Ron Finklestien

Maximizing H&E Equipment Services’ Yield: Increasing Returns from 2.2% to 12.8% Through Strategic Options Trading

Boost Your Income: Exploring Covered Calls with H&E Equipment Services Maximizing Returns with HEES Stock Options Shareholders of H&E Equipment Services Inc (Symbol: HEES) ...

Maximizing YieldBoost TPB: Increasing Returns from 0.5% to 11.2% with Options Strategies

Maximizing Returns with Turning Point Brands: A Look at Income Strategies Options Trading Opportunity for Shareholders Shareholders of Turning Point Brands Inc (Symbol: TPB) ...

Navigating the 22% Drop in Wolfspeed Stock: Strategies for Investors

Wolfspeed’s Stock Struggles Amid Financial Challenges Wolfspeed (WOLF) shares have decreased by 22% over the last month, trailing behind the Zacks Computer and Technology ...

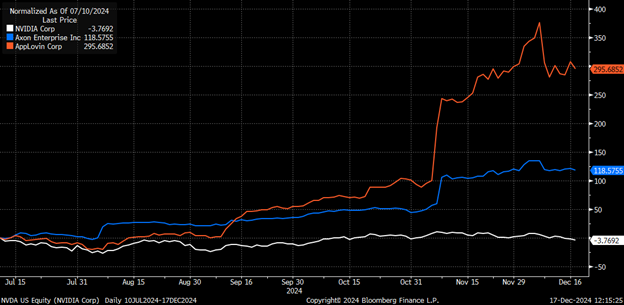

Will AI Stocks Stage a Strong Recovery Soon?

“`html AI Revolution: The Next Big Wave in Technology The AI Builders’ journey continues, but the emergence of a groundbreaking “killer app” is imminent, ...

Maximizing YieldBoost on SMG: Strategies to Increase from 3.9% to 8.6% with Options

Investing in Scotts Miracle-Gro: A Call to Boost Your Returns Opt for Covered Calls to Maximize Your Income Shareholders of Scotts Miracle-Gro Co (Symbol: ...