Ron Finklestien

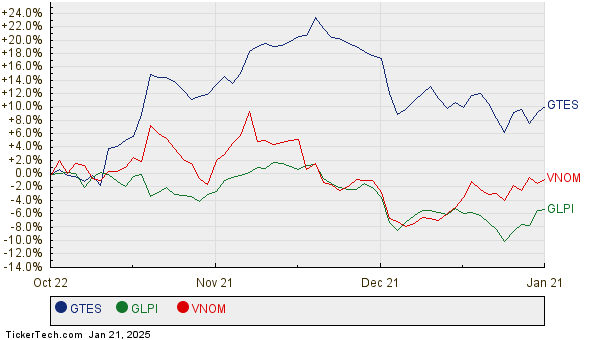

Green Plains’ Nebraska Carbon Initiative: Progress Update and Future Plans

Green Plains Inc. Advances Carbon Strategy, Set to Begin Operations by 2025 Green Plains Inc. (GPRE) has achieved key milestones for its ‘Advantage Nebraska’ ...

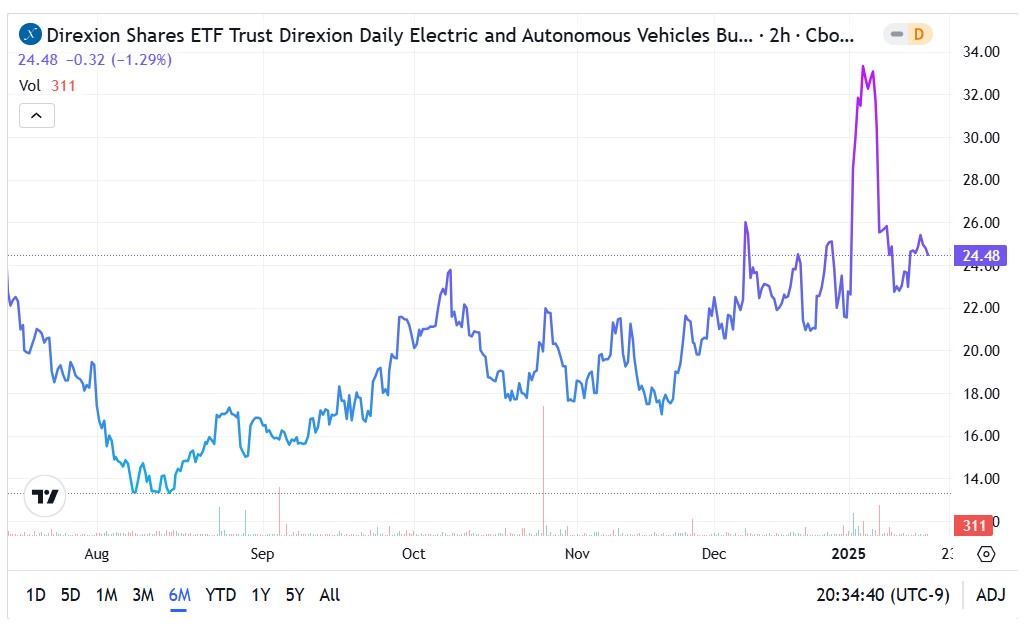

“Emerging Political Landscape Opens New Avenues for Direxion’s EVAV ETF Targeting Mobility Sector”

Tesla Soars Under Trump’s Influence: What Investors Need to Know Optimism Greets Tesla as Trump Begins Second Term American electric vehicle leader Tesla Inc ...

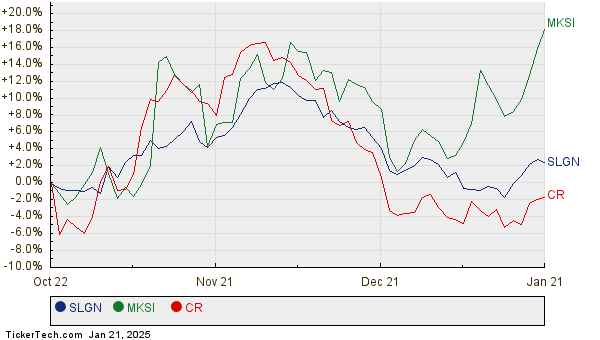

Anticipating Mohawk Industries’ Upcoming Earnings Report: Key Insights and Expectations

Mohawk Industries Set to Announce Q4 Earnings Amid Mixed Analyst Expectations Mohawk Industries, Inc. (MHK), founded in 1988 and based in Calhoun, Georgia, is ...

Devon Energy Earnings Forecast: Anticipated Insights and Trends

Devon Energy Prepares for Q4 Earnings Amid Market Challenges Company Overview and Upcoming Earnings Report Based in Oklahoma City, Oklahoma, Devon Energy Corporation (DVN) ...