The investing world is abuzz with excitement as the one-year price target for Aytu BioPharma (NasdaqCM:AYTU) experiences a meteoric rise, soaring to 8.16 per share. This surge marks a significant 60.00% increase from the previous estimate of 5.10 announced on January 16, 2024.

Insight into Price Target

Analysts have now set a new average price target for Aytu BioPharma, with figures ranging from a conservative low of 8.08 to a more bullish high of 8.40 per share. This remarkable escalation encapsulates a remarkable surge of 175.68% from the most recent closing price of 2.96 per share.

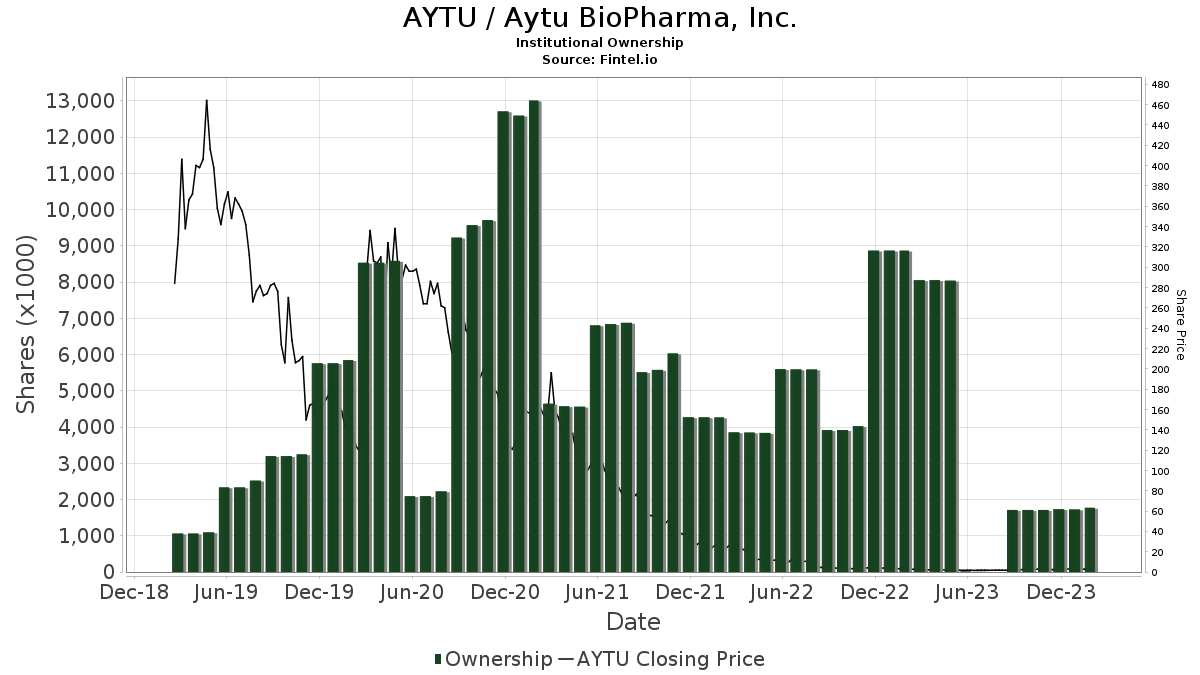

Understanding Fund Sentiment

A total of 30 funds or institutions have taken positions in Aytu BioPharma, showcasing a steady figure from the previous quarter. The average portfolio weight across all funds invested in AYTU now stands at 0.02%, reflecting a notable increase of 13.39%. Institutions collectively hold 1,773K shares, denoting a 3.04% upsurge in the last three months.

Shareholding Updates

Key institutional shareholders have made robust moves in their positions. Nantahala Capital Management retains 1,087K shares, representing a substantial ownership share of 19.52%, maintaining consistency in their holdings.

Meanwhile, Stonepine Capital Management captures attention with 472K shares, equating to 8.49% ownership. Notably, the firm has amped up its portfolio allocation in AYTU by an impressive 36.97% in the last quarter.

Renaissance Technologies has also upped its stake, holding 69K shares which translate to 1.24% ownership. With a remarkable 11.90% increase in shares from the prior filing, Renaissance Technologies has increased its stake by 8.50% over the past quarter.

Geode Capital Management’s strategic maneuvers should not be overlooked, now holding 33K shares, signifying 0.59% ownership. The firm has significantly bolstered its position by 84.57% over the last quarter.

Conversely, Acadian Asset Management has shown a decrease in its stake, holding 15K shares representing 0.26% ownership. The firm reduced its holdings by 54.13%, marking a 35.70% decrease in portfolio allocation in AYTU over the last quarter.

A Deeper Dive into Aytu BioPharma

Aytu BioPharma Background Information

(Description provided by the company)

Aytu BioScience stands as a commercial-stage specialty pharmaceutical company focused on introducing innovative products catering to critical patient needs. The company currently offers a range of prescription products targeting vast primary care and pediatric markets. Some notable offerings in its portfolio include Natesto®, ZolpiMist®, Tuzistra® XR, Karbinal® ER, and Poly-Vi-Flor® & Tri-Vi-Flor®, among others.

In response to the ongoing COVID-19 pandemic, Aytu BioPharma distributes rapid antibody and antigen tests, serving as essential diagnostic tools. Additionally, the company holds global licensing rights for the Healight™ technology platform, an investigational medical device explored for its potential in treating COVID-19 and other respiratory infections.

Providing comprehensive research tools, Fintel empowers individual investors, traders, financial advisors, and small hedge funds. Its expansive data covers diverse aspects of investing, from fundamentals and analyst reports to ownership data, fund sentiment, options sentiment, and insider trading activities. Moreover, Fintel’s exclusive stock picks leverage sophisticated, quantitatively tested models to enhance profitability for investors.

For more information, visit Fintel.

The opinions expressed in this article are solely those of the author and may not necessarily align with the views of Nasdaq, Inc.