Shares of Bank of Montreal BMO plunged 9.5% in response to its second-quarter fiscal 2024 (ended Apr 30) results. Adjusted earnings per share of C$2.59 declined 10.4% year over year.

A significant jump in provision for credit losses and lower net interest income (NII) primarily hurt the results. However, increases in non-interest income, higher loans and deposit balance and slightly lower expenses acted as tailwinds.

After considering non-recurring items, net income was C$1.87 billion ($1.38 billion), which surged 81.3% from the year-ago quarter.

Revenues Improve, Expenses Down

Total revenues (on an adjusted basis), net of insurance claims, commissions and changes in policy benefit liabilities (CCPB), were C$7.99 billion ($5.89 billion), up 2.5% year over year.

NII declined 6.1% year over year to C$4.53 billion ($3.34 billion). On the other hand, non-interest income came in at C$3.46 billion ($2.55 billion), up 16.3%.

Adjusted non-interest expenses decreased marginally to C$4.63 billion ($3.41 billion).

The adjusted efficiency ratio (net of CCPB) was 58%, down from 59.1% as of Apr 30, 2023.

Provision for credit losses (adjusted) was C$705 million ($519.5 million) in the reported quarter, up significantly from the year-ago quarter.

Loans & Deposits Rise

As of Apr 30, 2024, total assets were C$1.37 trillion ($1 trillion), up 3.7% from the prior-quarter end.

Bank of Montreal’s total net loans grew 2.3% sequentially to C$656.8 billion ($478.7 billion). Total deposits increased 2.6% to C$937.6 billion ($683.4 billion).

Profitability Ratios Deteriorate, Capital Ratios Improve

Bank of Montreal’s return on common equity (as adjusted) was 10.9% in the fiscal second quarter compared with 12.6% on Apr 30, 2023. Adjusted return on tangible common equity was 14.6% compared with 17.3% in the year-ago quarter.

As of Apr 30, 2024, the Common Equity Tier-I ratio was 13.1%, up from 12.2% a year ago. The Tier-I capital ratio was 14.9% compared with the previous year’s 13.9%.

Our Take

Bank of Montreal’s focus and efforts align with its organic and business restructuring strategies, and are anticipated to support revenues in the upcoming period. However, elevated expenses and an uncertain macroeconomic backdrop are headwinds.

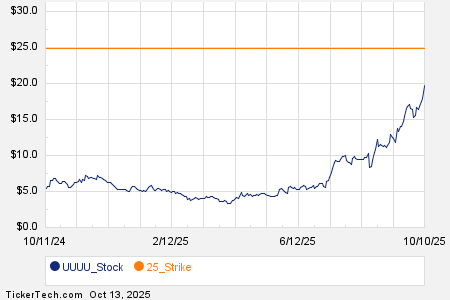

Bank Of Montreal Price, Consensus and EPS Surprise

Bank Of Montreal price-consensus-eps-surprise-chart | Bank Of Montreal Quote

Currently, BMO carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Canadian Banks

The Bank of Nova Scotia‘s BNS second-quarter fiscal 2024 (ended Apr 30) adjusted net income was C$2.11 billion ($1.55 billion), which declined 2.6% year over year.

A rise in expenses and a surge in provisions for credit losses hurt the results. However, higher revenues, an increase in loan balance and solid capital ratios were tailwinds for BNS.

Toronto-Dominion Bank TD reported second-quarter fiscal 2024 (ended Apr 30) adjusted net income of C$3.79 billion ($2.79 billion), which increased 2.2% from the prior-year quarter.

Results benefited from higher non-interest income and growth in loans and deposit balance. However, an increase in expenses and provision for credit losses were the undermining factors for TD.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Toronto Dominion Bank (The) (TD) : Free Stock Analysis Report

Bank of Nova Scotia (The) (BNS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.