concerns Over Trump Tariffs

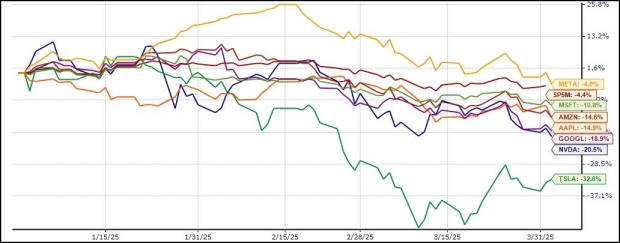

Market Set for Turbulence Ahead of Trump’s Tariff Announcement This week is shaping up to be one of the most eventful weeks of the ...

Significant Midweek Trading Insights: EWTX, PACK, and ORCL Option Movements

High Options Trading Volumes Highlight Key Stocks in Russell 3000 Among the components of the Russell 3000 index, several stocks saw significant options trading ...

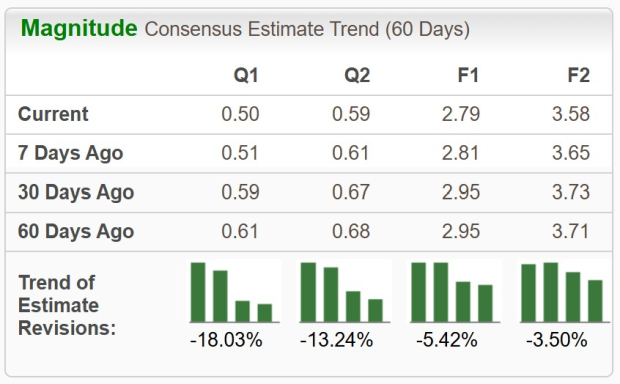

Anticipating Q1 Earnings: What to Watch For

S&P 500 Earnings Forecasts Show Steady Growth Amid Sector Shifts Note: The following is an excerpt from this week’s earnings Trends report. You can ...

Stay Calm Amidst Trump’s Tariffs: 2 Timeless Lessons from Warren Buffett

Market Turmoil Follows Trump’s Tariff Announcement as Stocks Plunge The recent “Liberation Day” declared by President Donald Trump is shrouded in uncertainty, but one ...