“`html

Broadcom reported a 17% year-over-year increase in Infrastructure Software revenues for Q3 fiscal 2025, reaching $6.8 billion, constituting 43% of total revenues. Gross margin improved by 300 basis points to 93%, while operating margin rose from 67% to 77%. The company expects Q4 fiscal 2025 Infrastructure Software revenues to be $6.7 billion, a 15% increase year-over-year, alongside anticipated AI revenues of $6.2 billion, up 66% year-over-year.

With strong competition from Microsoft, which is projecting a 37% growth in Azure for Q1 fiscal 2026, and Cisco, which secured over $2 billion in AI infrastructure orders, Broadcom must navigate a challenging landscape. Year-to-date, Broadcom shares have appreciated 46.2%, outpacing the Zacks Computer and Technology sector’s growth of 22.6%.

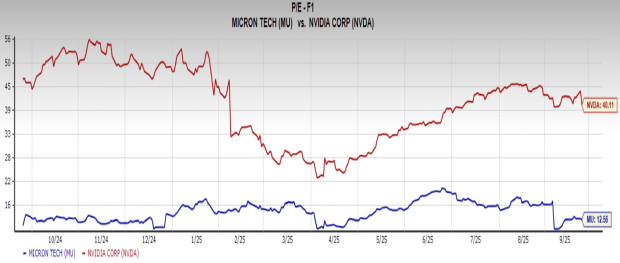

The Zacks Consensus Estimate for Broadcom’s fiscal 2025 earnings is now at $6.71 per share, suggesting a 37.8% growth from fiscal 2024. The company’s forward price/earnings ratio stands at 38.4X compared to the sector’s 29.45X, indicating its premium valuation.

“`