Ron Finklestien

“Trump’s First 100 Days: The Four Key Factors Impacting Your Financial Future”

Transforming Trading: Profit Opportunities Amidst Political Turbulence Editor’s Note: As Donald Trump prepares to start his second term as President of the United States ...

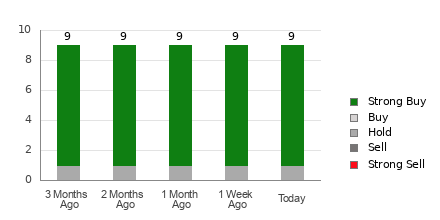

“Interactive Brokers (IBKR): Analysts Project Positive Outlook – Is It a Smart Investment?”

Wall Street Analysts Favor Interactive Brokers: Insights for Investors Investors frequently turn to recommendations from Wall Street analysts to guide their decisions on buying, ...

Significant Friday Options Trading Highlights: GLW, ITT, APP

Surge in Options Trading: Corning, ITT, and Applovin Make Waves The Russell 3000 index saw significant options trading activity today, particularly in Corning Inc ...

Sun Communities (SUI) Stock Surpasses 200-Day Moving Average

Sun Communities Shares Soar, Surpassing Key Moving Average Stock Performance Highlights and Detailed 52-Week Review In trading on Friday, shares of Sun Communities Inc ...

“Rumble Stock Soars 253% Over the Past Year: What Lies Ahead for 2025?”

Rumble’s Stock Surges: A Closer Look at Recent Growth Trends Rumble RUM shares have skyrocketed 253% over the last year, significantly outperforming the Zacks ...

Significant Friday Options Trading Insights: ALLY, NU, CWH

Strong Options Activity Highlights Key Players in the Market Ally Financial Leads with Significant Trade Volume In today’s options trading for the Russell 3000 ...