B of A Securities Downgrades Check Point Software Technologies Outlook

On October 30, 2024, Bank of America Securities changed their recommendation for Check Point Software Technologies (WBAG:CHKP) from Buy to Neutral.

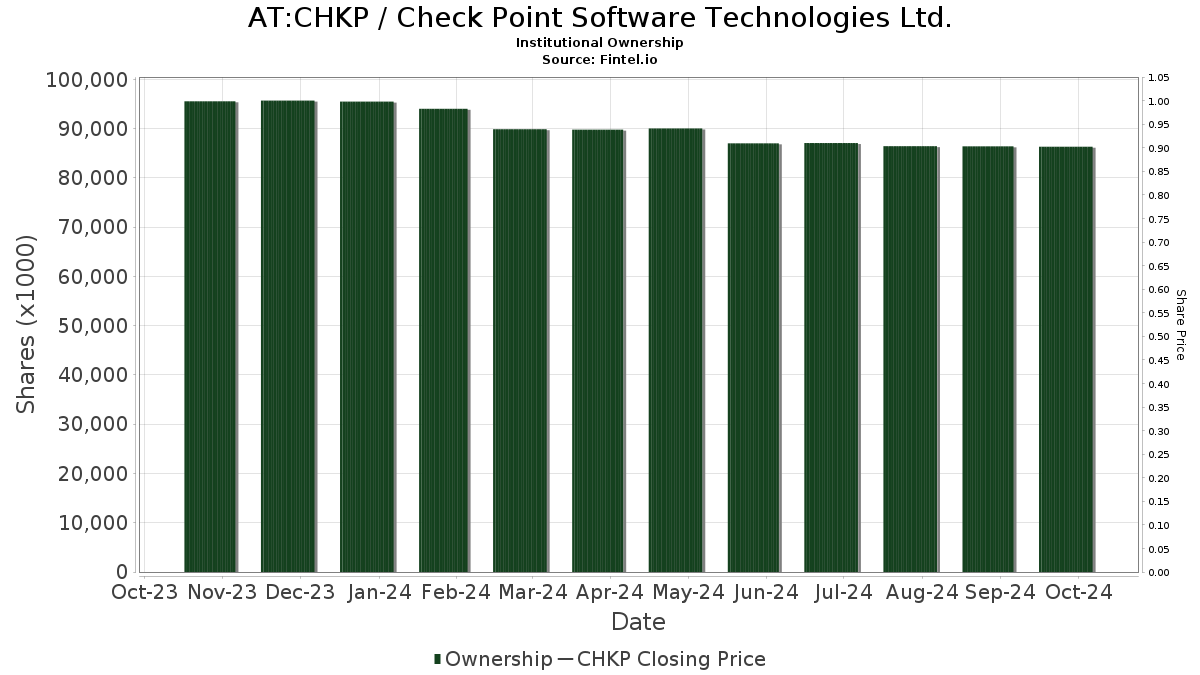

Current Fund Sentiment Toward CHKP

A total of 1,117 funds or institutions currently hold positions in Check Point Software Technologies. This figure represents an increase of 36 holders, or about 3.33%, compared to the previous quarter. The average portfolio weight of all funds invested in CHKP is 0.40%, a rise of 0.74%. In the past three months, total shares owned by institutions climbed by 0.90%, amounting to 86,537K shares.

Recent Moves by Major Shareholders

Massachusetts Financial Services owns 5,528K shares, accounting for 5.03% of the company. Previously, this firm reported holding 5,413K shares, marking an increase of 2.08%, despite decreasing its portfolio allocation in CHKP by 83.77% over the last quarter.

Acadian Asset Management holds 4,109K shares, representing 3.74% ownership. Their previous filing listed 3,717K shares, which is an increase of 9.54%. However, they have reduced their portfolio allocation in CHKP by 1.68% over the past quarter.

Ninety One UK reported holding 3,609K shares, or 3.28% of Check Point. This represents a small increase from 3,570K shares previously, with no change in their portfolio allocation over the past quarter.

Boston Partners now holds 3,572K shares, representing 3.25% ownership. This is a slight decrease from their prior holding of 3,624K shares, which is a reduction of 1.46%. They have significantly lowered their portfolio allocation in CHKP by 57.52% in the last quarter.

Lastly, Nordea Investment Management Ab own 2,350K shares, making up 2.14% of the company. They previously reported 2,675K shares, indicating a decrease of 13.82% and a reduced portfolio allocation in CHKP by 14.30% over the last quarter.

Fintel is a well-regarded investing research platform that caters to individual investors, traders, financial advisors, and small hedge funds.

The platform covers global data, including fundamentals, analyst reports, ownership information, fund sentiment, options sentiment, insider trading, options flow, and more. Furthermore, exclusive stock picks on Fintel are derived from advanced, backtested quantitative models designed to enhance profit margins.

Click to Learn More

This article first appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.