Ron Finklestien

Moody’s Q3 Earnings Outlook: Key Insights and Expectations

Moody’s Corp Prepares for Q4 Earnings, Analysts Predict Strong Growth Moody’s Corporation (MCO), based in New York, is a leader in risk assessment services. ...

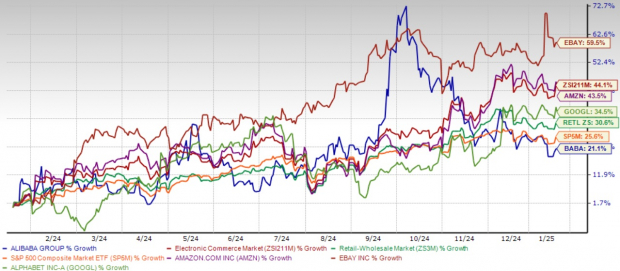

Evaluating Baba’s Investment Approach for 2025: Should You Invest Now or Hold Off?

Evaluating Alibaba’s Future: Risks and Rewards Ahead of 2025 As Alibaba BABA moves toward 2025, investors must decide whether now is the right time ...

Investor Skepticism May Open Door to S&P 500 Gains

While the market is experiencing fear, savvy investors might find a buying opportunity. The latest AAII Sentiment Survey has shown a contrarian Buy signal, ...

Biogen Quarterly Earnings Report: Key Insights and Expectations

Biogen Inc. (BIIB) Prepares for Q4 Earnings Report Amid Market Challenges Company Overview and Market Performance Biogen Inc. (BIIB), based in Cambridge, Massachusetts, focuses ...