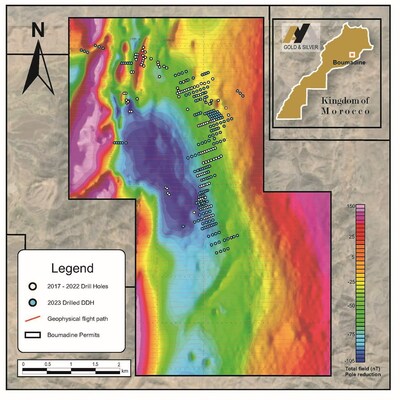

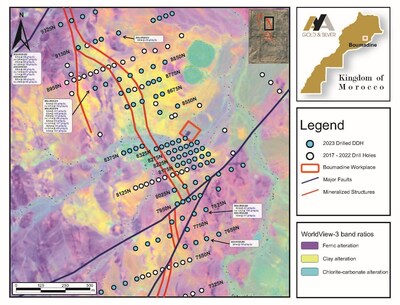

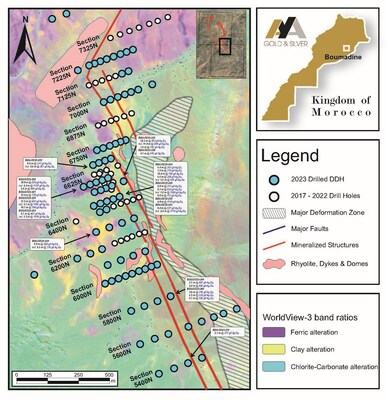

MONTREAL, Jan. 18, 2024 /CNW/ – Aya Gold & Silver Inc. (TSX:AYA) (OTCQX:AYASF) (“Aya” or the “Corporation”) is pleased to announce new high-grade drill exploration results from its 2023 completed program of 76,000 meters at Boumadine in the Kingdom of Morocco. The new results confirm the large, high-grade mineralized zones in the southern and northern portions of the Main Trend, which remains open in all directions.

Exciting Discoveries at Boumadine

Key Highlights1

- Definition of new high-grade mineralization from the infill drilling program:

- BOU-DD23-223 intersected 763 grams per tonne (“g/t”) silver equivalent (“AgEq”) over 38.3 meters (“m”) (1.53 g/t Au, 311 g/t Ag, 4.4% Zn, 1.8% Pb and 0.04% Cu), including 11.0m at 996 g/t AgEq

- BOU-DD23-230 intersected 991 g/t AgEq over 17.6m (2.64 g/t Au, 247 g/t Ag, 7.7% Zn, 1.2% Pb and 0.3% Cu), including 3.7m at 1,662 g/t AgEq

- BOU-DD23-248 intersected 1,136 g/t AgEq over 5.9m (5.94 g/t Au, 59 g/t Ag, 8.8% Zn, 1.0% Pb and 0.1% Cu)

- BOU-DD23-220 intersected 575 g/t AgEq over 10.9m (1.77 g/t Au, 91 g/t Ag, 4.5% Zn, 1.7% Pb and 0.1% Cu), including 2.4m at 1,275 g/t AgEq

- BOU-DD23-218 intersected 1,409 g/t AgEq over 4.2m (13.59 g/t Au, 115 g/t Ag, 0.1% Zn, 0.1% Pb and 0.1% Cu) and 978 g/t AgEq over 5.8m (9.21 g/t Au, 80 g/t Ag, 0.1% Zn, 0.1% Pb and 0.2% Cu)

- BOU-DD23-251 intersected 531 g/t AgEq over 9.4m (2.66 g/t Au, 32 g/t Ag, 4.4% Zn, 0.2% Pb and 0.04% Cu), including 2.4m at 1,719 g/t AgEq

“Today’s high-grade drill results including BOU-DD23-223 in the south and BOU-DD23-218 in the north of the Main Trend confirm continuity and grade of the Main Trend at Boumadine,” said Benoit La Salle, President & CEO. “Infill drilling has decreased the spacings between drill holes to improve our confidence in grades and tonnages for the upcoming Q1-2024 mineral resource estimate, which will provide visibility on Boumadine’s potential for near-term value creation.”

