Broadcom’s Stock Soars on AI Demand and Strategic Acquisitions

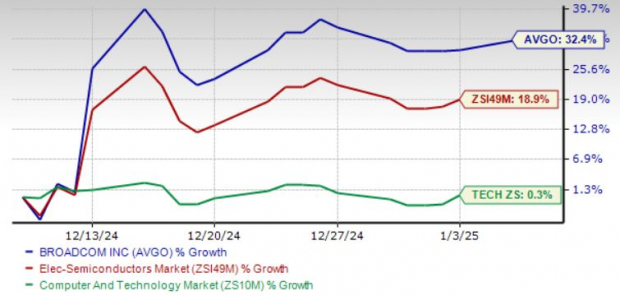

Broadcom (AVGO) shares have surged 32.4% over the past month, significantly outperforming both the Zacks Computer & Technology sector and the Zacks Electronics Semiconductors industry, which returned 0.3% and 18.9% during the same period.

The company’s impressive performance is driven by robust demand for its networking products and custom AI accelerators (XPUs). For fiscal 2024, AI revenue soared 220% compared to fiscal 2023, reaching $12.2 billion and making up 41% of Broadcom’s total semiconductor revenue.

The acquisition of VMware has also proven beneficial, as it enhances infrastructure software solutions. Since the acquisition, Broadcom has onboarded over 4,500 of its largest 10,000 customers to VMware Cloud Foundation, which supports the deployment of private cloud environments.

Broadcom’s partnerships with key players such as Arista Networks, DELL, Juniper, and Supermicro further amplify its success.

AVGO Leads in Industry Performance

Image Source: Zacks Investment Research

Strong interest in Broadcom’s application-specific integrated circuits (ASICs), designed to enhance AI and machine learning efficiency, continues to bolster revenue. Major firms like Alphabet (GOOGL) and Meta Platforms (META) rely on Broadcom’s ASIC technology.

Expansion of Broadcom’s AI Offerings

Recently, Broadcom introduced the industry’s first Face-to-Face (F2F) 3.5D XPUs. This advanced system, based on the 3.5D eXtreme Dimension System in Package (XDSiP) technology, aids AI developers in creating sophisticated XPUs.

XPUs play a critical role in training Generative AI (GenAI) models, demanding intricate integration of compute, memory, and I/O capabilities that optimize performance while minimizing power usage and costs. The popularity of 3.5D integration, which merges 3D silicon stacking with 2.5D packaging, reflects this trend.

Broadcom’s F2F technology tightly connects the internal layers of the top and bottom dies, yielding reliable connections with reduced electrical interference. This design significantly increases interconnect density and power efficiency compared to traditional methods.

The new F2F 3.5D XPU, developed using Taiwan Semiconductor (TSM) advanced processing and packaging techniques, connects multiple compute dies and memory modules to deliver high performance.

AI Initiatives Fuel Broadcom’s Future Growth

In the fourth quarter of fiscal 2024, networking revenues surged 158% year-over-year, driven primarily by AI XPU shipments, which doubled for Broadcom’s top three hyperscale customers. AI connectivity revenue also experienced a fourfold increase thanks to recent product shipments.

Looking ahead to the first quarter of fiscal 2025, Broadcom anticipates that momentum in AI connectivity will persist as more hyperscalers adopt Jericho3-AI systems. The company predicts AI revenues to reach $3.8 billion, marking a 65% increase year-over-year.

Broadcom’s ongoing development of next-generation XPUs, now in 3-nanometer technology, positions the company for substantial growth, with expectations for volume shipments to hyperscale customers expected in the latter half of fiscal 2025.

With hyperscalers creating their own XPUs, Broadcom foresees a significant opportunity. By 2027, each of these major customers aims to deploy 1 million XPU clusters within their infrastructures, presenting a potential serviceable market worth $60 billion to $90 billion in that fiscal year alone.

Rising Earnings Estimates for AVGO

The Zacks Consensus Estimate projects fiscal 2025 earnings at $6.30 per share, reflecting a 3% increase over the past month and indicating projected year-over-year growth of 29.36%.

Additionally, revenue estimates for fiscal 2025 are set at $61 billion, representing an 18.28% increase from the previous year’s reported figures.

For the first quarter of fiscal 2025, the consensus earnings estimate stands at $1.50 per share, indicating a 36.36% growth year-over-year. Revenue expectations for this quarter are around $14.62 billion, which indicates a 22.23% rise compared to the same time last year.

AVGO has consistently exceeded the Zacks Consensus Estimate in all four prior quarters, with an average surprise of 3.57%.

Broadcom Inc. Price and Earnings Consensus

Broadcom Inc. price-consensus-chart | Broadcom Inc. Quote

AVGO’s Valuation Status

Currently, AVGO shares are considered somewhat expensive, as indicated by a Value Score of F, suggesting an inflated valuation.

The forward 12-month Price/Sales ratio for AVGO is at 17.7X, exceeding its median of 12.48X and the sector’s average of 7.14X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Conclusion

Broadcom’s commitment to expanding its AI offerings and leveraging its extensive partner network underscores its potential for strong revenue growth. These elements support the current valuation and are expected to sustain upward share price trends as we look toward 2025.

Currently, Broadcom holds a Zacks Rank of #2 (Buy) and a Growth Score of B, presenting a strong investment opportunity based on Zacks’ proprietary methodology.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? You can download 7 Best Stocks for the Next 30 Days for free.

Broadcom Inc. (AVGO): Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report