B of A Downgrades Fox Factory Holding to Neutral

In a move bound to stir the waters, B of A Securities altered their stance on Fox Factory Holding (NasdaqGS:FOXF) from a resolute Buy to a more tempered Neutral. The shift, announced on February 23, 2024, has undoubtedly raised eyebrows among avid investors and analysts alike.

Analyst Price Projections Point to 54.55% Growth

Current data released on February 24, 2024, suggests that the average one-year price target for Fox Factory Holding stands at 73.44. Ranging from a low of 50.50 to a high of $115.50, this forecast indicates a potential uptick of 54.55% from the most recent closing price of 47.52. The figures crystalize a future brimming with possibilities.

Financial Growth on the Horizon

Projected annual revenue for Fox Factory Holding stands at 1,828MM, marking a robust 24.85% enhancement. The forecasted annual non-GAAP EPS at 6.51 hints at a promising trajectory for the company’s financial health.

Sentiment in the Investment Sphere

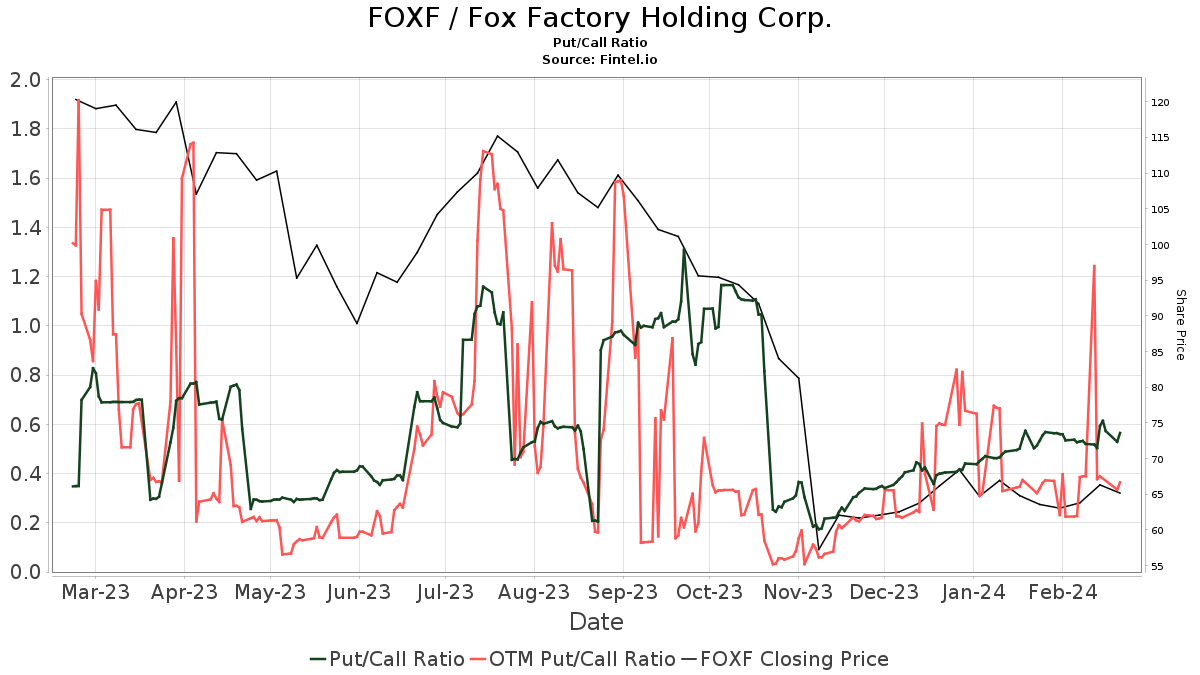

The accumulated data indicates the presence of 714 funds or institutions actively holding positions in Fox Factory Holding. This marginally decreased by 4 owner(s) or 0.56% during the last quarter. Noteworthy is the average portfolio weight dedicated to FOXF, collectively valued at 0.23%, reflecting a decrease of 19.32%. Amidst this flux, total institutional shares witnessed a decline of 3.44% in the last three months, standing at 57,086K shares. A glimmer of hope emanates from the put/call ratio of FOXF, settling at 0.55 and heralding a bullish outlook for the future.

Insights into Shareholder Actions

Kayne Anderson Rudnick Investment Management has been in the limelight, holding 3,420K shares, which signify an ownership stake of 8.07% in the company. The recent filing depicted a reduction in ownership by 7.49%, coupled with a notable 61.24% decrease in the firm’s portfolio allocation concerning FOXF over the last quarter.

The narrative is strangely similar with Wasatch Advisors, where 2,660K shares constitute a 6.28% ownership of the firm. Mitigating the stock ownership by 15.22% and a 48.47% reduction in the portfolio allocation regarding FOXF in the last quarter stimulates the conversation of market fluctuations.

Further into the shareholder dynamics unveils Virtus KAR Small-Cap Growth Fund, claiming a shareholding of 2,375K shares, translating to 5.61% ownership of Fox Factory Holding. In a subtle shift, this represented a decrease of 2.45% from prior filings and an 8.37% decrease in the firm’s portfolio allocation related to FOXF.

Neuberger Berman Group and FIL contribute to this nuanced shareholder puzzle as they navigate changes in ownership and portfolio allocation. Neuberger Berman Group held 2,271K shares, marking a 5.36% ownership of the company, while FIL wielded 1,695K shares, representing 4.00% ownership of Fox Factory Holding. The dynamic nature of these shifts promises a colorful future for the company and its shareholders.

Unveiling Fox Factory Holding

The enigmatic Fox Factory Holding Corp. streams innovative, ride-enhancing products across a spectrum that spans bicycles, vehicles, trucks, and specialty applications. Acting as a prime supplier to top-tier OEMs and bicycle manufacturers, the firm also caters to aftermarket clientele through a diverse range of high-quality products. The narrative asserts Fox Factory Holding’s pivotal role in the ever-evolving mobility segment.

About Fintel

Fintel stands as a beacon for investors, offering a trove of investing research tools tailored for individual investors, traders, financial advisors, and small hedge funds. With a global reach, the platform delivers a comprehensive selection of fundamentals, analyst reports, ownership data, and fund sentiment, providing a holistic view of the market. Fintel also excels in offering insights into insider trading, options sentiment, and unusual options trades that foster informed decision-making. The exclusive stock picks, backed by advanced quantitative models, pave the way for enhanced profitability.

For those seeking to dive deeper into the complexities of the investment realm, Fintel emerges as a reliable partner in navigating the intricacies of the financial landscape.

This article’s initial publication unfolded on Fintel, marking another chapter in the ever-evolving saga of financial markets.

The opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.