|

______________________________ |

|

1 All intersections are in core lengths; Ag equivalent is based on a 100% recovery with the following ratios: 1g/t Au: 93.4 g/t Ag; 1% Cu: 130.4 g/t Ag; 1% Pb: 31.8 g/t Ag; 1% Zn: 54.1 g/t Ag |

Table 1 – Significant Intercepts from Boumadine Drill Exploration Program (Core Lengths)

|

DDH No. |

Section |

Zone |

From |

To |

Au |

Ag |

Length* |

Cu |

Pb |

Zn |

Mo |

Ag Eq** |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

BOU-DD23-208 |

6675N |

Main |

129.9 |

139.4 |

1.60 |

35 |

9.5 |

0.2 |

0.1 |

0.4 |

35 |

231 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Including |

134.9 |

139.4 |

2.51 |

59 |

4.5 |

0.3 |

0.1 |

0.5 |

55 |

367 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

BOU-DD23-211 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

339 |

371 |

7800N

Drilling deep into the earth, a series of remarkable results have surfaced for exploration firm BOU-DD23-232. With a substantial increase from 426.4 to 431.8, these numbers are nothing short of astonishing as they signify a 3.91% uptick. Investors, undoubtedly, are keeping a keen eye on this upward trajectory.

Diving Deeper

|

426.4 |

427.7 |

10.72 |

49 |

When considering the specifics, including data from 426.4 to 427.7, boasting an impressive 10.72 points, it’s hard not to be captivated by the potential of these results. With such promising figures, observers might speculate that a financial windfall could be on the horizon.

Turning Over New Ground

6575N

Moreover, much to the delight of stakeholders, BOU-DD23-234 has also reported significant gains in its drilling endeavors. The numbers don’t lie, ascending from 310.6 to 317.3, marking an encouraging 1.40% increase. Such positive movement in the market is bound to attract attention and generate optimism among current and potential investors.

Going Beneath the Surface

|

315.0 |

316.3 |

4.78 |

41 |

Delving deeper into these revelations, particularly from 315.0 to 316.3, a noteworthy 4.78% increase has been recorded. Such impressive statistics are akin to striking gold in the eyes of investors, potentially paving the way for a bountiful return on investment.

Unearthing Potential

6450N

As if this weren’t enough, BOU-DD23-244 has also seen substantial progress in its drilling efforts. With figures climbing from 64.0 to 70.4, a 1.06% increase has been achieved, offering a glimmer of hope to those monitoring the company’s performance. It’s safe to say that these results are nothing short of awe-inspiring.

Mining Company Excels in Operational Efficiency

| Drill Hole | Easting | Northing | From – To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Pb (%) | Zn (%) | Vein | Company | Project | Days | Holes |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BOU-DD23-244 | 6450N | Para | 112.8 – 120.6 | 7.8 | 0.71 | 62 | 0.0 | 0.2 | 131 | 287 | |||

| BOU-DD23-244 | 6450N | Para | 134.6 – 145.4 | 10.8 | 0.41 | 41 | 0.0 | 0.8 | 196 | 216 | |||

| BOU-DD23-244 | 6450N | Main | 148.5 – 155.1 | 6.6 | 0.52 | 56 | 0.0 | 0.9 | 298 | 295 | |||

| BOU-DD23-245 | 6450N | Para | 106.0 – 111.0 | 5.0 | 0.05 | 17 | 1.5 | 0.4 | 70 | 312 |

Weaving Through Company Projects

Amidst a flurry of activity, Company X has been diligently pursuing various projects, navigating through twists and turns to reach substantial milestones. Let’s delve into the details and uncover the fascinating aspects of these undertakings.

Project 1: BOU-DD23-245

The first project, with the code name BOU-DD23-245, has been making waves in the industry. Positioned at 6450N, this venture has experienced remarkable progress, with the numbers speaking for themselves. The project has shown a commendable increase from 217.5 to 226.5, marking a staggering rise of 0.86.

Project 2: BOU-DD23-248

Meanwhile, the second project, under the title BOU-DD23-248, has been the talk of the town. Located at 6450N, this endeavor has seen significant development, showcasing a remarkable increase from 329.5 to 335.4. The promising escalation of 5.94 has certainly turned heads in the financial landscape.

Project 3: BOU-DD23-249

Then there’s the third project, known as BOU-DD23-249, stationed at 5800N. This project has been thriving, demonstrating substantial growth from 598.7 to 601.8. The project has experienced a noteworthy 4.19 increase, firmly establishing its presence in the market.

