MDU Resources Group Upgraded to Buy by B of A Securities

Analyst Forecast Signals Significant Price Increase Potential

On November 5, 2024, B of A Securities made a notable shift in their assessment of MDU Resources Group (NYSE:MDU), raising their outlook from Neutral to Buy.

Price Target Indicates Strong Growth Ahead

As of October 22, 2024, MDU Resources Group has an average one-year price target of $28.39 per share. This target varies from a low of $26.26 to a high of $32.55. Remarkably, the average price target suggests a potential increase of 72.58% from its most recent closing price of $16.45 per share.

Check out our leaderboard to see which companies have the largest potential price target increases.

Strong Revenue Projections

MDU Resources Group is expected to generate annual revenue of $7,064 million, marking an impressive increase of 60.64%. Additionally, the projected annual non-GAAP EPS stands at 2.33.

Fund Sentiment on the Rise

Currently, there are 778 funds or institutions holding positions in MDU Resources Group, which is an increase of 26, or 3.46%, over the last quarter. The average weight of MDU in these portfolios is 0.24%, reflecting a growth of 4.88%. Institutions collectively increased their ownership by 5.72% over the past three months, bringing total shares owned to 175,652K.

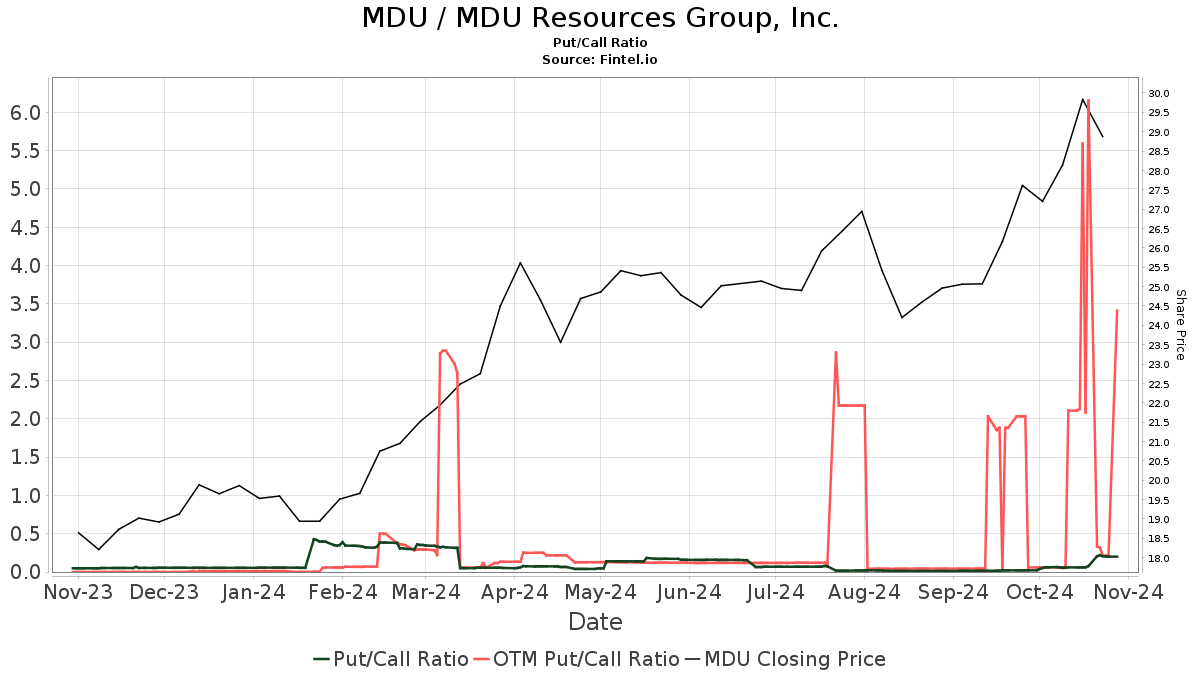

MDU’s put/call ratio is at 0.12, which indicates a bullish sentiment among investors.

Institutional Investors’ Holdings

Corvex Management maintains a significant stake, holding 10,147K shares, representing 4.98% of the company, with no change since the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares owns 6,406K shares (3.14% ownership), up slightly from 6,394K shares, reflecting a 0.18% increase, though the firm lowered its overall portfolio allocation to MDU by 2.97% in the last quarter.

Additionally, the iShares Core S&P Mid-Cap ETF holds 6,342K shares (3.11% ownership), marking a minor increment from 6,340K shares, with a 1.99% rise in portfolio allocation.

Barrow Hanley Mewhinney & Strauss has increased its holding from 4,292K to 6,048K shares (2.97% ownership), reflecting a remarkable 29.04% gain in shares and a 43.83% increase in portfolio allocation.

The Vanguard Small-Cap Index Fund Investor Shares holds 5,129K shares (2.52% ownership), down from 5,195K shares, a decrease of 1.28%, yet this firm also raised its portfolio allocation by 3.16% during the last quarter.

MDU Resources Group Overview

(This description is provided by the company.)

MDU Resources Group, Inc. is a part of the S&P MidCap 400 index and the S&P High-Yield Dividend Aristocrats index, dedicated to Building a Strong America® by offering essential products and services through its regulated energy delivery and construction materials businesses.

Fintel serves as a comprehensive investing research platform for individual investors, financial advisors, and small hedge funds, offering extensive data and insights into market performance.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.