Comparing Baidu and Tencent: Key Players in AI Growth

China’s tech giants Baidu (BIDU) and Tencent Holdings Limited (TCEHY) are significant contenders in the artificial intelligence (AI) race. Known as the “Google of China,” Baidu leads in Internet search and online advertising within its market. Tencent, with its WeChat super-app and vast gaming and social media empire, is also heavily investing in AI technologies, including large language models and cloud computing. Both companies are attractive options for investors interested in AI advancement.

Notably, Baidu and Tencent showcase similar attributes that position them at the forefront of China’s AI boom. They benefit from extensive user bases—WeChat boasts nearly 1.4 billion users—and abundant data resources for training AI systems. Furthermore, both companies enjoy significant government backing amid China’s ambition to spearhead AI innovation. As the global market for generative AI expands, Baidu introduced its ERNIE Bot, a ChatGPT-like chatbot, while Tencent released its Hunyuan foundation model, showcasing their commitment to competitiveness. Investors increasingly view these firms as leading AI contenders in China.

We’ll now examine the fundamentals of both stocks to discern which may be the more promising investment opportunity at this time.

The Case for Baidu Stock (BIDU)

Baidu remains the preeminent search engine in China, commanding a dominant share of the online search market. This primary search and advertising enterprise generates robust cash flow, which Baidu is channeling into its AI efforts. In addition to search, the company is expanding into AI cloud services, autonomous driving through its Apollo unit, and smart devices, marking a significant shift toward becoming an AI-first company.

The ERNIE Bot has quickly established itself in the market, amassing over 200 million users and managing 1.65 billion daily API calls by late 2024, thanks to widespread developer and enterprise adoption. Furthermore, Baidu plans to launch an open-source ERNIE 4.5 model, enhancing multimodal reasoning capabilities by 2025. Baidu’s Apollo Go robotaxis reached an impressive 1.1 million rides in the fourth quarter alone, pushing total rides past 9 million as operations extend to new cities, including Hong Kong.

Despite its progress in AI and cloud computing, Baidu must contend with competition from Alibaba‘s (BABA) Alibaba Cloud and Tencent’s cloud offerings. Alibaba Cloud (Aliyun) currently leads the Chinese cloud market with an extensive array of enterprise services. This scenario underscores the necessity for Baidu to continuously innovate to maintain its competitive position.

Baidu’s recent financial results present a nuanced picture. While cost controls and efficiencies have bolstered profitability, overall revenue growth faced challenges. In 2024, revenues slightly declined, reflecting difficulties in the advertising sector. Positively, the AI Cloud segment has shown promise, with revenues growing 17% in 2024, fueled by rising demand for AI services.

Management characterized 2024 as a pivotal year for Baidu’s AI strategy, forecasting more substantial benefits from AI investments in 2025. The company maintains a healthy financial position, reporting RMB 170.5 billion in net cash (approximately $24 billion) and free cash flow of RMB 13.1 billion. In 2024, Baidu repurchased over $1 billion in shares as part of a $5 billion buyback program, an indication of management’s confidence and support for the stock. The confluence of improving margins, disciplined cash management, and ongoing AI initiatives suggest a positive outlook for Baidu’s financial trajectory as it seeks to rekindle revenue growth.

The Case for Tencent Stock (TCEHY)

Unlike Baidu, Tencent is a diversified tech conglomerate, boasting strengths in social media, gaming, fintech, cloud, and entertainment. Its flagship, WeChat (Weixin), is the primary social platform and digital wallet for many in China, serving nearly 1.4 billion monthly active users by the end of 2024. This extensive reach provides Tencent with a substantial data advantage. Additionally, Tencent operates the largest gaming business in China and is among the top global video game publishers by revenue.

The synergy among Tencent’s core franchises—including social networks and gaming—generates steady cash flow, which is channeled into growth areas like cloud computing and online payments. The company’s ecosystem, consisting of QQ, WeChat, and various streaming, music, and fintech services, is deeply integrated into daily life in China, providing a strong competitive advantage. This solid foundation supports Tencent’s investments in emerging technologies such as AI.

Although Tencent entered the generative AI space later than Baidu, it has swiftly developed its AI capabilities. In early 2025, Tencent launched Hunyuan Turbo S, an advanced AI model capable of delivering rapid chatbot responses without compromising quality, significantly outpacing competitors like DeepSeek.

Tencent integrates AI throughout its ecosystem, enhancing functionalities like Weixin Search and smart mini-program recommendations. The company has restructured its AI teams to foster innovation and expanded R&D and capital expenditures to support growth. Through Tencent Cloud, the company provides AI services that include speech/image recognition, user behavior analytics, and ad optimization, though it still trails behind Alibaba Cloud in market size.