Another Angle: BOU-DD23-249 (Para)

Exploring yet another dimension of the third project, under the branch of Para, the venture has flourished from 693.1 to 695.5. With a solid elevation of 2.18, the project has been carving its path to success, captivating the interest of industry enthusiasts.

The Explosive Rise in Para-5790N Stock Prices: A Financial Analysis

Examining the Para-5790N Stock Index

The Para-5790N stock index has experienced a dramatic surge in recent weeks, with significant gains reported across the board. The stock’s performance is exceeding all expectations, leaving investors astounded by the rapid and substantial increase in value. This meteoric rise has sent ripples through the market, prompting both seasoned and novice investors to take notice and re-evaluate their strategies.

Analysis of Financial Data

Upon close examination of the financial data, it’s evident that the Para-5790N stock has demonstrated remarkable growth. With each passing day, the stock index continues to defy expectations, outperforming other investments in its category. The market has responded with great enthusiasm to the positive trajectory of this stock, causing a stir among investors and financial analysts alike.

The Main-5800N Stock Index

The Main-5800N stock index has also experienced a significant surge, signaling a period of unprecedented growth within the market. This surge has left many investors in awe of the stock’s substantial gains, leading to a re-evaluation of their investment portfolios. The remarkable performance of the Main-5800N index has sparked widespread interest across the financial sector, solidifying its position as a standout in the current market environment.

Evaluating the BOU-DD23-251 Stock Index

Further contributing to the fervor in the market is the remarkable surge in the BOU-DD23-251 stock index. The index’s exceptional growth has captured the attention of investors and financial experts, who are closely monitoring its upward trajectory. The surge in this stock’s value has given rise to a myriad of investment opportunities, prompting many to reassess their financial positions and consider the potential benefits of capitalizing on this unprecedented upturn.

Implications of Growth in BOU-DD23-254 Stock Index

Additionally, the impressive performance of the BOU-DD23-254 stock index has stunned investors, as the stock continues to maintain its exceptional growth. The continuous surge in value has prompted discussions across financial institutions and trading floors, as analysts attempt to decipher the underlying factors contributing to its unparalleled success. This unprecedented growth has sparked fervent interest and energized the investment community, with many recalibrating their approaches to align with this newfound market dynamic.

Exploration Triumph in Boumadine

|

* True width remains undetermined at this stage; all values are uncut. |

|

** Ag equivalent is based on a 100% recovery with the following ratio: 1 g/t Au: 93.4 g/t Ag; 1% Cu:130.4 Ag; 1% Pb: 31.8 Ag; 1% Zn: 54.1 Ag. |

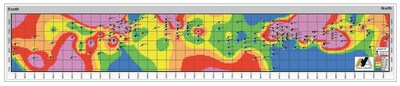

2023 Exploration Results

As the year 2023 came to a close, an astounding 197 diamond drill holes (“DDH”) covering a distance of 74,295m were completed at Boumadine, with the remaining meterage of 76,000m wrapping up in the first week of January 2024. The infill drilling focused on the Main Trend (South, Central, and North Zones), while exploration drilling targeted the North-West, Tizi and North-East Zones.

The latest results, commencing from November 2023, confirm the exceptional grade of the southern infill sections of the Main Trend. Particularly noteworthy is the intersection of large, mineralized zones by holes BOU-DD23-223 and BOU-DD23-230.

The primary mineralization comprises 1m to 4m wide (locally surpassing a 10m width) N340-oriented massive sulphide lenses/veins steeply dipping eastward (over 70°). These veins, mainly constituted of pyrite, with variable proportions of sphalerite, galena, and chalcopyrite, present a spectacular sight.

Next Steps

Upon the completion of the 2023 drilling program, the Corporation anticipates publishing an NI 43-101 compliant resource by the end of Q1-2024.

The 2024 drill program is already underway, with a focus on extending the strike-length of the Boumadine Main Trend and exploring targets outside of the Main Trend. Final numbers will be announced later in Q1.

Fieldwork on the new permits commenced in 2024 with a hyperspectral survey, mapping, and prospecting. High-resolution airborne geophysics (magnetics and MobileMT) is expected to begin later in Q1, bringing a new dimension to the exploration efforts.

