Ron Finklestien

Nvidia’s CEO Reveals Exciting Insights on the Future of Quantum Computing

Nvidia CEO’s Quantum Computing Insight Shakes Market In a recent panel discussion at CES in Las Vegas, Nvidia (NASDAQ: NVDA) CEO Jensen Huang shared ...

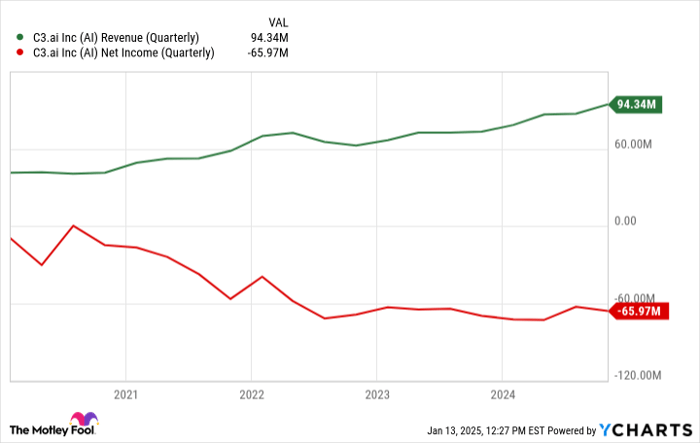

C3.ai’s CEO Highlights “Game-Changing Moment” in Company History

“`html Is C3.ai Poised for a Breakthrough with Microsoft Partnership? Growth investors often overlook a company’s less-than-stellar profits if they believe in its future ...

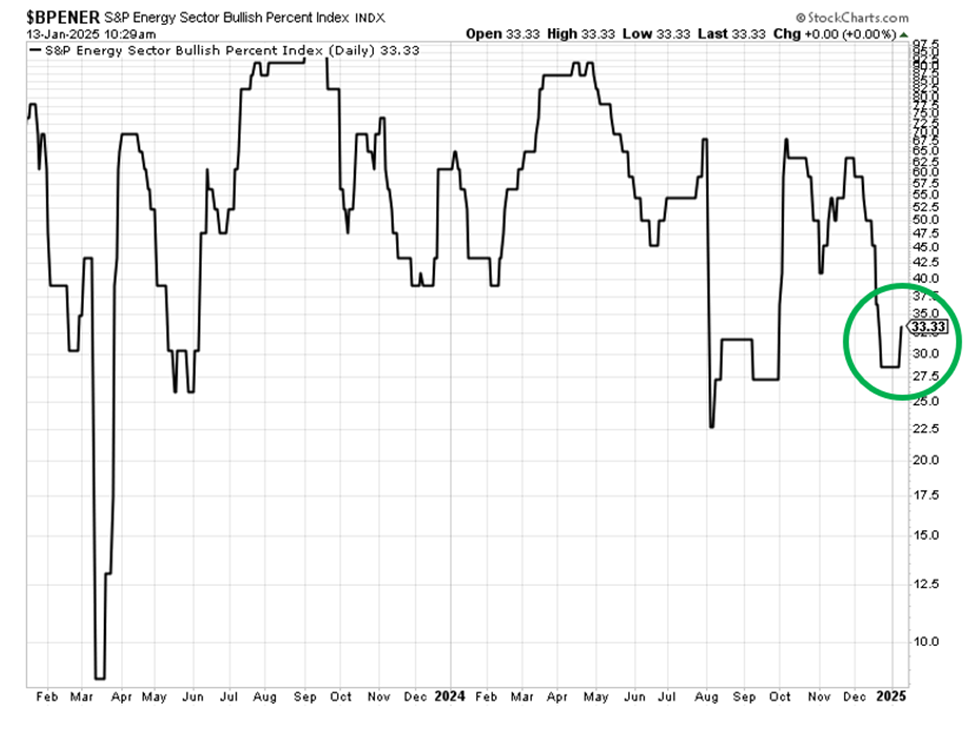

Navigating the Market Landscape of “Trump 2.0” in 2025

“`html Energy Sector Gains Fuel Optimism as Traders Anticipate Trump’s Second Term Analyzing trading opportunities, Trump’s impact on businesses, and potential for a “peace ...

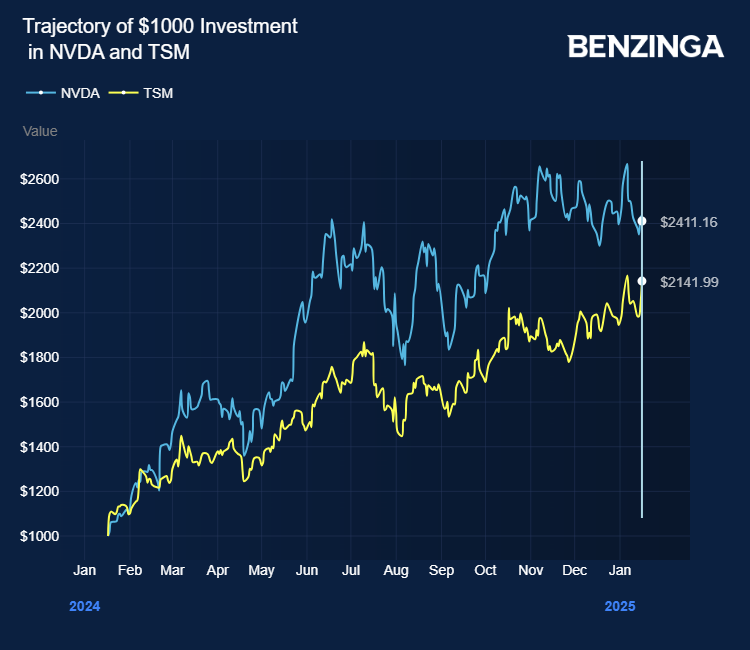

Nvidia Maintains High Demand for Taiwan Semiconductor’s Advanced Packaging Amidst Evolving Technologies

Nvidia’s Demand for Advanced Chip Packaging Remains Strong Robust Needs Amid Changes in Technology Demand for advanced packaging from Taiwan Semiconductor Manufacturing Co TSM ...

Significant Thursday Options Trading: Highlights on CI, BBWI, and TSN

Surge in Options Trading Volume Highlights Notable Activity in Major Stocks The Cigna Group, Bath & Body Works, and Tyson Foods Make Waves in ...