Bank of America Outpaces Peers Amid Volatile Market Conditions

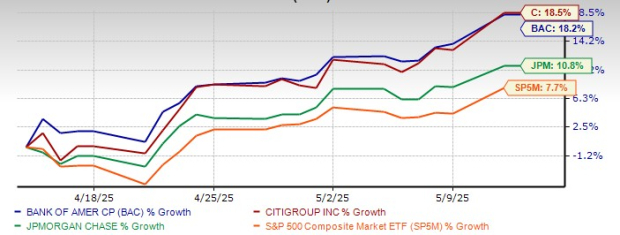

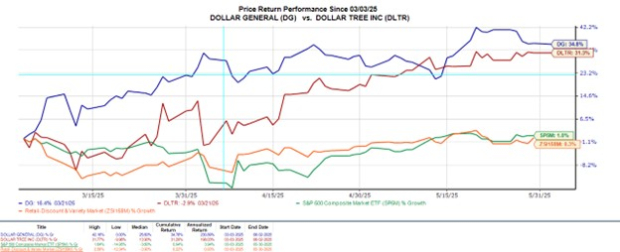

Shares of Bank of America (BAC) have risen 18.2% in the past month, outperforming the S&P 500 Index. In comparison, JPMorgan (JPM) and Citigroup (C) saw gains of 10.8% and 18.5%, respectively.

BAC One-Month Price Performance

Image Source: Zacks Investment Research

Over the last month, the U.S. stock market faced significant volatility driven by trade policy developments and Federal Reserve monetary decisions. Early in the month, investor sentiment declined due to escalating trade tensions with China, pushing the Nasdaq into bear market territory. However, a brief truce in tariffs between the U.S. and China led to a surge in equities. Recently, the Dow Jones, S&P 500, and Nasdaq experienced their largest single-day gains in over a month, marking a strong recovery amid easing trade concerns.

In this climate of uncertainty, we assess the future performance outlook for BAC stock.

Key Considerations for Bank of America

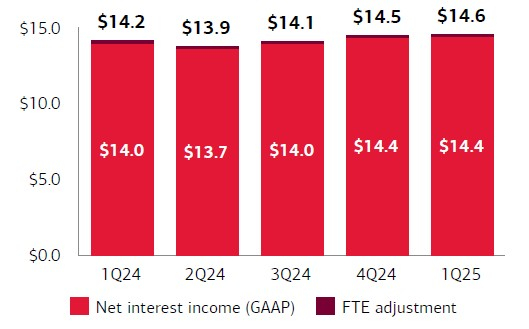

Interest Rate Trajectory: When the Federal Reserve cut interest rates by 100 basis points last year, Bank of America’s net interest income (NII) benefited. Factors such as fixed-rate asset repricing, increased loan balances, and a gradual decline in deposit costs contributed to the sequential increase in NII since Q2 2024, despite the pressures of lower interest rates.

Bank of America’s Net Interest Income (FTE, $B)

Image Source: Bank of America Corp.

During the May 6-7 FOMC meeting, the Fed kept interest rates stable at 4.25-4.5%. Fed Chair Jerome Powell indicated a cautious approach, suggesting no immediate changes to monetary policy are required until the effects of Trump’s tariffs on employment and inflation become clearer. Consequently, interest rates may remain elevated for an extended period.

Looking ahead, Bank of America expects NII to increase in 2025, buoyed by steady loan demand, elevated interest rates, and strong deposit balances. The company anticipates sequential growth in NII for all quarters this year, with the potential to reach between $15.5 billion and $15.7 billion in Q4. Thus, a 6-7% rise in NII is forecasted for 2025.

Branch Expansion and Digital Growth: The company is strategically expanding its branch network across the U.S. to enhance customer relationships and penetrate new markets, with plans to open over 165 new financial centers by 2026. This initiative follows earlier expansion announcements made in June 2023, focusing on markets like Omaha, Boise, and Milwaukee.

Bank of America’s emphasis on branching out into new markets aligns with industry trends aimed at optimizing networks to strengthen customer ties and seize new business opportunities. Blending digital services with in-person capabilities may offer Bank of America a competitive edge in the evolving banking sector.

The company also intends to invest heavily in technology to improve customer engagement and boost cross-selling opportunities.

Digital Adoption

Image Source: Bank of America Corp.

Strong Balance Sheet and Liquidity: Bank of America’s liquidity remains robust. As of March 31, 2025, the average global liquidity sources stood at $942 billion. Furthermore, the firm enjoys investment-grade credit ratings of A1, A-, and AA- from Moody’s, S&P Global Ratings, and Fitch Ratings, respectively, ensuring ease of access to debt markets.

The bank continues to reward shareholders. After passing the 2024 stress test, Bank of America raised its quarterly dividend by 8% to 26 cents per share. Over the past five years, dividends swelled four times, yielding an annualized growth rate of 8.84%, with a current payout ratio of 31% of earnings.

In July 2024, the company authorized a $25 billion stock repurchase program set to commence on August 1, 2024. By March 31, 2025, approximately $14.4 billion of this buyback authorization remained, with intentions to repurchase nearly $4.5 billion in shares each quarter going forward.

