Autoscope Technologies Corporation Receives Upgrade Amid Strong Dividend and Product Growth

Autoscope Technologies Corporation (AATC) has been upgraded to “Outperform” due to its impressive dividend returns, supportive end-market conditions, increasing product momentum, and an attractive valuation.

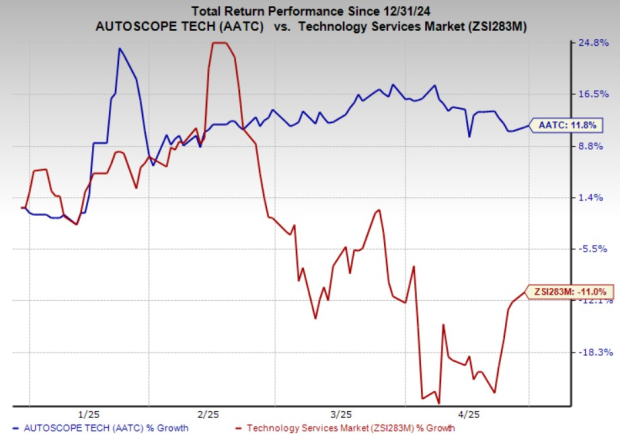

Solid Price Performance

AATC shares have outperformed the industry this year, gaining 11.8% compared to a 11% decline in the overall sector during the same period.

Image Source: Zacks Investment Research

The following factors bolster the investment thesis.

Impressive 7% Dividend Yield Indicates Stability

Autoscope offers a robust dividend yield of approximately 7%, based on a quarterly dividend of 15 cents per share (increased in Q4 of 2024) against a recent share price of $8.60. The company recently issued a one-time special dividend of $1.32 per share in February 2024. Supported by $4.4 million in cash and over $5 million in annual operating cash flow, the dividend program appears financially secure, providing downside protection and attracting yield-focused investors in today’s volatile market.

Long-Term Demand Boosted by Federal Infrastructure Funding

The U.S. Department of Transportation’s Safe Streets and Roads for All (SS4A) program allocates $5 billion in funding through 2026, directly benefiting Autoscope’s intelligent traffic solutions. This initiative focuses on enhancing traffic safety infrastructure, aligning perfectly with AATC’s offerings.

As funds are deployed, demand for above-ground detection platforms like Autoscope Vision, IntelliSight, and Analytics is expected to rise, positioning the company for sustained revenue growth and order visibility over several years.

Scheduled North America Launch of IntelliSight in 2025

Autoscope plans to introduce its high-performance IntelliSight platform, already successful in the EMEA markets, to North America in 2025 under the brand “Autoscope OptiVu.” This AI-powered solution detects vehicles, pedestrians, and bicycles while integrating with smart city infrastructure. Its proven success in Europe builds confidence for a successful launch in the U.S., expected to generate significant new revenue and reinforce the company’s competitive position.

High-Margin Product Line Rapidly Gaining Market Share

Product sales more than doubled in 2024 to $429,000, representing over 3% of total revenues compared to just 1.3% in 2023. Notably, fourth-quarter 2024 product revenues surged to $292,000, accounting for almost 9% of that quarter’s sales. Demand for Wrong Way detection, Autoscope Analytics, and IntelliSight drove this increase. These products achieve gross margins of up to 40% in Q4 2024, significantly higher than the full-year 2024 margin of 24.5% and a substantial improvement from the negative margins of 2023, indicating profitable diversification beyond legacy royalties.

Strong EBITDA to Free Cash Flow Conversion

Autoscope’s operational model demonstrates strong capital efficiency. In 2024, the company reported $6.2 million in operational income, converting $5.2 million into cash from operating activities, leading to an 84% EBITDA-to-FCF conversion rate. This strong performance showcases disciplined expense management and capital allocation. The high conversion ratio enhances the company’s ability to self-fund dividends, invest in research and development, and navigate macroeconomic challenges without requiring external financing.

Trading at a Discount with a 6X Trailing EBITDA

Based on $6.7 million in 2024 EBITDA, Autoscope’s enterprise value is around $40 million, resulting in a valuation at just 6X trailing EBITDA, below the typical 10-15X range for infrastructure technology peers. As product revenues increase and investor confidence grows in recent launches, the stock is likely to see a meaningful valuation adjustment. The current price offers a margin of safety for value-conscious investors.

Strong Balance Sheet with $7M in Liquidity

As of the end of 2024, Autoscope reported $4.4 million in cash and $2.8 million in short-term investments, providing $7.2 million in liquid assets. With minimal debt totaling $1.6 million, robust cash flow, and no large upcoming capital obligations, the company retains considerable financial flexibility. This liquidity supports its dividend strategy, mitigates execution risks during product rollouts, and creates opportunities for strategic investments. Autoscope’s solid balance sheet continues to strengthen its position in the market.