Last week, the European Automobile Manufacturers Association released data on new car registrations for March 2024. Registrations in the European Union (“EU”) car market witnessed a year-over-year decline of 5.2% last month and came in at 1 million units. This marked the first decline of the year. Registrations in key markets of Germany, Spain, France and Italy contracted 6.2%, 4.7%, 1.5% and 3.7%, respectively, on a year-over-year basis.

In the first quarter of 2024, EU market vehicle registrations reached 2.8 million units, up 4.4% year over year. During the said timeframe, registrations in Italy and France recorded growth of 5.7% each on a year-over-year basis. Registrations in Germany and Spain increased 4.2% and 3.1%, respectively, in the first three months of the year.

Earnings season for the auto sector kicked off last week as the auto replacement parts provider Genuine Parts Company GPC unveiled its quarterly results. The company missed sales but surpassed earnings expectations. Auto retailer Group 1 Automotive GPI signed an agreement to buy U.K. Dealerships of Inchcape for nearly $439 million.

Electric vehicle (EV) behemoth Tesla TSLA, in a bid to control costs to prepare for its next phase of growth, announced the layoff of 10% of its workforce. U.S. auto giant Ford F opened online orders for its 2024 F-150 Lightning pickup after pausing shipments earlier this year. Japan’s auto biggie Nissan NSANY announced plans to produce EVs powered by next-generation batteries at scale by early 2029.

Last Week’s Important News

Genuine Parts delivered first-quarter 2024 adjusted earnings of $2.22 per share, up 3.7% year over year. The bottom line surpassed the Zacks Consensus Estimate of $2.15 per share. The company reported net sales of $5.78 billion, which lagged the Zacks Consensus Estimate of $5.84 billion but inched up 0.3% year over year. This nominal increase was due to a 1.9% boost from acquisitions, offset by a 0.9% drop in comparable sales and a 0.7% impact from unfavorable foreign currency transactions.

Genuine Parts had cash and cash equivalents worth $1.05 billion as of Mar 31, 2024. Long-term debt decreased to $3.03 billion from $3.55 billion as of Dec 31, 2023. For 2024, Genuine Parts expects revenues from automotive and industrial sales to witness year-over-year upticks of 2-4% and 3-5%, respectively. Overall sales growth is projected to be in the range of 3-5%. The company envisions adjusted earnings of $9.80-$9.95 per share. Operating cash flow is expected to be in the band of $1.3-$1.5 billion. FCF is guided to be between $800 million and $1 billion.

Group 1 inked a deal to acquire Inchcape’s U.K. automotive retailing business and the related owned real estate. The all-cash transaction will cost nearly $439 million to GPI, including the appraised real estate value of $279 million. The transaction is anticipated to close in the third quarter of 2024. In 2023, Inchcape’s U.K. dealerships registered annual revenues of around $2.7 billion.

Inchcape has 54 dealership locations across England and Wales, including Audi, BMW/MINI, Jaguar Land Rover, Porsche, Toyota, Lexus, Mercedes-Benz/smart, Volkswagen and Volkswagen Commercial Vehicles. The acquired assets complement GPI’s geographic footprint in the East and South East of England and allow it to enter new markets in the Central and North West regions of England and Wales. GPI has acquired around $1 billion of annual revenues year to date. With the completion of this impending acquisition, the annual acquired revenues are expected to be around $3.7 billion.

Tesla is slashing its global headcount by 10%. Tesla employed more than 140,000 people by the end of 2023. The latest round of job cuts will affect roughly 14,000 workers as Tesla aims to reduce costs and boost productivity. TSLA’s CEO Elon Musk emphasized the significance of cost containment measures as the company prepares for its next phase of growth led by next-generation vehicles.

Quoting from the leaked company-wide email sent by Musk, “As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity. As part of this effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10% globally. There is nothing I hate more, but it must be done. This will enable us to be lean, innovative and hungry for the next growth phase cycle.”

Ford opened online orders for its 2024 F-150 Lightning pickup after pausing shipments earlier this year. The 2024 F-150 Lightning pickup is now shipping from the Rouge EV plant. The automaker recently announced a price cut on some of its F-150 Lightning pickup trims. The price of the F-150 Lightning Flash trim was reduced by $5,500 to $67,995. The prices of the XLT Standard Range and Lariat Extended Range were reduced by $2,000 and $2,500 to $64,995 and $79,495, respectively. The prices of Lightning Pro Standard Range and Lightning Platinum Extended Range variants remained unchanged at $54,995 and $84,995, respectively.

Ford has also made a few technology changes in the 2024 F-150 Lightning pickup. The model will now have a Vapor Heat Pump System to optimize performance in various temperatures. It will have an updated charging speed display to show the charging status and speed, including an estimated time to finish. The Tow Technology Package is now standard on XLT and above trims.

F currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nissan plans to produce EVs powered by next-generation batteries at scale by early 2029.The automaker is trying to catch up in the EV space with batteries that are more efficient, cheaper, safer and take less time to charge than the existing lithium-ion batteries. Nissan will first perform a prototype test on solid-state batteries and then produce them at an unfinished pilot plant in Yokohama. The automaker plans to commence the production of batteries at the site starting March 2025. To ramp up the production to 100 megawatt hours per year, it will deploy 100 workers per shift from the financial year starting April 2028.

To produce the rear floor of EVs, NSANY will utilize heavy-force machines. The process will reduce the manufacturing cost and weight of the components by 10% and 20%, respectively. Per Hideyuki Sakamoto, executive vice president for manufacturing and supply chain management of Nissan, after experimenting with different things, the company decided to use a 6,000 tonnes gigacasting machine to manufacture the car’s rear body structure using aluminum casting.

Price Performance

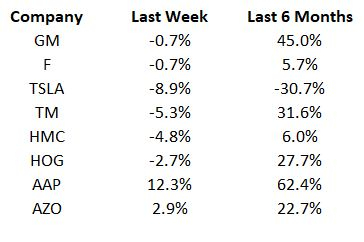

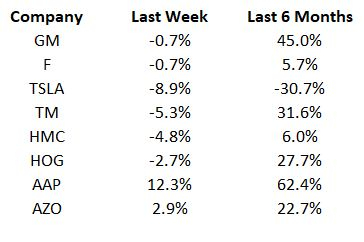

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Auto sector earnings season will switch to high gear this week. Investors and industry watchers are keenly awaiting quarterly reports of Tesla, Ford and General Motors, among others.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Ford Motor Company (F) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Nissan Motor Co. (NSANY) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.