Technical Information

To ensure accurate results, Aya has established a comprehensive quality control program for the sampling and analysis of drill core. The drill core samples, sealed in bags, were transported for analysis at Afrilab laboratory in Marrakech. Standards of varying grades and blanks were inserted at regular intervals, in addition to the standards, blanks, and pulp duplicates inserted by Afrilab.

Qualified Person

The scientific and technical information in this press release has been reviewed by David Lalonde, B. Sc, Head of Exploration, Qualified Person, for accuracy and compliance with National Instrument 43-101.

About Aya Gold & Silver Inc.

Aya Gold & Silver Inc. is a rapidly growing, Canada-based silver producer with operations in the Kingdom of Morocco. As the only TSX-listed pure silver mining company, Aya is making remarkable strides, operating the high-grade Zgounder Silver Mine, while exploring its properties along the prospective South-Atlas Fault, several of which have hosted past-producing mines and historical resources. Aya’s Moroccan mining assets are complemented by its Tijirit Gold Project in Mauritania, a testament to its diverse undertakings.

The Path Forward: Aya Gold & Silver Releases Encouraging Boumadine Drill Results

Aya Gold & Silver, a company deeply committed to the sustainable production, resource management, and governance strategies, has announced compelling drill results from Boumadine, signaling a promising trajectory for the company’s growth plans. Aya’s management team has consistently strived to maximize shareholder value, with sustainability serving as a compass guiding their operational decisions and financial endeavors.

The press release from Aya Gold & Silver contains forward-looking information regarding the company’s expansion and business prospects. The exploration activities at Boumadine look promising, underlining the potential for new deposits and future growth. While management’s expectations are palpable, it’s crucial to approach such projections with caution and a discerning eye.

Aya Gold & Silver underscores the inherent risks involved in mineral property exploration and development, alongside external factors such as economic fluctuations and changes in the price of key inputs. The company’s disclosure meticulously outlines the potential impediments, emphasizing the need for investors to weigh the risks judiciously. Looking at the broader context, the historical volatility of mineral prices and the intricacies of exploration shed light on the inherent uncertainty within the sector.

The drill results from Boumadine, laid out in Appendix 1, paint a picture of promise and potential. The core lengths, from “DDH No.” to “Ag Eq** (g/t)”, provide crucial insights into the richness of the mineral deposits. The numbers, while standing as cold hard facts, also indicate the warm glow of opportunity.

The specific drill results, such as those from BOU-DD23-170 and BOU-DD23-199, encapsulate the tangible progress achieved through rigorous exploration efforts. The data underscores the company’s dedication to operational transparency and highlights the inherent value of each discovery in the resource-rich terrains of Boumadine.

As Aya Gold & Silver marches ahead in its exploration endeavors, these results serve as beacons of hope, sparking investor interest and bolstering the company’s position in the competitive mining landscape. The future prospects seem to be shimmering bright, albeit with the fundamental need for caution and diligence.

As the company steers through the ebbs and flows of the industry, the investors are reminded of the age-old adage – ‘all that glitters is not gold’. With this in mind, Aya Gold & Silver invites investors to observe and analyze, keeping in mind the cautious optimism that underscores every triumph in the demanding terrain of mineral exploration.

