Stock Splits: Potential Candidates for 2025 from Bank of America

The trend of stock splits has gained traction, especially in the technology sector, over recent years. Although stock splits do not alter a company’s fundamentals or its market value, they can elicit strong emotional reactions from investors. Increased liquidity allows for a more extensive shareholder base, positively impacting share prices. Historically, stocks that undergo splits have seen growth between 25% and 30% in the year that follows, considerably surpassing the benchmark S&P 500, which averages annual growth of 10% to 12%.

Recently, Bank of America pinpointed 23 companies as potential candidates for a stock split in 2025. Here, we focus on two notable picks from this list.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox each market day. Sign Up For Free »

Meta Platforms: A Strong Candidate

Meta Platforms (NASDAQ: META) is a social media and digital advertising powerhouse that shows promise despite current market volatility. After a nearly 13.6% decline from its 52-week high of $740.90 in February due to escalating macroeconomic pressures, Meta’s shares are still up 9.3% in 2025.

Over the past three years, Meta’s stock has surged by 219.8%. Remarkably, the company has not yet executed a stock split, positioning it as a strong candidate for one. In fiscal year 2024, which ended on December 31, 2024, revenues reached $164.5 billion, a 22% increase year over year. Operating profit surged 48% to $69.4 billion, driven by its vast Family of Apps ecosystem (including Instagram, Facebook, Messenger, and WhatsApp), which engages nearly 3.3 billion daily users—over 40% of the global population.

Moreover, Meta leverages its advanced artificial intelligence (AI) to enhance advertising performance and user interaction. The company has implemented the Andromeda machine learning system, developed with Nvidia, to refine ad personalization. This initiative has improved ad quality by 8% and is preparing Meta for larger advertising volumes moving forward.

Additionally, Meta is leading the charge in the agentic AI sector, with its Meta AI assistant currently utilized by over 700 million active users monthly. The management anticipates growing this user base to over 1 billion by 2025, resulting in significant data acquisition to enhance its AI offerings and create new revenue streams.

With planned capital expenditures of $60 billion to $65 billion in 2025, much of which is designated for AI infrastructure, concerns about short-term ROI are understandable. However, these investments hold the potential for substantial long-term gains. Considering these favorable conditions and the likelihood of a forthcoming stock split, Meta may emerge as a favorable choice for savvy investors.

Netflix: A Veteran in the Streaming Market

Another company positioned for a possible stock split in 2025 is leading streaming service Netflix (NASDAQ: NFLX), nearly a decade since its 7-for-1 stock split in 2015.

As of the end of fiscal year 2024, Netflix reported over 300 million paid memberships. Considering multiple viewers per household, the company estimates its global audience at more than 700 million individuals. This extensive paid subscriber base allows Netflix to benefit from economies of scale in content development, especially compared to competitors like Walt Disney’s Disney+ and Warner Bros. Discovery’s HBO, which have 100 million and 95.8 million subscribers, respectively.

Netflix’s advertising revenue is also demonstrating growth; ad-supported memberships increased sequentially by 30% in the fourth quarter of fiscal year 2024. Notably, view hours for these plans match those of non-ad-supported options. In 2025, Netflix plans to leverage high engagement rates to enhance the appeal of ad-supported tiers for advertisers.

This robust engagement has translated into strong financial performance for Netflix. The company achieved revenue growth of 16% year over year to $39 billion. Additionally, operating margins improved by 610 basis points to 26.7%. Notably, net income rose by 61% year over year to $8.71 billion. Netflix also maintained high cash generation, with $7.4 billion in operating cash flow and $6.9 billion in free cash flow during FY 2024. Furthermore, the company is focused on returning value to shareholders, having repurchased $6.2 billion in shares in FY 2024.

Given Netflix’s solid business model, favorable financial metrics, and elevated share price, the stock appears to be a wise investment as a potential split approaches in 2025.

Investment Consideration for Meta Platforms

Before considering an investment in Meta Platforms, investors should note the following:

The Motley Fool Stock Advisor analyst team has recently identified what they believe are the 10 best stocks for investors, and Meta Platforms does not rank among them. The selected 10 stocks are expected to deliver significant returns over the next several years.

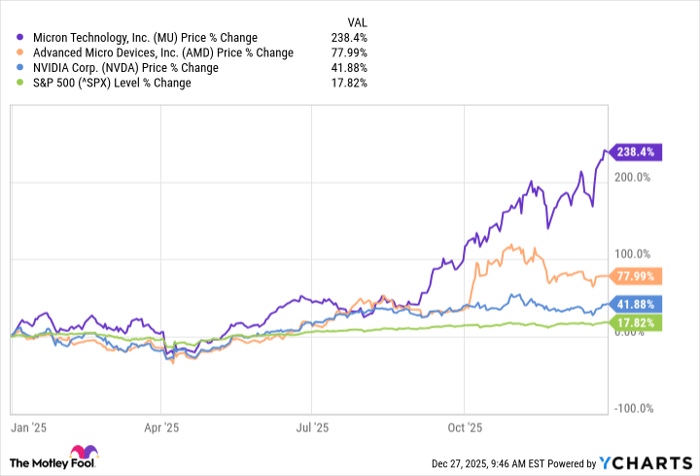

For instance, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, that investment would have grown to $655,630!

Stock Advisor offers a straightforward guide to successful investing, including strategies for portfolio-building, regular analyst updates, and two new stock recommendations each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since its inception in 2002.* Join Stock Advisor to access the latest top 10 list.

See the 10 stocks »

*Stock Advisor returns as of March 10, 2025

Bank of America is an advertising partner of Motley Fool Money. Randi Zuckerberg, a former director of market development for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on the board of directors for The Motley Fool. Manali Pradhan holds no positions in any mentioned stock. The Motley Fool is invested in and recommends Bank of America, Meta Platforms, Netflix, Nvidia, Walt Disney, and Warner Bros. Discovery. For more information, please refer to The Motley Fool’s disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily represent those of Nasdaq, Inc.