Baidu Set to Report Q1 2025 Earnings Amid Mixed Performance

Baidu, Inc. BIDU is set to report its first-quarter 2025 results on May 21, prior to the market’s opening. In the previous quarter, Baidu reported non-GAAP earnings per share (EPS) of $2.63, surpassing the Zacks Consensus Estimate of $1.78. Its total revenues reached $4.68 billion, down 2% year over year, though this still exceeded analyst expectations by 2.5%. The downturn in top-line revenue continues to be affected by ongoing weaknesses in online marketing, which were somewhat compensated by strong performance in the AI Cloud division.

Baidu Core revenues saw a modest year-over-year growth of 1%, totaling $3.8 billion, reflecting a mixed performance across its various business lines. Notably, the AI Cloud segment achieved a remarkable 26% increase in revenue year over year during the fourth quarter, helping to offset difficulties in online marketing.

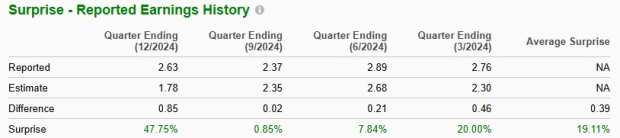

This prominent Chinese technology company has consistently beaten earnings estimates over the last four quarters, achieving an average surprise of 19.1%. You can refer to the historical figures in the chart below.

Image Source: Zacks Investment Research

First-Quarter Estimates for BIDU

The Zacks Consensus Estimate for Baidu’s first-quarter EPS has risen to $1.96 from $1.65 in the last 60 days. However, this figure reflects a 29% decline compared to the same period last year. Revenue expectations stand at $4.3 billion, indicating a 1.6% year-over-year decline. For 2025, BIDU is anticipated to experience a modest 1.7% increase in revenue compared to 2024.

In terms of EPS, a decrease of 4.3% is expected for this year.

Image Source: Zacks Investment Research

Analyzing Baidu’s Earnings Potential

Our model suggests that Baidu may not achieve an earnings beat this reporting cycle. A stock typically needs a positive earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) for this to occur. Currently, Baidu shows an earnings ESP of 0.00% and holds a Zacks Rank of #3.

Factors Influencing Baidu’s Q1 Results

Expectations for Baidu’s first-quarter revenues suggest continued declines due to macroeconomic challenges and a slow recovery in advertising. The online marketing segment, which significantly contributes to the company’s revenue, posted a 7% year-over-year drop last quarter. Despite efforts to integrate generative AI into their search process, monetization remains limited, with only 22% of result pages now featuring AI-generated content. Management notes that significant revenue increases from GenAI will take some time, with a gradual recovery in advertising projected for the first half of 2025.

China’s economic landscape remains fragile, influenced by deflationary trends and instability in the property sector. Such factors are likely exerting pressure on advertising budgets and enterprise IT expenditure, both essential for Baidu’s core and cloud divisions. This challenging environment may have compounded the pressures facing Baidu’s first-quarter results.

Additionally, the iQIYI segment continues to struggle, reflecting a 14% year-over-year revenue decline in the last quarter, and no signs of a rebound are evident. The sustained difficulties in monetizing content and growing the subscriber base are exacerbated by consumer caution.

Despite these challenges, the AI Cloud segment serves as a vital growth driver for Baidu. Last quarter, AI Cloud revenues surged by 26% year over year, powered by the adoption of Baidu’s ERNIE foundation models and the Tianfeng MaaS platform. With falling inference costs and increasing use of generative AI tools among businesses, management anticipates continued momentum in 2025. Notably, ERNIE’s daily API calls reached 1.65 billion in the fourth quarter, with external usage increasing by 178% quarter over quarter, potentially balancing the overall decline in advertising revenues.

