B of A Securities Upgrades Church & Dwight to Buy: Fund Sentiment Insights

On April 15, 2025, B of A Securities upgraded their outlook for Church & Dwight (WBAG:CHD) from Neutral to Buy.

Current Fund Sentiment

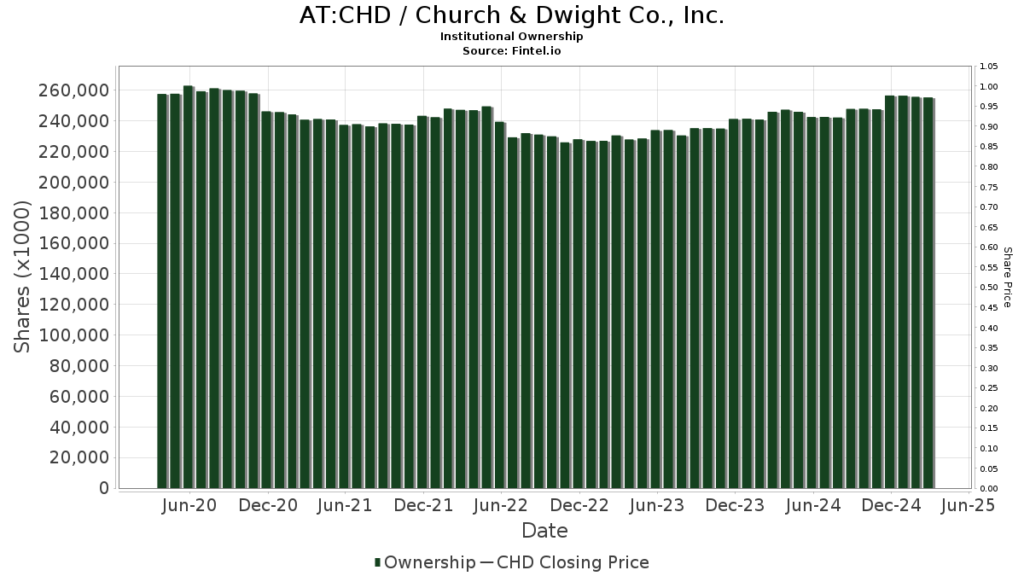

A total of 1,761 funds and institutions are reporting positions in Church & Dwight, reflecting an increase of 11 owners, or 0.63%, in the last quarter. The average portfolio weight for all funds dedicated to CHD stands at 0.25%, which marks an increase of 2.99%. However, total shares owned by institutions decreased by 0.75% over the last three months, reaching 254,256K shares.

Institutional Shareholder Activity

Capital International Investors possess 8,536K shares, which translates to 3.47% ownership of the company. Their previous filing showed ownership of 9,339K shares, indicating a decrease of 9.40%. Consequently, the firm reduced its portfolio allocation in CHD by 10.55% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) report holding 7,689K shares, representing 3.12% ownership of Church & Dwight. In its last disclosure, VTSMX owned 7,741K shares, showing a decrease of 0.68%. Their portfolio allocation in CHD fell by 2.13% over the last quarter.

JPMorgan Chase has increased its ownership to 7,336K shares, comprising 2.98% of the company. The firm previously reported holding 6,146K shares, reflecting a substantial increase of 16.22%. Their portfolio allocation in CHD rose by 16.96% in the last quarter.

Fundsmith LLP holds 6,857K shares, which constitutes 2.79% ownership of Church & Dwight. In a prior filing, it reported 6,883K shares, reflecting a decrease of 0.37%. However, the firm increased its portfolio allocation in CHD by 7.35% in the last quarter.

Massachusetts Financial Services holds 6,666K shares, representing 2.71% ownership. Their previous filing indicated 8,016K shares, which is a significant decrease of 20.25%. This firm dropped its portfolio allocation in CHD by a striking 86.60% over the last quarter.

Fintel serves as a leading investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our coverage spans global fundamentals, analyst reports, ownership insights, fund sentiment, options trading, and more. Additionally, we offer exclusive Stock picks using advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.