Baird Downgrades Universal Health Services: Key Financial Insights Ahead

Fintel reports that on April 15, 2025, Baird downgraded their outlook for Universal Health Services (LSE:0LJL) from Outperform to Neutral.

Average Price Target Indicates Significant Growth Potential

As of April 2, 2025, the average one-year price target for Universal Health Services is 232.83 GBX/share. This figure shows a potential increase of 34.49% compared to its most recent closing price of 173.12 GBX/share. The forecasts vary, ranging from a low of 188.27 GBX to a high of 293.99 GBX.

See our leaderboard of companies with the largest price target upside.

Projected Financial Overview

The annual revenue projection for Universal Health Services is 15,651MM, reflecting a slight decrease of 1.12%. Additionally, the anticipated non-GAAP EPS stands at 12.80.

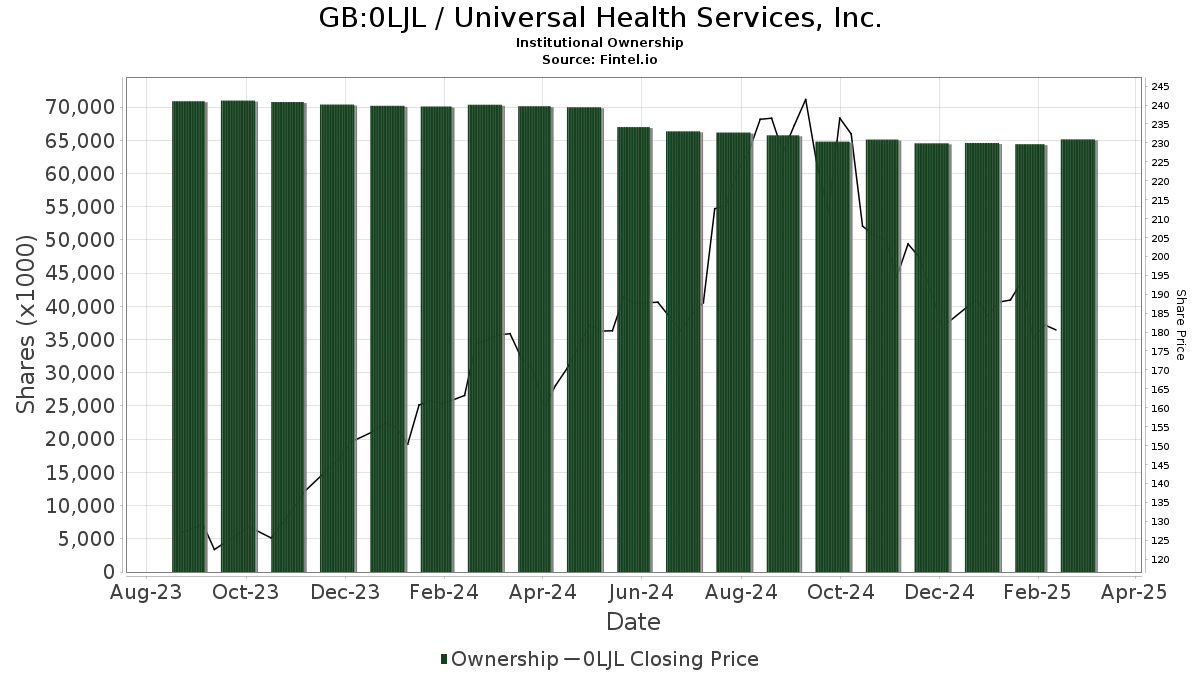

Investor Sentiment and Institutional Holdings

Currently, there are 1,291 funds or institutions reporting positions in Universal Health Services. This marks an increase of five owners, or 0.39%, in the last quarter. The average portfolio weight of all funds dedicated to 0LJL has increased by 21.48%, reaching 0.16%. Total institutional shares owned rose by 1.24% over the past three months, amounting to 65,079K shares.

Institutional Investment Activity

First Eagle Investment Management currently holds 4,675K shares, which represents 8.10% ownership of the company. This is an increase from their previous holding of 4,631K shares, a rise of 0.94%. However, the firm has decreased its portfolio allocation in 0LJL by 14.20% in the last quarter.

SGENX – First Eagle Global Fund continues to hold 3,368K shares, corresponding to 5.83% ownership, with no changes in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 1,750K shares, or 3.03% of the company. This reflects a decrease from their previous 1,801K shares, noting a reduction of 2.90% in the last quarterly report.

Geode Capital Management holds 1,714K shares, representing 2.97% ownership—an increase from their earlier 1,662K shares, which accounts for a rise of 3.04%. Yet, the firm has reduced its portfolio allocation in 0LJL by 59.27% in the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares owns 1,589K shares, which indicates 2.75% ownership. This ownership is slightly up from 1,557K shares previously, illustrating an increase of 2.03%. Nonetheless, the portfolio allocation in 0LJL decreased by 24.35% over the last quarter.

Fintel offers one of the most comprehensive investing research platforms available for individual investors, traders, financial advisors, and small hedge funds. Our data encompasses global fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, and more. Additionally, our exclusive Stock picks are driven by rigorous, backtested quantitative models designed to improve profitability.

Click to Learn More.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.