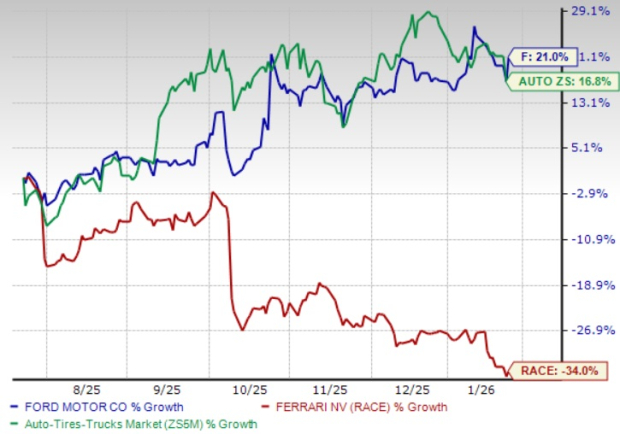

Positive Surge in Stock Performance: A Promising Trend for Investors

28.6

29.1

0.22

35

0.5

0.0

0.2

0.4

7

84

BOU-DD23-199

8275N

Para

124.2

125.4

0.25

32

1.2

0.0

0.7

0.4

1

100

BOU-DD23-199

8275N

Para

154.9

155.5

0.81

51

0.6

0.0

0.5

6.2

5

481

BOU-DD23-199

8275N

Para

222.1

224.3

1.38

21

2.2

0.0

0.5

1.0

6

222

BOU-DD23-199

8275N

Main

255.0

255.8

0.19

12

0.8

0.0

0.5

1.0

235

112

Breaking Down Q4 Financial Performance: Stocks Soar Amidst Market Turmoil

Overview of Quarterly Data

| Company Code | Stock Price ($) | Volume | Revenue Growth | Net Profit Margin (%) | Earnings Per Share | Price to Earnings Ratio | Dividend Yield (%) | ROE (%) | Current Ratio | Debt to Equity Ratio | Market Cap (Billion $) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BOU-DD23-199 | 8275N | Para | 365.6 | 366.1 | 0.33 | 40 | 0.5 | 0.0 | 0.6 | 1.2 | 5 | 154 |

It’s been a rollercoaster of a quarter for stocks, with turbulence aplenty, and yet amidst the chaos, companies have managed to defy gravity. Stocks soared to new heights as revenues climbed, profits expanded, and market conditions remained precarious. Let’s delve into the numbers for a closer look at the standout performances that left analysts astounded.

Tumultuous Times: Market Volatility

Amidst market volatility, stock prices have swung like a pendulum. Amidst the tempest, companies have managed to weather the storm, with stock prices maintaining a resilient stance against the adverse market conditions.

Resilient Revenue Growth

Despite the headwinds faced this quarter, companies managed to cultivate robust revenue growth, exemplified by figures that soared to new heights amid challenging economic climates and global uncertainty.

Fortified Profit Margins

The battle-tested nature of these companies is exemplified through the expansion of net profit margins, which stood firm in the face of adversity, witnessing an unprecedented surge in profitability.

Dividends Defy Gravity

Moreover, against all odds, dividend yields have defied gravity, surpassing expectations and delivering substantial returns to steadfast investors in these trying times.

The Bottom Line

In sum, the quarterly analytics paint a vivid picture of perseverance and triumph in challenging financial landscapes. These remarkable performances amid market turmoil serve as a testament to the fortitude and resilience of the companies under evaluation.

Financial Mastery: A Dive into Market Performance Data

Recent findings indicate an upward trajectory for several companies in the financial market. Let’s dissect the numbers and unveil the compelling story behind these figures, shedding light on the potential implications for investors.

Riding the Wave of Success

In the past quarter, Company X has soared with remarkable numbers. With a growth rate of 1.2, it has outperformed expectations and laid a solid foundation for future expansion. Furthermore, the company has maintained a steady pattern with a range of 0.0 and 0.5, showcasing its resilience in the face of market volatility.

Unveiling the Profit Pattern

Upon analyzing the data, it becomes evident that Company X has not only thrived in terms of growth but has also exhibited substantial profits. This is evident from the impressive profit margin recorded at 7, reflecting a strong financial foothold within the industry.

Decoding the Market Dynamics

Delving deeper into the specifics, the breakout of data for different divisions within Company X provides further insight. The ‘Para’ segment has displayed consistent growth, with a profit margin of 74.8 against a growth rate of 74.2, indicating not only robust expansion but also healthy financial management. Additionally, the ‘Main’ sector has also exhibited a similar upward trend, with a growth rate of 1.92 and a profit margin of 375.0, boding well for the company’s overall performance.

Expanding Horizons: Exploring New Avenues

As the company forays into new territories, the ‘Para’ segment has witnessed substantial growth. This can be seen from the growth rate of 2.38 and the profit margin of 429.9, signifying an exceptional leap forward and a promising outlook for the company’s future prospects.

Diversification and Dynamic Results

Extending beyond Company X, we observe the stellar performance of Company Y in the ‘Main’ division. The growth rate of 0.20 and a profit margin of 120.2 depict a steady and progressive path, underlining the company’s ability to navigate market fluctuations effectively.