However, rising costs associated with expanding AI infrastructure may pressure the company’s profitability. As Baidu enhances its AI capabilities and develops its autonomous driving unit, maintaining operational efficiency will be crucial. Nonetheless, improvements in AI Cloud’s operating margins are likely to buffer overall margin pressures as Baidu focuses on valuable enterprise contracts and refines its infrastructure for greater efficiency.

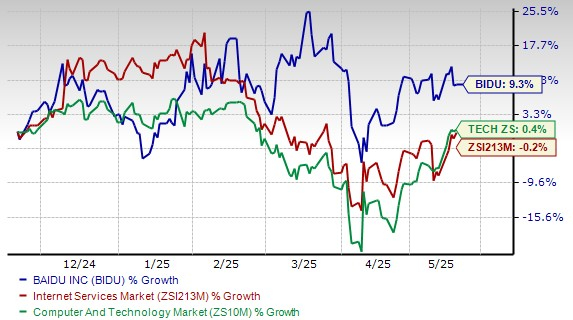

BIDU Stock Performance Compared to Sector and Industry

In the past six months, BIDU’s shares have risen by 9.3%, surpassing the Zacks Internet – Services industry, which has declined by 0.2%, and the Zacks Computer and Technology sector, which recorded a 0.4% growth.

SOUN Stock’s 6-Month Performance

Image Source: Zacks Investment Research

Valuation Overview of BIDU Stock

Considering valuations, Baidu is currently trading at a discount compared to its industry peers and historical metrics. Its forward 12-month price-to-earnings (P/E) ratio is lower than its five-year average, and it holds a Value Score of A.

This positions Baidu at a significant discount to the broader tech sector and its Chinese counterparts, such as Alibaba BABA, which has a forward P/E of 11.02, and Tencent TCEHY, with a forward P/E of 16.75.

Image Source: Zacks Investment Research

Considerations for Holding Baidu Stock

Baidu remains a

Baidu Shows Resilience Amidst Challenges with Innovative AI Strategy

Baidu, Inc. (BIDU) is demonstrating its potential as a worthwhile investment thanks to strong innovation, solid financials, and attractive valuation. Currently, the stock trades 23.2% below its 52-week high, yet it has recently gained 7.6% within a month, indicating renewed investor confidence. The company is making significant progress in its AI transformation, showcasing advancements such as ERNIE 4.5 Turbo, ERNIE X1 Turbo, pet communication AI, and the expansion of its Apollo Go robotaxi services.

AI Transformation Shows Promise

Despite facing ongoing macroeconomic headwinds in China and challenges in its core online advertising and iQIYI segments, Baidu’s effective execution in artificial intelligence, particularly in the AI Cloud segment, suggests long-term growth opportunities. Its generative AI capabilities, driven by the ERNIE foundation model, are seeing increased commercial activity, with a surge in API call volumes and faster enterprise adoption.

Valuation Indicates Good Entry Point

Baidu’s current valuation further supports a wait-and-see approach. The stock trades at a lower multiple than both its peers and its historical averages, while outperforming broader tech and internet services sectors over the past six months. Although short-term earnings and revenue growth may face pressure from China’s economic landscape, Baidu’s robust innovation pipeline, strategic focus on monetizing AI, and improved operating leverage in the cloud business form a solid basis for potential recovery. In summary, although Baidu’s first-quarter results may exhibit short-term weaknesses, they are likely to underscore the long-term promise of its AI advancements. Any signs of monetizing generative AI or sustained strength in AI Cloud could alleviate investor concerns regarding short-term earnings challenges.

Stock Recommendations and Analysis

For those seeking investment prospects, a number of expert-picked stocks are making headlines. Notably, several have previously achieved impressive gains, with returns of +143.0%, +175.9%, +498.3%, and +673.0%. These selected stocks are often under the radar of Wall Street, presenting an opportunity to invest early.

For the latest stock recommendations, investors can explore options such as Baidu, Tencent Holding Ltd. (TCEHY), and Alibaba Group Holding Limited (BABA). Comprehensive analysis reports on these companies are available for those interested in expanding their portfolio.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.