Baird Lowers Honeywell International’s Rating: Insights Into Market Sentiment

Fintel reports that on October 25, 2024, Baird downgraded their outlook for Honeywell International (XTRA:ALD) from Outperform to Neutral.

Analyst Price Forecast Predicts 9.65% Growth

As of October 22, 2024, the average one-year price target for Honeywell International is 212,11 €/share. Predictions range from a low of 189,92 € to a high of 240,78 €. This average price target represents an increase of 9.65% from its latest reported closing price of 193,44 € / share.

Check out our leaderboard of companies with the largest price target upside.

Annual Revenue and Earnings Projections

The projected annual revenue for Honeywell International is 39,047 million euros, reflecting a growth of 3.16%. Additionally, the anticipated annual non-GAAP EPS stands at 10.11.

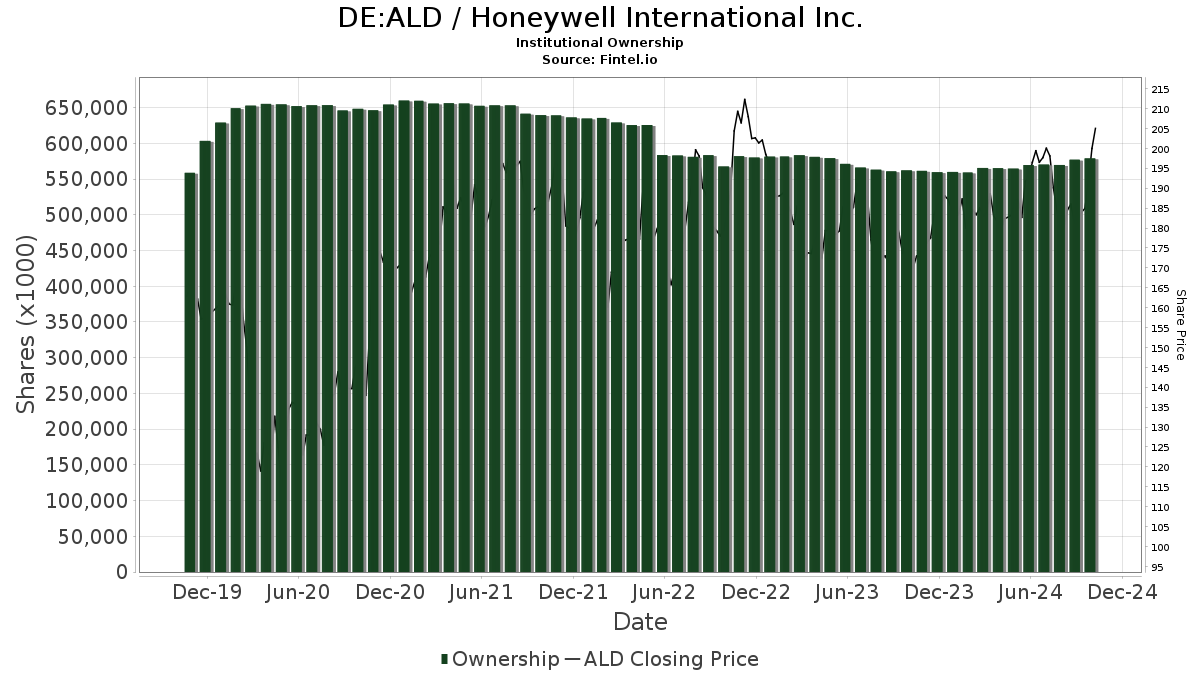

Current Fund Sentiment

There are 3,573 funds or institutions reporting positions in Honeywell International. This marks an increase of 40 owners, or 1.13%, in the last quarter. The average portfolio weight for all funds dedicated to ALD is 0.45%, up by 0.93%. In the past three months, total shares owned by institutions have risen by 5.09%, totaling 578,926K shares.

Actions of Major Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 20,574K shares, representing 3.17% ownership of the company. In its previous filing, the firm reported owning 20,507K shares, which is an increase of 0.32%. Vanguard has raised its portfolio allocation in ALD by 1.50% this past quarter.

JPMorgan Chase owns 19,148K shares, equating to 2.95% ownership. Previously, the firm reported holding 16,520K shares, showing a growth of 13.73% and a 17.11% increase in its portfolio allocation in ALD over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares holds 16,713K shares, which corresponds to a 2.57% stake in Honeywell. Compared to the prior filing, which showed ownership of 16,614K shares, this is a slight increase of 0.59%. However, the firm reduced its portfolio allocation in ALD by 0.92% over the past quarter.

Wellington Management Group LLP owns 16,450K shares, representing 2.53% of the company. This is down from 17,581K shares in its previous filing, reflecting a decrease of 6.88% in their allocation in ALD over the last quarter.

Newport Trust holds 15,678K shares, translating to a 2.41% ownership of the company, with no change from the last quarter.

Fintel is recognized as a leading investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data provides detailed insights into fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Moreover, our exclusive stock picks leverage advanced, backtested quantitative models to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.