Ron Finklestien

Maximize FOXA Returns: Elevate Yield from 1.1% to 6.2% with Options Strategies

Maximize Returns with Covered Calls on Fox Corp Shares Strategies for Investors Eyeing Additional Income from FOXA Shareholders of Fox Corp (Symbol: FOXA) seeking ...

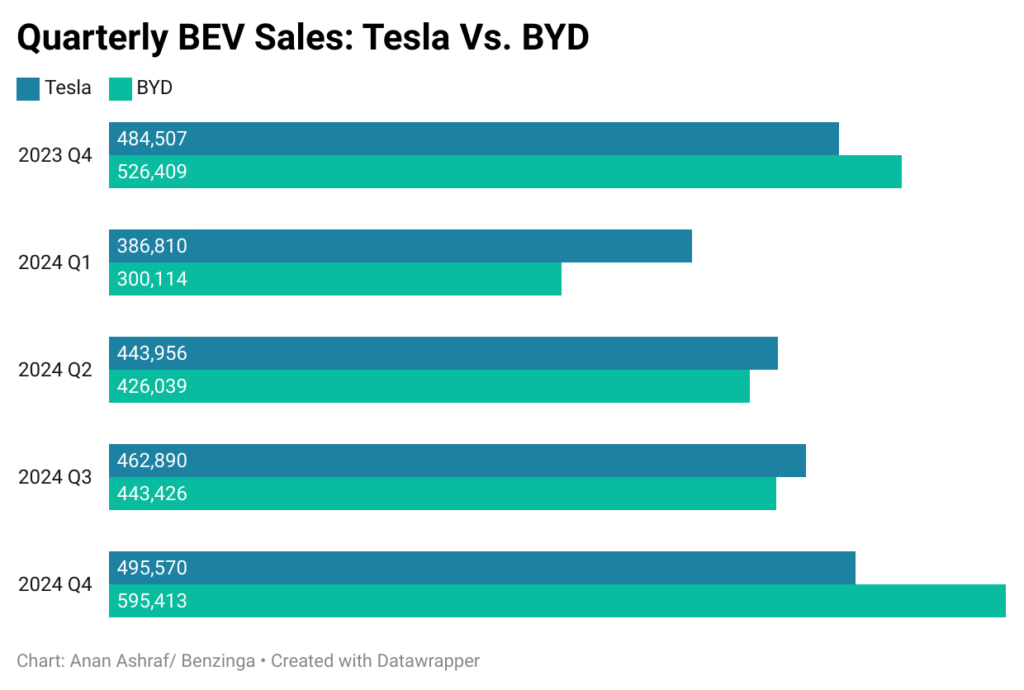

From Mockery to Competition: How BYD Emerged as Tesla’s Top Rival by 2024

BYD Surges Ahead of Tesla in EV Sales Overview of the Competition: The Chinese electric vehicle leader BYD Co Ltd. BYDDY has now surpassed ...

Maximizing GEN Returns: Strategies to Increase Yield from 1.8% to 20.1% with Options

Maximizing Returns with Gen Digital Inc: A Covered Call Strategy Enhancing Dividend Income with $28 Covered Calls Shareholders of Gen Digital Inc (Symbol: GEN) ...

Significant Thursday Options Trends: AMAT, AVGO, CMG

High Options Trading Activity Sees Applied Materials, Broadcom, and Chipotle Lead the S&P 500 Applied Materials, Broadcom, and Chipotle Experience Significant Contract Volumes Among ...

Significant Thursday Options Trading Insights: FTAI, PRA, AKAM

Highlighting Active Options Trades in the Russell 3000 Options trading activity shows significant interest in FTAI Aviation Ltd, ProAssurance Corp, and Akamai Technologies Inc. ...