Ron Finklestien

Warren Buffett’s $296 Billion Portfolio: 35% Allocated to Three Key AI Stocks

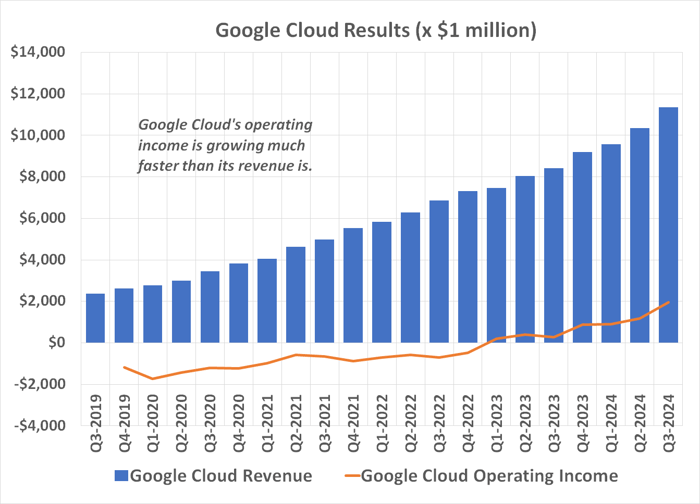

“`html Berkshire Hathaway’s Buffett Bets on AI: A Look at Three Key Investments Since Warren Buffett took the helm at Berkshire Hathaway (NYSE: BRK.A)(NYSE: ...

Will This Tech Stock Maintain Its Billionaire Backing Through 2025?

Investing Wisdom: Why Billionaires Favor Alphabet Stock Just because a group of billionaires owns the same stock doesn’t automatically make it a great addition ...

“Top AI Stocks to Watch for 2025: My Top Picks”

The AI Revolution: Invest in the Future of Technology The rise of artificial intelligence (AI) in 2024 has reshaped our world in unprecedented ways. ...

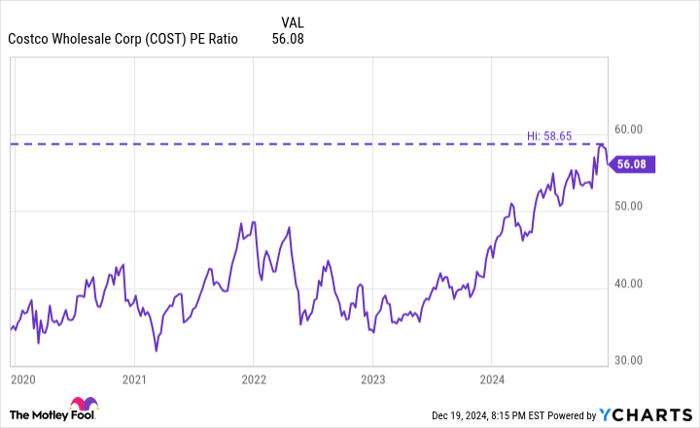

“Exceptional Growth: This Stock Surged 106,400% Post-IPO—Potential Split on the Horizon for 2025”

Costco Likely to Split Shares as Price Hits New Heights Statistical data shows that stocks typically outperform the market in the year following a ...

Discover the Powerhouse Vanguard ETF with 37.6% Allocated to Nvidia, Apple, and Microsoft

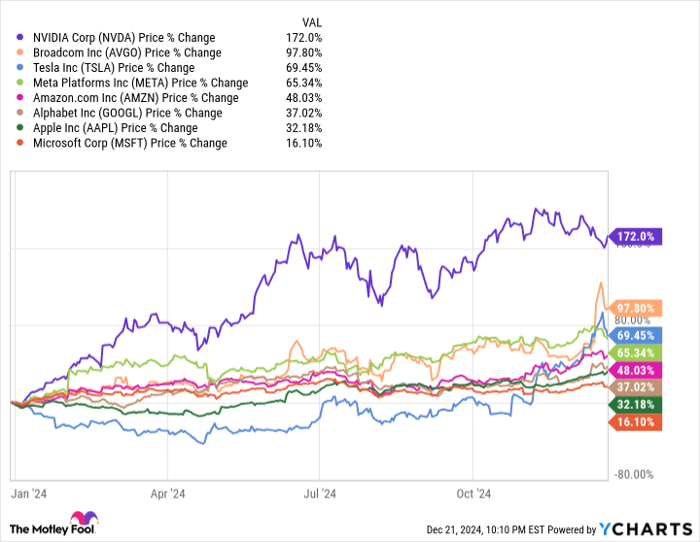

“`html Tech Titans Thrive as Vanguard ETF Hits Higher Returns This chart shows the eight American technology companies valued at $1 trillion or more ...