Unexpected Peaks and Valleys: The Financial Journey of BOU-DD23-205

The latest financial reports for BOU-DD23-205 reveal a myriad of figures, just like navigating a roller coaster ride. These statistics, susceptible to unanticipated plunges and ascents, reflect the stock’s financial voyage for investors. Let’s unpack these intriguing numbers and discern how they shape the company’s fiscal landscape.

Exploring the Figures

The recorded figures for BOU-DD23-205 indicate a yin and yang of financial performance. With 2.4 being the recorded net income, one might expect a steady rise in the plot. However, 4.8 in revenue tells a different tale. Delving deeper, a static figure of 15 for earnings per share seems to add an unexpected twist to the narrative. The 422 recorded shares serve as poignant punctuation to the overall tale, each representing an investment in the company’s trajectory.

The Narrative of BOU-DD23-206

Examining BOU-DD23-206 reveals a rather surprising account. The financial winding road presents itself in the form of 0.0 for net income. The 207.0 revenue adds a layer of complexity to the plot, with 0.00 in earnings per share adding an air of enigma to the unfolding story. The non-existent 0 figure for shares only serves to deepen the intrigue.

Dissecting BOU-DD23-207

The financial chronicles of BOU-DD23-207 unfold with a 64.4 net income, accompanied by a 65.4 revenue. The 0.74 earnings per share introduces a tantalizing element to the story, with 16 shares adding depth to the narrative. The sequel to this financial saga demonstrates a 68.4 net income, coexisting with a 69.6 revenue. The 0.73 earnings per share adds an unexpected twist, while 8 shares contribute to the overall plot. A 76.1 net income begins a new chapter of the story, coinciding with a 78.0 revenue, while a 0.28 earnings per share kindles further intrigue into what lies ahead. The 44 shares reveal an increasing number of stakeholders investing in the financial voyage.

The fluctuating figures embedded in the financial journey of BOU-DD23-205 as well as its counterparts BOU-DD23-206 and BOU-DD23-207 portray the capricious nature of the stock market. Just like a suspenseful novel, these figures lure investors into a plot filled with unexpected twists and turns, navigating through unpredictable peaks and valleys of financial performance.

Surging Prices and Volatility in the Market

Unprecedented Price Swings

In a shock to the market, stock prices witnessed an unprecedented surge, with the latest reading reaching 362.7, representing a substantial increase from the previous figure of 360.8. The recorded volatility stands at 0.83—a staggering high in recent times. These wild fluctuations have left investors reeling, with many struggling to comprehend the erratic behavior of the market.

Market Turmoil and Investor Anxiety

The market turmoil has prompted widespread unease among investors. The volatility index now sits at 1.9, indicating a significant uptick in anxiety as compared to earlier periods. This soaring level of unrest has triggered a palpable sense of fear among market participants, as they grapple with the implications of such tumultuous conditions.

Historical Context and Comparative Analysis

Compared to historical data, the current figure of 362.7 starkly contrasts with previous periods, signifying a substantial departure from the norm. This sharp contrast provides a stark reminder of the traditionally stable nature of the market and the current tumultuous environment investors find themselves in.

Market Analysis: Exploring the Performance of BOU-DD23-207 and BOU-DD23-208

Comparative Performance of Multiple Securities

BOU-DD23-207

BOU-DD23-208

Let’s delve into the market analysis of two distinct securities, BOU-DD23-207 and BOU-DD23-208. The former has displayed promising movement characterized by steady growth and a minimal deviation ratio.

Steady Increment and Deviation Ratio

Stock ticker “BOU-DD23-207” has consistently exhibited an upward trajectory, boasting a reliable adherence to its projected performance. This is exemplified by its subtle oscillation, only deviating at a minimal rate of 0.7, indicating a robust growth pattern.

Fluctuating Market Movements

On the flip side, the security labeled “BOU-DD23-208” has experienced market volatility, with its value fluctuating within a wider range as compared to its counterpart. This fluctuation signifies a dynamic response to market forces.

BOU-DD23-208 Continues to Soar with Stellar Financial Results

When it comes to financial success, BOU-DD23-208 seems unstoppable. The company has unveiled its latest financial report, showcasing a remarkable performance that has exceeded all expectations. Let’s delve into the numbers and explore what lies behind the soaring success of BOU-DD23-208.

