Ron Finklestien

Is Tesla Still a Smart Investment for 2025 Amidst Its Dominance in the EV Market?

Tesla Thrives Amid Controversy: To Buy or Not by 2025? Tesla (NASDAQ: TSLA) has emerged as one of the standout stocks over the past ...

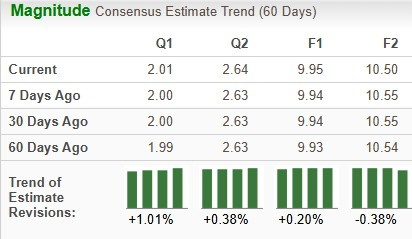

CME Group Earnings Forecast: Key Insights and Expectations

CME Group Poised for Earnings Release Amid Mixed Analyst Sentiments Valued at $83.9 billion by market cap, CME Group Inc. (CME) stands as the ...

Hershey’s Upcoming Quarterly Earnings: Key Insights and Expectations

Hershey Company Prepares for Earnings Report Amid Mixed Analyst Sentiment The Hershey Company (HSY), based in Hershey, Pennsylvania, is a leading name in global ...

“BIOA Investors Can spearhead Securities Fraud Class Action Against BioAge Labs, Inc. with Schall Law Firm”

Investors File Class Action Against BioAge Labs Following Troubling Trial News LOS ANGELES, Jan. 20, 2025 /PRNewswire/ — The Schall Law Firm, known for ...

“Analyzing J&J Stock: Investment Strategies Before Q4 Earnings Announcement”

Johnson & Johnson: Q4 Earnings Preview and Market Dynamics Important Highlights The Zacks Consensus Estimate for JNJ’s Q4 sales is $22.5 billion, with earnings ...

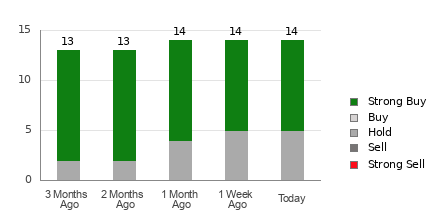

“Leidos (LDOS) Gains Favor with Wall Street Analysts: Is It Time to Invest?”

Should You Follow Wall Street’s Advice on Leidos (LDOS)? Investors frequently rely on Wall Street analysts for buy, sell, or hold recommendations. Changes in ...

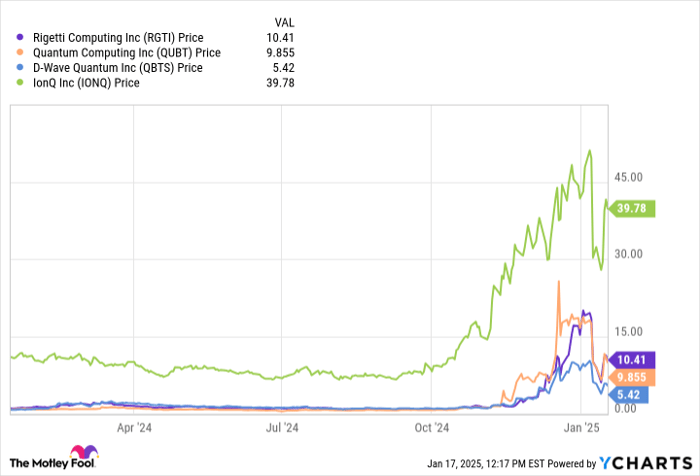

“Preparing for 2025: Quantum Computing Set to Dominate AI Trends with This Key Stock at the Forefront”

Quantum Computing: The New Frontier in AI Investments Artificial intelligence (AI) is the biggest opportunity in the tech sector today, and within this realm, ...

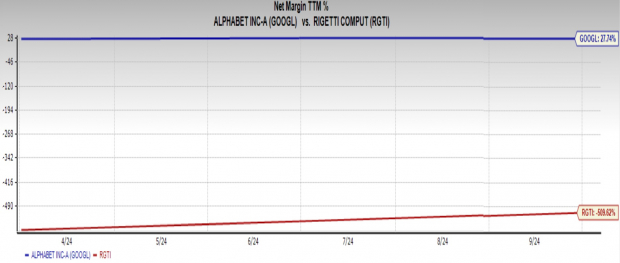

Comparing Quantum Computing Investments: Alphabet’s $2.4T vs. Rigetti’s $2.8B Valuation

GOOGL vs. RGTI: Analyzing Quantum Computing Investment Potential Quantum computing is rapidly evolving and could generate enormous financial opportunities. Analysts predict the quantum computing ...