Challenges in Investment Banking: Bank of America has faced hurdles in its investment banking (IB) business since global deal activity slowed in early 2022. The company experienced a sharp drop in total IB fees—45.7% in 2022 and 2.4% in 2023—though a reversal occurred in 2024 with a year-over-year increase of 31.4% in IB fees.

Despite anticipated improvements in mergers and acquisitions (M&A) following President Trump’s re-election and the hope for favorable regulatory changes, the expected surge failed to materialize. Nonetheless, the first quarter of 2025 saw better-than-expected performance, with the Global Banking division achieving stable IB fees of $847 million, offset by recovering advisory revenues and increased debt underwriting income.

Deal-making activities have recently stalled due to uncertainties surrounding tariffs and trade wars, leading to heightened market volatility. As a result, companies are reconsidering M&A ambitions despite stabilizing rates and ample capital for investment. This trend could negatively impact the IB operations of Bank of America, JPMorgan, and Citigroup, which rely heavily on M&A advisory fees.

However, as conditions begin to improve for deal-making, global M&A activity is projected to rise. This should ultimately support Bank of America’s growth in IB fees, supported by a strong IB pipeline and an active M&A market.

Deteriorating Asset Quality: Bank of America has seen a decline in asset quality. Following negative provisions in 2021, there was a significant increase in provisions over the subsequent years, with a 115.4% jump in 2022, 72.8% in 2023, and 32.5% in 2024. Additionally, net charge-offs grew by 74.9% in 2023 and 58.8% in 2024, trends that continued into Q1 2025.

Given that interest rates are unlikely to decrease significantly soon, borrowers’ credit profiles may suffer. The company is closely monitoring the effects of persistent high rates and quantitative tightening on its financial health.

“`html

Bank of America Faces Mixed Forecast and Investment Challenges

Bank of America’s (BAC) asset quality is expected to remain subdued due to the ongoing economic uncertainty and the impact of tariffs on inflation. This situation continues to affect its overall loan portfolio.

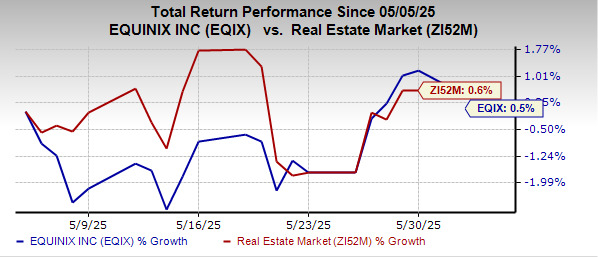

Analysts Remain Optimistic About BAC

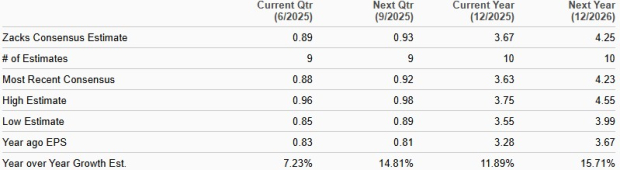

In the last month, the Zacks Consensus Estimate for BAC’s earnings in 2025 has slightly increased to $3.67. Conversely, the estimate for 2026 earnings has decreased to $4.25. Currently, analysts project an 11.9% growth for 2025 and 15.7% for 2026.

Bank of America Earnings Estimates

Image Source: Zacks Investment Research

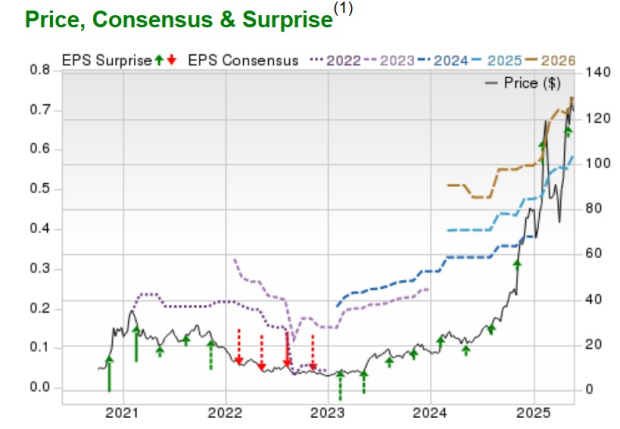

Assessing Bank of America’s Valuation

Bank of America stock is currently trading at a 12-month trailing price-to-tangible book (P/TB) ratio of 1.64X, which is below the industry average of 2.61X. This suggests that BAC is undervalued relative to its peers.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

Compared with JPMorgan’s P/TB of 2.75X, BAC appears less expensive, although it trades at a premium to Citigroup’s 0.84X P/TB.

Investment Outlook for Bank of America

With a global presence and diversified revenue streams, Bank of America is well-positioned for organic growth. Ongoing branch openings and high long-term interest rates, alongside technological advancements aimed at customer retention, bolster its growth potential. The bullish sentiment from analysts and attractive valuation further enhance the stock’s appeal.

Nonetheless, BAC grapples with near-term challenges. Increased regulatory capital requirements under Basel III, macroeconomic uncertainties due to tariffs, and potential interest rate cuts add to investor caution. Issues like weak performance in the Investment Banking sector and declining asset quality remain concerns. Investors may want to hold off until there is more clarity on these macroeconomic factors.

Existing shareholders are advised to maintain their positions for potential long-term gains. Currently, Bank of America holds a Zacks Rank #3 (Hold).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`