B of A Securities Upgrades Hormel Foods Outlook to Neutral

Fintel reports that on April 15, 2025, B of A Securities upgraded their outlook for Hormel Foods (WBAG:HRL) from Underperform to Neutral.

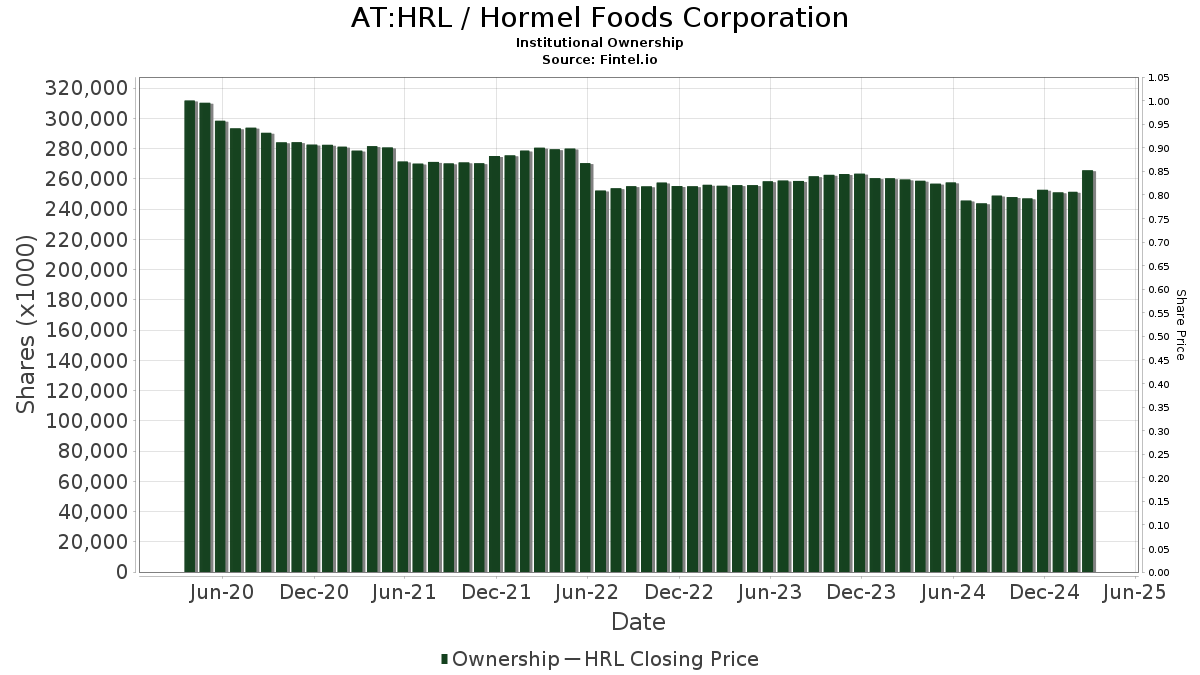

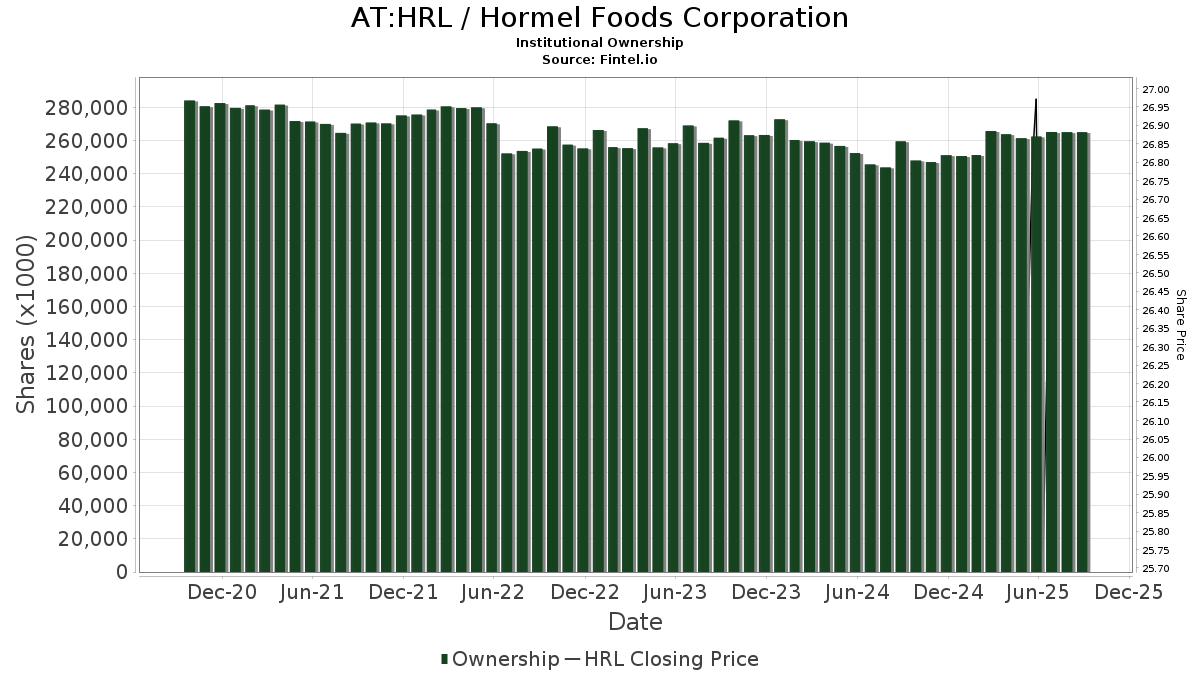

Current Fund Sentiment on Hormel Foods

There are currently 1,205 funds or institutions reporting positions in Hormel Foods. This marks an increase of 17 owners, equating to a 1.43% rise compared to the last quarter. The average portfolio weight of all funds dedicated to HRL now stands at 0.13%, reflecting a substantial 41.98% increase. Over the past three months, total shares owned by institutions have risen by 5.48%, totaling 263,910K shares.

Recent Actions by Other Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) now holds 9,472K shares, representing 1.72% ownership of Hormel Foods. Previously, the fund reported ownership of 9,582K shares, indicating a decrease of 1.16%. Their portfolio allocation in HRL decreased by 3.59% last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 7,871K shares, equating to 1.43% ownership. In its last filing, this firm reported owning 7,611K shares, marking an increase of 3.30%. However, it also decreased its portfolio allocation in HRL by 3.18% in the last quarter.

Invesco currently owns 7,843K shares, which represents 1.43% ownership. Previously, it reported 7,310K shares, reflecting a 6.80% increase. Despite this growth, the firm decreased its HRL portfolio allocation significantly by 90.81% over the last quarter.

Geode Capital Management holds 7,461K shares, representing 1.36% ownership. In its previous report, the firm owned 7,363K shares, which is an increase of 1.32%. Nevertheless, Geode decreased its allocation in HRL by 3.97% in the last quarter.

The Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) has 6,484K shares, representing a 1.18% ownership stake. Previously, the fund held 6,386K shares, translating to an increase of 1.52%. Yet, it reported a decrease in its HRL portfolio allocation by 0.27% last quarter.

Fintel is a comprehensive investing research platform available to individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses global fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, and unusual options trades, among other insights. We also provide exclusive Stock picks powered by advanced, backtested quantitative models aimed at improving profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.