Bank of America Downgrades Outlook for Honeywell International

Fintel reports that on October 24, 2024, B of A Securities downgraded their outlook for Honeywell International (WBAG:HON) from Buy to Neutral.

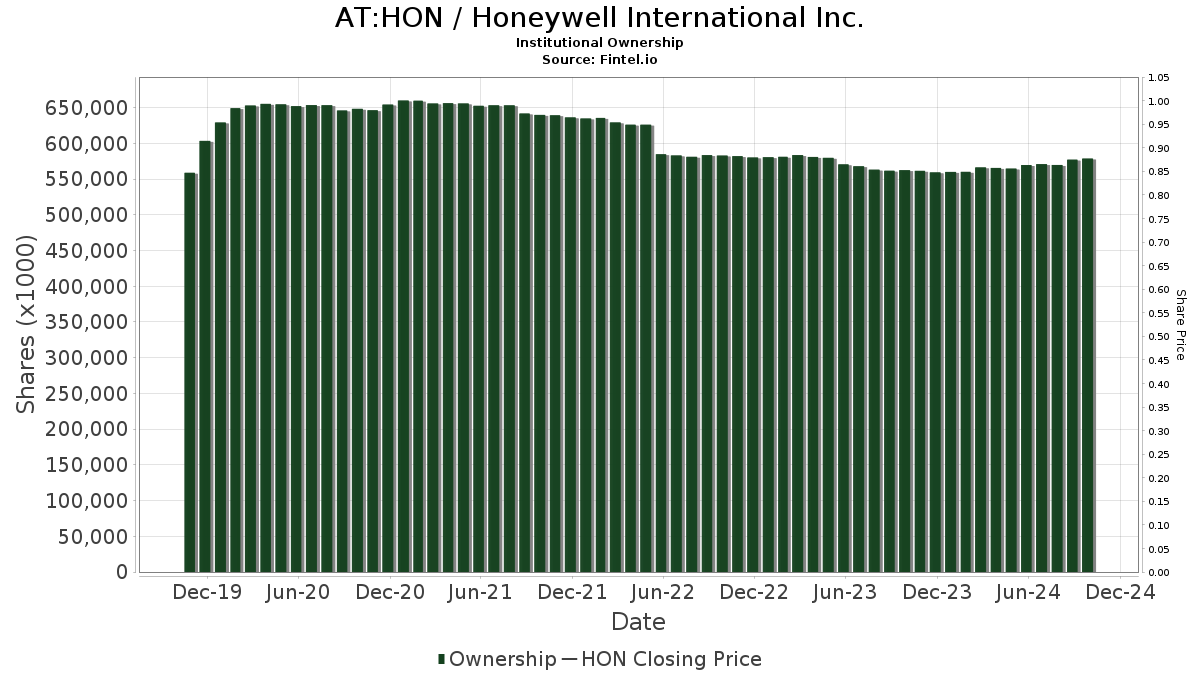

Current Fund Sentiment Towards Honeywell

There are currently 3,576 funds or institutions holding positions in Honeywell International, marking an increase of 45 owners or 1.27% from the previous quarter. The average portfolio weight of all funds invested in HON is 0.45%, up by 1.03%. Additionally, total shares owned by institutions have risen by 5.10% in the last three months, totaling 579,383K shares.

Actions of Notable Shareholders

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 20,574K shares, accounting for 3.17% of the company. This is an increase from their prior holding of 20,507K shares, reflecting a growth of 0.32%. They have raised their portfolio allocation in HON by 1.50% over the last quarter.

JPMorgan Chase has increased its stake to 19,148K shares, which is 2.95% ownership, up from 16,520K shares, showing a significant increase of 13.73%. Their portfolio allocation in HON grew by 17.11% in the past three months.

The Vanguard 500 Index Fund Investor Shares (VFINX) now holds 16,713K shares, representing 2.57% ownership, slightly up from 16,614K shares, an increase of 0.59%. However, they decreased their portfolio allocation in HON by 0.92% over the past quarter.

Wellington Management Group LLP has reduced its holdings to 16,450K shares, which represents 2.53% ownership, down from 17,581K shares, indicating a decrease of 6.88%. Their portfolio allocation in HON was lowered by 1.91% over the previous quarter.

Finally, Newport Trust holds 15,678K shares, equating to 2.41% ownership of the company, and has made no changes in the last quarter.

Fintel is a leading investing research platform that serves individual investors, traders, financial advisors, and small hedge funds.

Providing a comprehensive database that includes fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options flow, and much more, Fintel also offers exclusive stock picks driven by advanced, backtested quantitative models aimed at improving investor returns.

Visit to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.