Ron Finklestien

Anticipating Rollins’ Upcoming Quarterly Earnings: Key Insights and Expectations

Rollins, Inc. Set to Announce Earnings Amid Market Challenges Rollins, Inc. (ROL), based in Atlanta, Georgia, provides pest and wildlife control services to both ...

“Top 2 Warren Buffett Stocks for Long-Term Investment Through 2025 and Beyond”

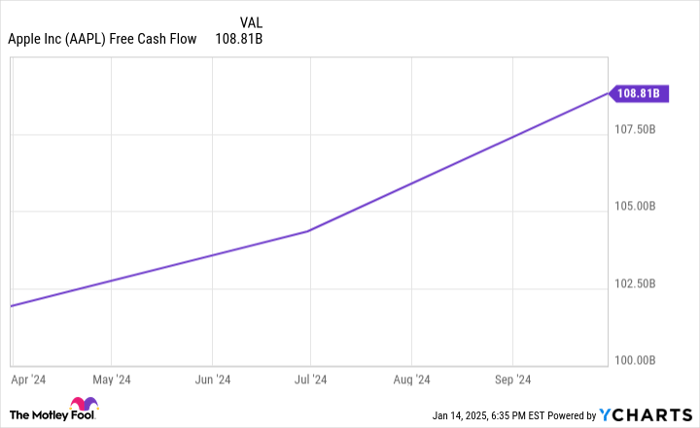

Buffett’s Stock Picks: Why Apple and Amazon Are Solid Investments for 2024 Warren Buffett, known as the Oracle of Omaha, is often regarded as ...

Moody’s Q3 Earnings Outlook: Key Insights and Expectations

Moody’s Corp Prepares for Q4 Earnings, Analysts Predict Strong Growth Moody’s Corporation (MCO), based in New York, is a leader in risk assessment services. ...

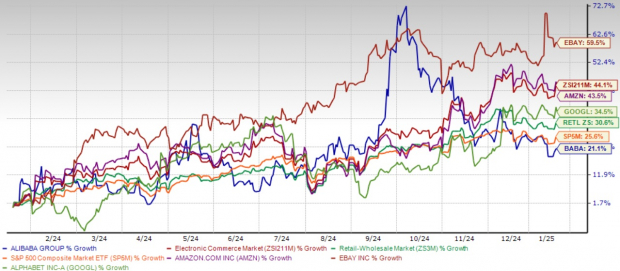

Evaluating Baba’s Investment Approach for 2025: Should You Invest Now or Hold Off?

Evaluating Alibaba’s Future: Risks and Rewards Ahead of 2025 As Alibaba BABA moves toward 2025, investors must decide whether now is the right time ...