Baird Begins Coverage of V2X with Positive Outlook

Analyst Price Projections Indicate Slight Decline

Fintel reports that on October 11, 2024, Baird initiated coverage of V2X (NYSE: VVX) with an Outperform recommendation.

Current Price Targets for V2X

As of September 25, 2024, the average one-year price target for V2X is $63.24 per share. Price estimates vary, with a low of $55.55 and a high of $71.40. This average target reflects a small decline of 1.19% from the most recent closing price of $64.00 per share.

For more insights, check our leaderboard featuring companies with the largest price target upside.

Revenue and Earnings Outlook

The projected annual revenue for V2X is $4,187 million, representing a modest increase of 1.51%. Additionally, the projected annual non-GAAP EPS stands at 4.19.

Fund Sentiment Analysis

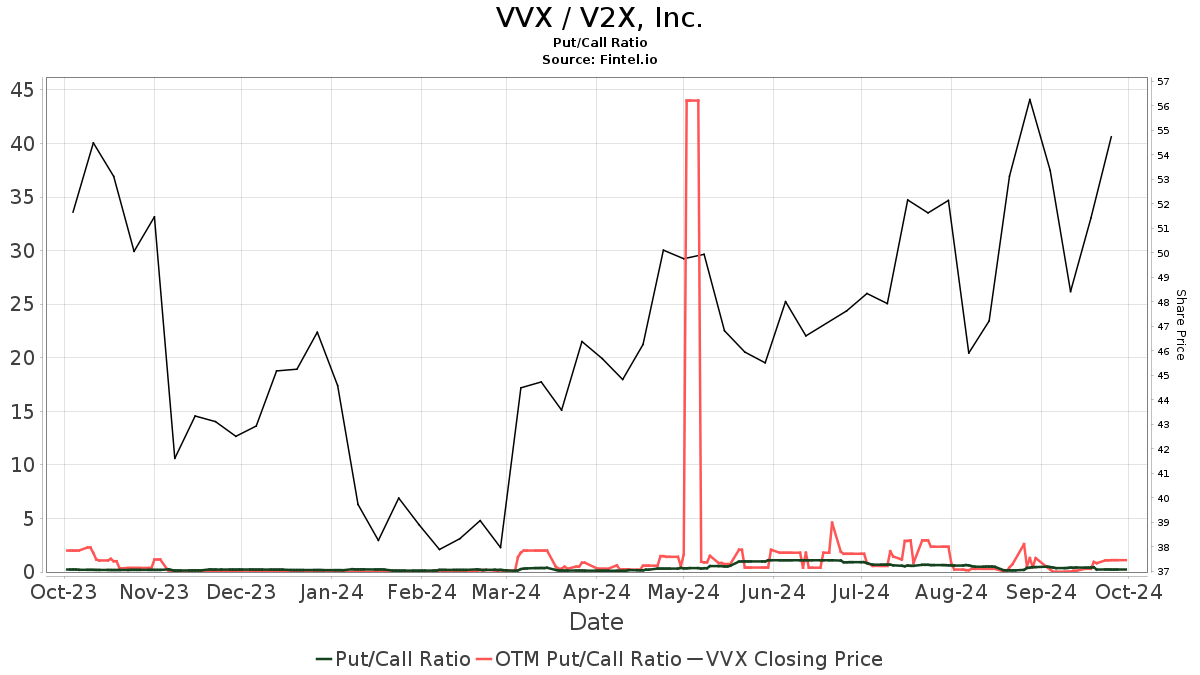

Currently, there are 363 funds or institutions reporting positions in V2X, down by 20 owners, or 5.22%, compared to the previous quarter. The average allocation of funds invested in VVX is 0.36%, a rise of 12.88%. Total shares held by institutions grew by 1.75% over the last three months to 32,804,000 shares.  The put/call ratio for VVX is 0.36, indicating a bullish outlook among investors.

The put/call ratio for VVX is 0.36, indicating a bullish outlook among investors.

Institutional Shareholder Activities

AIP holds 18,967,000 shares, accounting for 60.81% of the company. There has been no change in ownership over the last quarter.

FCTDX – Strategic Advisers Fidelity U.S. Total Stock Fund now holds 488,000 shares, a 1.56% ownership that represents a 12.52% increase from the previous filing, with a 27.36% increase in its portfolio allocation in VVX.

FSCRX – Fidelity Small Cap Discovery Fund currently holds 437,000 shares, corresponding to 1.40% ownership, marking a decrease of 6.02% from prior holdings of 463,000 shares. However, it increased its portfolio allocation in VVX by 0.81% last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has 428,000 shares, representing 1.37% ownership, up 25.80% from 317,000 shares. It also raised its portfolio allocation in VVX by 34.57% over the last quarter.

FLPSX – Fidelity Low-Priced Stock Fund holds 391,000 shares, or 1.25% ownership, reflecting a slight decrease of 0.51% from its previous 393,000 shares but an increase in allocation of 3.96% over the last quarter.

About V2X

Vectrus is a leading global provider of service solutions with more than 70 years in the industry. It specializes in facility and base operations, supply chain logistics, IT support, and engineering services primarily for U.S. government customers worldwide. Based in Colorado Springs, Colorado, Vectrus employs about 7,100 people across 148 locations in 26 countries. In 2020, the company reported sales of $1.4 billion.

Fintel serves as a comprehensive investment research tool for individual investors, traders, financial advisors, and small hedge funds, providing a wealth of data on fundamentals, analyst reports, ownership statistics, and more. With a global perspective, Fintel offers a range of advanced tools, including quantitative models designed for enhanced profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.