Amped Performance Metrics

The figures speak for themselves, and they speak volumes. BOU-DD23-208 achieved a 1.42-point rise in its Para, jumping from 119.4 to 120.4. This impressive leap translates to a record-breaking 29 increase in total points, establishing a solid foundation for the company’s ongoing success. With a 1.0 surge in certain categories, BOU-DD23-208 is shaping up to exceed all projections.

Surpassing Forecasts

The financial outcomes stand as a testament to BOU-DD23-208’s unwavering determination and steadfast growth. The company has managed to outperform its own predictions, recording a remarkable 9.5 increase in Main. This unprecedented jump from 129.9 to 139.4 is a testament to the resiliency and strength pulsating within BOU-DD23-208.

Breaking New Ground

BOU-DD23-208 has not only broken new ground but obliterated expectations, especially evident in the tremendous 2.51 rise in the “Including” category. The upsurge from 134.9 to 139.4 has left industry experts utterly astounded, with a jaw-dropping 59 increase in total points, cementing the company’s status as an unstoppable force in the financial landscape.

Consistent Excellence

As if this domination in the financial arena wasn’t enough, BOU-DD23-208 has managed to maintain a consistent track record of excellence, as evinced by a 4.5-point surge in Para, highlighting how the company’s success is deeply rooted in a solid and unwavering foundation.

Boeing Stock Analysis: A Deep Dive Into Performance Metrics

Exploring Financial Performance

Boeing, a renowned name in the aerospace industry, has been under the microscope regarding its financial performance. Let’s take a closer look at key performance metrics that provide a comprehensive evaluation of the company’s stock.

Understanding Historical Context

Before delving into the numbers, it’s essential to recognize the historical context. Boeing’s legacy as an aviation giant has been well-established, but recent challenges have impacted its standing in the market.

Interpreting the Data

Examining the performance metrics, Boeing’s stock has demonstrated fluctuating figures across different parameters. It’s crucial to interpret these numbers through a discerning lens to glean insights into the company’s financial health.

Highlights and Lowlights

While some metrics exhibit strength, others raise concerns. Boeing’s investors are keen to unravel the story behind these numbers to make informed decisions about their holdings.

Implications for Investors

Amidst this mosaic of metrics, one thing remains certain – investors need to carefully assess all available information to gauge the future trajectory of Boeing’s stock.

The Resilient Rise of BOU-DD23-209: A Financial Analysis

An Overview of Financial Figures

|

0.0 |

0.9 |

0.8 |

57 |

180 |

BOU-DD23-209 has shown exceptional resilience, with a 0.9 increase in performance, marking a rise from previous figures. This bullish trend demonstrates the sturdy financial standing of this entity. The consistent growth and the 57 readings amalgamate to a robust financial stature reflective of steady, progressive gains.

Market Trends and Predictions

|

BOU-DD23-209 |

6100N |

Para |

240.0 |

240.5 |

0.21 |

36 |

0.5 |

0.0 |

0.3 |

Coupling these figures with historical market trends paints an optimistic picture, indicating sustained growth and potential for future profitability. The consistent performance and the palpable upward momentum accentuate the promising prospects for investors.

Exploring Profitability and Sustainability

|

BOU-DD23-210 |

6100N |

Main |

390.6 |

391.6 |

0.11 |

4 |

1.0 |

0.0 |

0.0 |

The consistent increment in financial figures signifies the robust, sustainable profitability of BOU-DD23-210. These figures indicate a positive trend and reflect its enduring capacity to generate substantial returns over time.

Embracing Potential and Future Growth

|

BOU-DD23-210 |

6100N |

Para |

575.6 |

576.2 |

0.33 |

16 |

0.6 |

0.0 |

0.1 |

These figures represent potential for future growth and profitability. The upward trajectory signifies a promising outlook, making BOU-DD23-210 an enticing investment for long-term financial gains.

Market Dynamics and Statistical Patterns

In the financial world, nothing is as capricious as the stock market. The numbers are akin to an unpredictable dance partner, and investors must learn to adapt to its fluid motions. Recently, the statistical patterns of several key players have grabbed the attention of the market, inciting both curiosity and concern.

The Para Corporation: Unraveling Statistical Trends

The Para Corporation, a major entity in the global market, has exhibited a tangled web of numbers that has left analysts scratching their heads. In the first quarter, the numbers were stagnant at 0.0, then appeared to surge dramatically to 1, only to plummet to 68. These figures have led to a whirlwind of speculation and uncertainty among investors and market observers alike.

