Baird Upgrades Elastic N.V.: A Closer Look at Institutional Sentiment

On November 22, 2024, Baird raised its outlook for Elastic N.V. (MUN:3E1) from Neutral to Outperform.

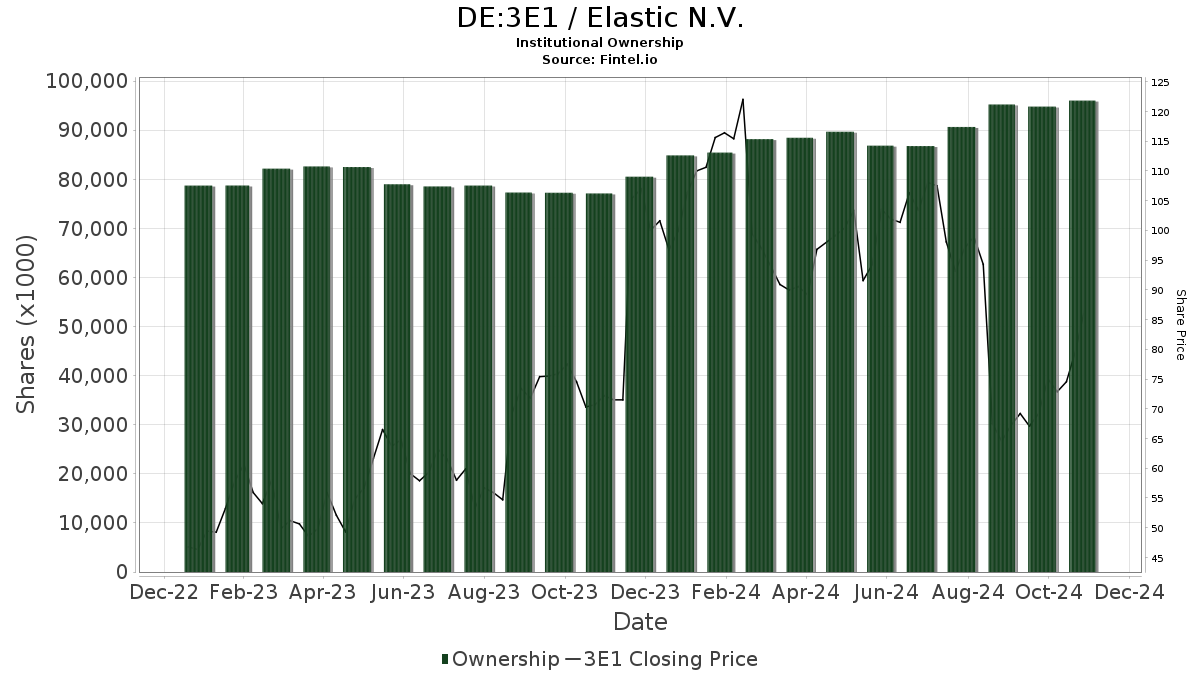

Institutional Ownership Trends

Currently, 739 funds or institutions are holding positions in Elastic N.V., reflecting a slight decrease of 12 owners, or 1.60%, in the past quarter. The average portfolio weight dedicated to 3E1 stands at 0.38%, an increase of 0.44%. Over the last three months, total shares held by institutions have dropped by 0.87%, totaling 96,024K shares.

Recent Changes by Major Shareholders

Baillie Gifford, a notable shareholder, currently holds 9,412K shares, equating to 9.16% ownership. This represents a decrease from 9,786K shares, a decline of 3.98%. The firm has reduced its allocation in 3E1 by 37.75% over the last quarter.

Another significant player, the Vanguard International Growth Fund Investor Shares (VWIGX), holds 5,658K shares, amounting to 5.51% ownership. Previously, this firm owned 5,943K shares, marking a decrease of 5.03% and a 30.51% cut in their portfolio allocation in 3E1 last quarter.

BlackRock retains 5,206K shares, which translates to 5.07% ownership. Meanwhile, JPMorgan Chase holds 3,924K shares, representing 3.82%. This is a considerable drop from their earlier holding of 4,595K shares, showing a decrease of 17.11%, and it also indicates a 96.40% reduction in their portfolio allocation for 3E1.

Voya Investment Management has 3,797K shares, or 3.70% ownership, also down from 4,558K shares, reflecting a 20.04% reduction. Their portfolio allocation in 3E1 decreased by 48.68% in the last quarter.

Fintel serves as a comprehensive investing research platform, catering to individual investors, traders, financial advisors, and small hedge funds. Our extensive data includes various elements such as fundamentals, analyst reports, ownership statistics, fund sentiment, options sentiment, and insider trading information.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.