Ron Finklestien

The Ultimate AI Stock Recommendation: My Top Pick for Investors

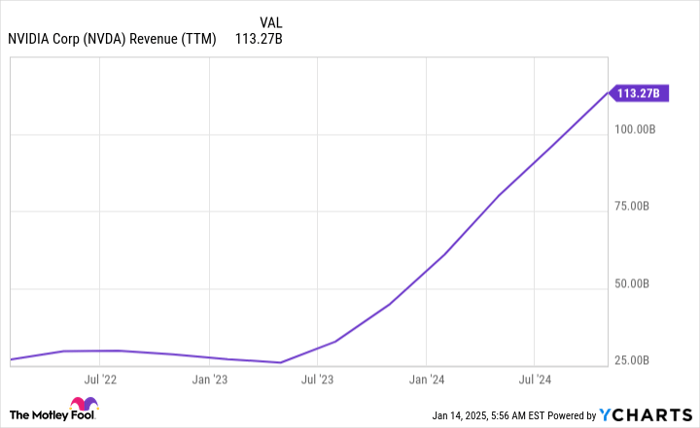

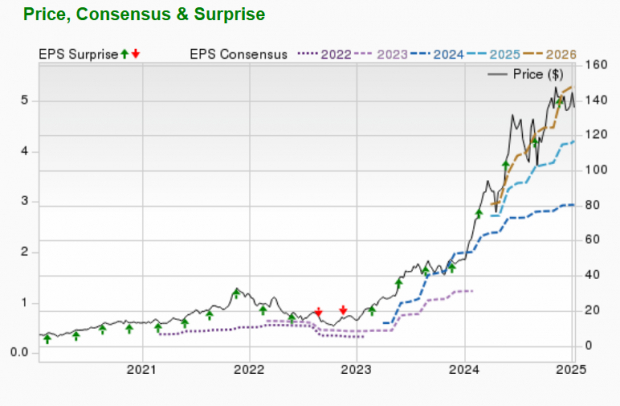

Nvidia: The AI Stock to Watch as Demand Surges Selecting a single artificial intelligence (AI) stock can be challenging. With numerous investment options available, ...

“Healthcare AI Surges: Projected $125 Billion Growth by 2028”

Health AI: A New Era for Patient Care as Avant Technologies Expands Its Reach USA News Group News Commentary Issued on behalf of Avant ...

Significant Friday Options Activity: DMRC, ZS, and VST Insights

Noteworthy Options Trading in Russell 3000 Components: A Focus on Digimarc, Zscaler, and Vistra Significant Activity in Digimarc Corp Options Looking at the options ...

Top AI Stocks Worth a $500 Investment in 2023

2025: A Promising Year for AI Investing Artificial intelligence (AI) played a crucial role in driving the market upward last year. The performance of ...

Top 5 Stocks Poised for Growth Amidst Bitcoin’s Surge

Bitcoin Surges Past $100,000: What It Means for Investors Key Insights Bitcoin has surpassed $100,000 again after reaching an all-time high of $106,533 in ...