Tencent’s financial results have shown marked improvement in the past year. Remarkably, the firm reported a return to double-digit revenue growth in the fourth quarter of 2024, driven by a rebound in advertising (partly thanks to AI-enhanced targeting) and recovery in its gaming division. In 2024, Tencent increased share repurchases by more than double to approximately HK$112 billion and announced a 32% increase in dividends for 2025, highlighting its strong cash flow amidst ongoing investments. Management noted that AI-powered enhancements to advertising technology and features like Video Accounts contributed significantly to these robust results, evidencing AI’s positive impact on Tencent’s financial performance.

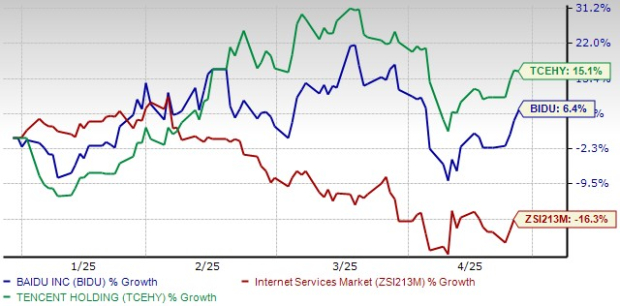

Share Price Performance & Valuation of BIDU and TCEHY Stocks

Baidu and Tencent stocks have outperformed the Zacks Internet – Services industry this year. However, Tencent has seen a more substantial gain of 15.1% year-to-date compared to Baidu.

Image Source: Zacks Investment Research

In terms of valuation, Baidu is currently trading…

Comparing Baidu and Tencent: Valuation and Earnings Overview

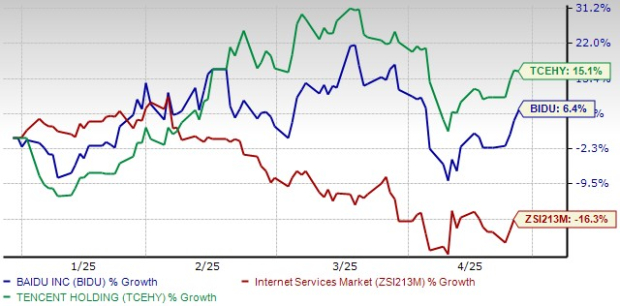

Baidu, Inc. (BIDU) currently displays competitive pricing metrics, trading at a forward 12-month price-to-sales (P/S) ratio below its five-year average. As a result, it earns a Value Score of A.

Image Source: Zacks Investment Research

Performance Comparison Between Baidu and Tencent

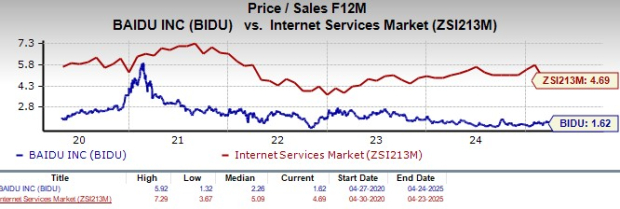

In contrast, Tencent Holdings Ltd. (TCEHY) has seen a rally this year and trades at approximately 5.47X its forward 12-month P/S ratio. This is higher than both the industry average and its five-year average. Therefore, Baidu appears to offer better value on a sales basis.

Image Source: Zacks Investment Research

Growth Estimates for BIDU and TCEHY

Analysts are becoming more optimistic about the earnings potential for both Baidu and Tencent. Over the past 60 days, the Zacks Consensus Estimate for Baidu’s and Tencent’s current year earnings per share (EPS) has seen upward revisions, indicating a positive change in sentiment.

Looking at the numbers for the current year, Baidu’s revenues are projected to increase by 1.7% to $18.8 billion, while its EPS is expected to decline by 4.3% to $10.08. Conversely, Tencent anticipates an 8.7% revenue growth to $99.85 billion and a 14.4% EPS increase to $3.74. This robust growth trajectory and profitability for Tencent as it approaches 2025 is underscored by its strong investment capabilities in AI and other sectors, justifying its higher valuation.

For Baidu Stock

Image Source: Zacks Investment Research

For Tencent Stock

Image Source: Zacks Investment Research

Conclusion

In conclusion, while both Baidu and Tencent are prominent players in the artificial intelligence space, Tencent currently presents a more attractive investment option. Its diversified revenue streams, solid growth trajectory, and effective AI integration position it well for future value creation. This is reflected in its Zacks Rank #2 (Buy), compared to Baidu’s Zacks Rank #3 (Hold), signifying a more favorable outlook for Tencent’s earnings growth.

Disclaimer: The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.