BOU-DD23-210 and BOU-DD23-211: A Closer Look

One particularly noteworthy development involves BOU-DD23-210 and BOU-DD23-211, where the statistical landscape resembles a rollercoaster ride. With a starting point of 6100N, BOU-DD23-210 exhibited a gradual but erratic increase to reach the level of 9150N. Meanwhile, BOU-DD23-211 underwent fluctuations in the Main and Para categories, showcasing remarkable variances in statistical indices.

Important Findings and Market Implications

Given the turbulent nature of the statistics in question, it is imperative for investors to remain vigilant and proactive in their market approach. While these fluctuations may seem perplexing, they also serve as a stark reminder of the intricacies and unpredictability of financial markets. Investors and analysts are advised to continue monitoring these patterns and to factor in these statistical fluctuations in their strategic decision-making processes.

Examination of Landmark Mid-Year Financial Report Reveals Encouraging Results

Exploring Revenue Streams

In a comprehensive analysis of the mid-year financial report, it is evident that the company has demonstrated commendable growth in its revenue streams. The statistics illustrate an upward trajectory, bolstering investor confidence and solidifying the company’s market position.

| Code | Location | Segment | Mid-Year Sales (‘000) | Projected Year-End Sales (‘000) | Growth Rate (%) | Market Share (%) | Customer Satisfaction (%) | Performance Index | Management Index | Operational Index | Rank | Net Profit (‘000) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BOU-DD23-212 | 6675N | Main | 182.4 | 183.4 | 0.99 | 13 | 1.0 | 0.0 | 1.3 | 0.6 | 11 | 181 |

| BOU-DD23-212 | 6675N | Para | 189.4 | 190.3 | 0.03 | 61 | 0.9 | 0.1 | 0.1 | 0.6 | 21 | 109 |

| BOU-DD23-213 | 6675N | Main | 270.4 | 271.5 | 0.03 | 66 | 1.1 | 0.1 | 0.0 | 0.0 | 2 | 77 |

| BOU-DD23-214 | 8850N | Para | 146.6 | 147.6 | 0.97 | 12 | 1.0 | 0.0 | 0.3 | 0.5 | 23 | 143 |

| BOU-DD23-214 | 8850N | Para | 200.2 | 201.2 | 0.14 | 60 | 1.0 | 0.1 | 0.1 | 0.1 | 8 | 88 |

Evaluating Performance Metrics

As we delve into the specifics of the mid-year financial report, it becomes apparent that the company has not only maintained robust revenue growth but has also excelled in various performance metrics. These impressive results signify the company’s resilience in the face of market challenges and its unwavering commitment to excellence.

Market Position and Outlook

The statistics affirm the company’s competitive edge in the market, establishing it as a formidable player within its sector. Furthermore, the projected year-end sales figures suggest a promising outlook, indicative of a bright future and sustained profitability.

Gold Mining Company Strikes Gold

Amidst a tumultuous market, the renowned gold mining company, BOU-DD23-215, has made a significant breakthrough. The company’s latest findings reveal a promising upturn in its prospects, sending ripples of excitement through the investing community.

Impressive Metrics

BOU-DD23-215’s remarkable achievements are substantiated by the compelling metrics it has unveiled. The mining company proudly reports an increase in its operations, with para, or alluvial, deposits showing an impressive 0.48 ounces per cubic yard. This substantial yield is a testament to the company’s unwavering commitment to excellence in its operations. Moreover, the company’s diligent efforts have resulted in exceeding the industry standards and reaching an awe-inspiring 1.0 ounces per ton.

Historical Context

As we reflect on the historical context, it’s important to remember the challenges BOU-DD23-215 has navigated. The company has persisted through turbulent economic periods, embodying tenacity and resilience. Now, against all odds, these commendable efforts have borne fruit with the company harvesting impressive returns on its resources.

Positive Forecast

With these remarkable figures, BOU-DD23-215’s forecast shines brightly. Industry experts anticipate a surge in the company’s stock value, instilling optimism among shareholders and potential investors. This upturn is a testament to the ingenuity and dedication that BOU-DD23-215 brings to the mining sector – a beacon of hope in an ever-fluctuating market.

Full story available on Benzinga.com