B of A Securities Downgrades Archer-Daniels-Midland Outlook

Fintel reports that on May 8, 2025, B of A Securities has adjusted their outlook for Archer-Daniels-Midland (LSE:0JQQ) from Neutral to Underperform.

Analyst Price Forecast Indicates Possible Upside

As of May 7, 2025, Archer-Daniels-Midland’s average one-year price target stands at 50.73 GBX/share. Predictions range from a low of 45.61 GBX to a high of 59.01 GBX. The average price target signifies a potential increase of 6.35% from its most recent closing price of 47.70 GBX/share.

Financial Projections

The estimated annual revenue for Archer-Daniels-Midland is projected at 100,496MM, reflecting a growth of 19.84%. Additionally, the expected annual non-GAAP EPS is 6.75.

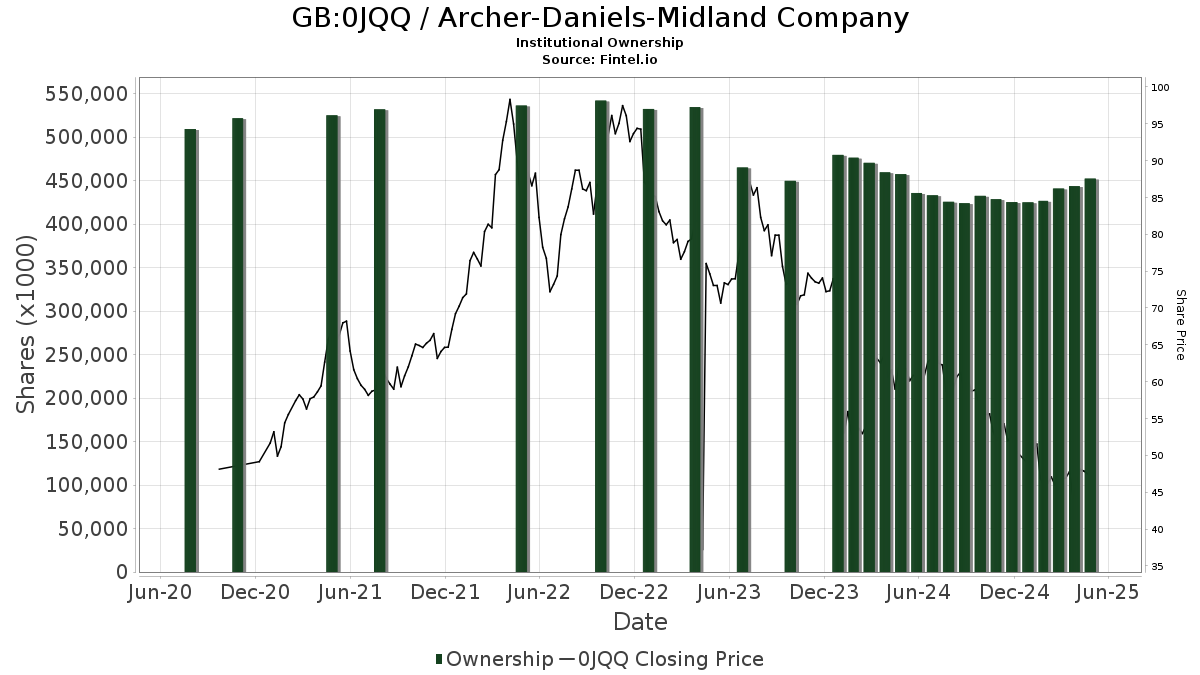

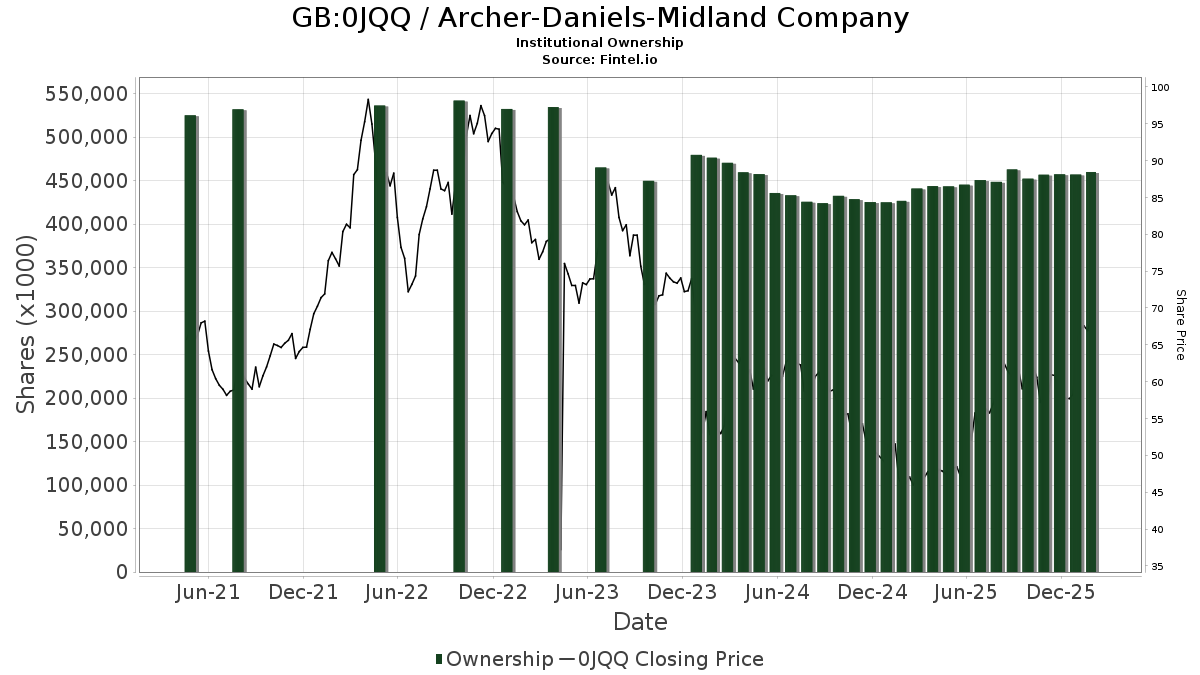

Fund Sentiment Overview

Currently, 1,689 funds or institutions are reporting positions in Archer-Daniels-Midland, marking a slight increase of 3 owners or 0.18% in the last quarter. The average portfolio weight dedicated to 0JQQ is now 0.21%, which represents a rise of 6.08%. Over the past three months, total shares owned by institutions have increased by 5.90% to reach 452,262K shares.

Shareholder Actions

State Farm Mutual Automobile Insurance holds 46,797K shares, equating to a 9.74% ownership stake in the company, with no changes reported in the last quarter.

Wellington Management Group LLP has 21,153K shares, representing 4.40% ownership. This is an increase from 19,430K shares previously, marking an 8.14% rise, although the firm’s allocation in 0JQQ decreased by 86.52% over the last quarter.

Charles Schwab Investment Management owns 17,455K shares, or 3.63% of the company. This is a significant jump from 3,876K shares previously, reflecting a 77.80% increase. Their portfolio allocation in 0JQQ surged by 243.40% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 14,944K shares, accounting for 3.11% ownership. This signifies a slight decrease of 1.37% from 15,149K shares previously. The firm’s allocation in 0JQQ has dropped by 17.79% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares maintains 12,943K shares, reflecting 2.69% ownership. This represents a modest increase of 3.23% from the prior report of 12,525K shares, although the fund’s allocation in 0JQQ decreased by 17.33%.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.