AppLovin Corporation (APP) has seen a significant rise in advertising activity following the launch of its advanced AI engine, Axon 2, in Q2 2023. Advertising spend on AppLovin’s platform has quadrupled, with gaming clients contributing to an annual run rate of $10 billion. This surge has positioned AppLovin among the leading ad tech companies globally.

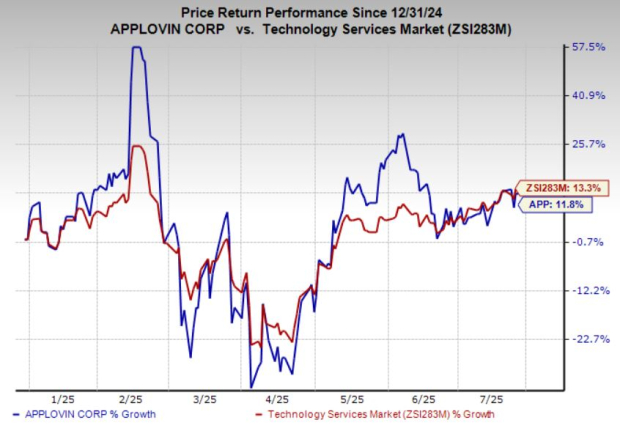

In Q1 2025, AppLovin reported a 40% year-over-year revenue increase, with adjusted EBITDA rising by 83% and net income climbing 144%. These results reflect the effectiveness of its AI-driven strategy and indicate a structural shift in profitability, driven by Axon 2. However, AppLovin’s stock has only increased by 12% year-to-date, trailing the industry average of 13%, amid valuation concerns and downward revisions in earnings expectations.

Currently, AppLovin trades at a forward price-to-earnings ratio of 34.56, significantly higher than the industry average of 24.01. As investor confidence wanes, the company’s stock has dropped to a Zacks Rank #3 (Hold), a decline from its previous strong buy status. The market is now closely watching for signs of either a reacceleration in earnings or a repricing of stock value.