“`html

Tesla’s Stock Soars Amid Trump’s Return: What It Means for the EV Market

Tesla (NASDAQ:TSLA) shares have jumped nearly 40% over the past four trading sessions after Donald Trump returned to the White House. Although Trump has been skeptical of electric vehicles in the past, his growing relationship with Elon Musk could lead to new policies that favor the EV market. Musk’s influence could create a more supportive environment for Tesla moving forward.

Insights from Bank of America

Bank of America analyst John Murphy shared his perspective, stating, “A Trump administration could ease regulations, supporting TSLA’s growth trajectory.” He highlighted ongoing probes by the Biden administration into Tesla’s Full Self-Driving (FSD) system, suggesting that scrutiny might lessen under Trump.

Potential Changes in Regulation

Elon Musk has proposed a national framework for self-driving car regulations, which the Trump administration is open to. This could facilitate Tesla’s planned Robotaxi service launch in the coming year, a process that currently requires state-by-state approval.

Impact of Environmental Policies

Trump’s administration has shown little interest in climate change, which ironically could benefit Tesla. Easing environmental regulations might allow traditional automakers to delay their plans for electric vehicles, reducing competition against Tesla. Murphy noted, “This could help TSLA maintain its hold on the domestic EV market, especially as it plans to release new models with more affordable entry prices.”

Market Dynamics and Competitors

Another consideration is the Trump administration’s expected tougher stance on China. This could hinder some Tesla competitors from entering the U.S. EV market. However, some analysts caution that tariffs could provoke a response from Beijing. While Murphy acknowledges this risk, he believes Tesla would be less impacted compared to others if EV tax credits and subsidies are adjusted.

Analyst Ratings and Price Target

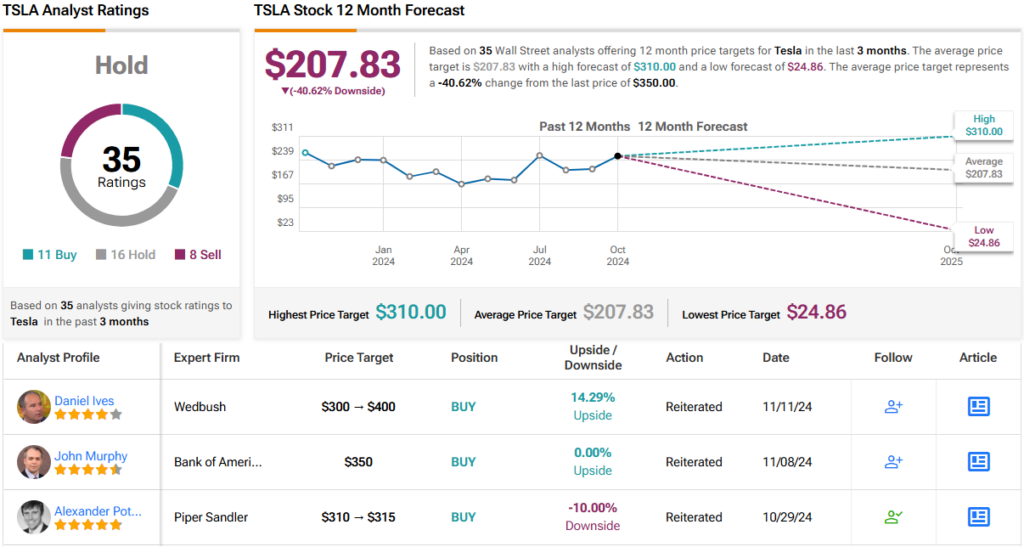

John Murphy rates Tesla shares as a Buy and has raised his price target from $265 to $350. With TSLA currently at this level, he may soon need to reevaluate his forecast.

Wall Street’s Overall Sentiment

How does the broader market see Tesla? Currently, Tesla stock has a Hold consensus rating, based on 16 Holds, 11 Buys, and 8 Sells. Analysts predict a potential decline, with an average price target of $207.83, suggesting a ~41% drop over the next year. (See Tesla stock forecast)

To discover valuable stock trading ideas, visit TipRanks’ Best Stocks to Buy, a resource that consolidates TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. This content is for informational purposes only. It is crucial to conduct your own analysis before making any investment.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`