Banco Santander’s Dividend Announcement

Banco Santander announced on February 19, 2024, that its board of directors had declared a regular semi-annual dividend of $0.10 per share ($0.19 annualized). This marked an increase from the previous dividend of $0.08 per share.

To be eligible for the dividend, shares must be acquired before the ex-dividend date of April 29, 2024. Shareholders as of April 30, 2024, will receive the payment on May 2, 2024.

At the current share price of $4.00, Banco Santander’s stock offers a dividend yield of 4.75%.

Fund Sentiment and Analyst Projections

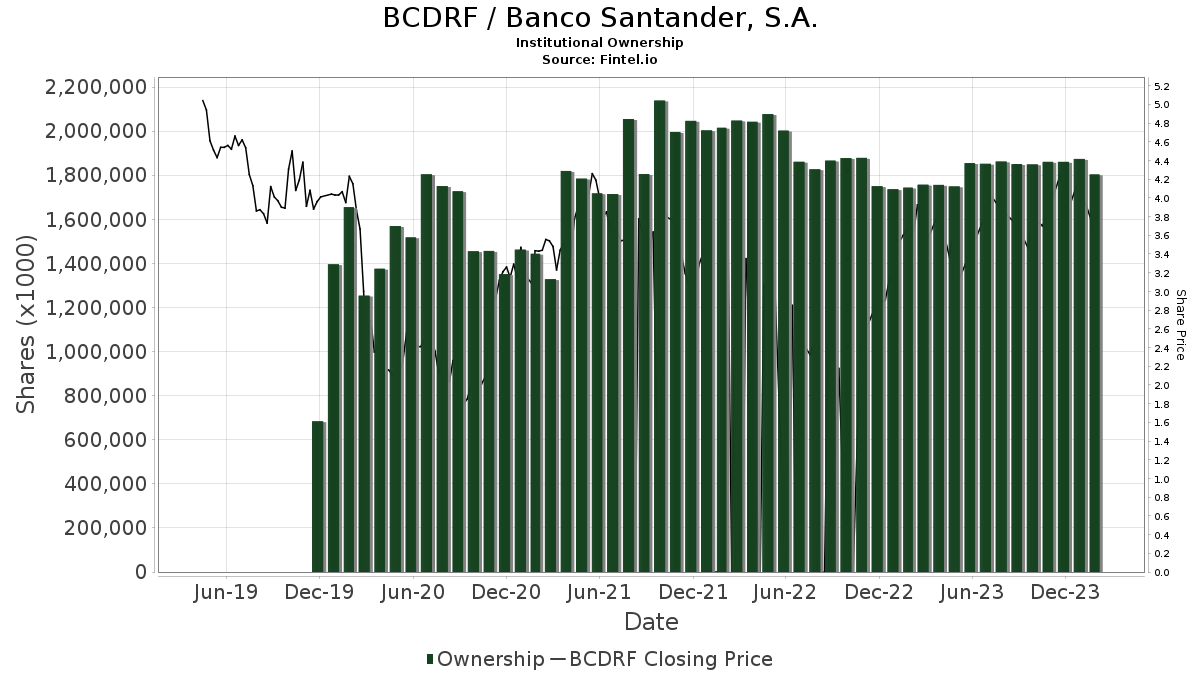

Reportedly, 442 funds or institutions hold positions in Banco Santander, marking a 4.49% increase in the last quarter. The average portfolio weight dedicated to $BCDRF stands at 0.47%, exhibiting a 2.23% rise. Institutional share ownership has grown by 1.13% in the last three months to 1,808,389K shares.

Analyst price forecasts indicate an estimated 30.44% increase, with an average one-year target price of $5.22. Forecasts range from $3.75 to $8.67.

Insights into Shareholder Activity

Institutional activity reveals varying trends. Dodge & Cox International Stock Fund, for instance, reduced its holdings by 7.28%, whereas Vanguard Developed Markets Index Fund Admiral Shares increased its stakes by 99.79%.

Similarly, iShares Core MSCI EAFE ETF saw a modest increase of 1.83% in its holdings, and Fidelity Series International Value Fund downsized its position by 4.71%. Dodge & Cox Global Stock Fund also decreased its allocation by 20.10%.

For investors interested in in-depth financial analyses, Fintel offers a robust platform catering to individual investors, traders, financial advisors, and small hedge funds. Their data encompasses fundamentals, analyst reports, ownership insights, and much more for informed decision-making.

It’s always fascinating to dive into the intricate world of market dynamics and explore how financial institutions navigate the ever-changing landscape of investments.

Remember, in the tumultuous sea of stocks, staying informed can be a buoy to guide your investment ship.