The Dividend Declaration

February 12, 2024 marked the day Bank of N.T. Butterfield & Son’s board of directors declared a regular quarterly dividend of $0.44 per share ($1.76 annualized), maintaining the previous quarter’s dividend payout. For shareholders to benefit from this declaration, shares must be purchased before the ex-dividend date on February 23, 2024. Those recorded as shareholders by February 26, 2024, are set to receive the payment come March 11, 2024.

The Numbers Breakdown

At the current share price of $30.37, the stock’s dividend yield stands at 5.80%. Reflecting on the past five years, the dividend yield has averaged 5.70%. It touched its lowest at 4.31% and peaked at an impressive 11.57%. Evidently, the current dividend yield is 0.08 standard deviations above the historical average. Additionally, the company’s dividend payout ratio stands at 0.38, indicating a noteworthy financial stance.

Ownership and Analyst Insights

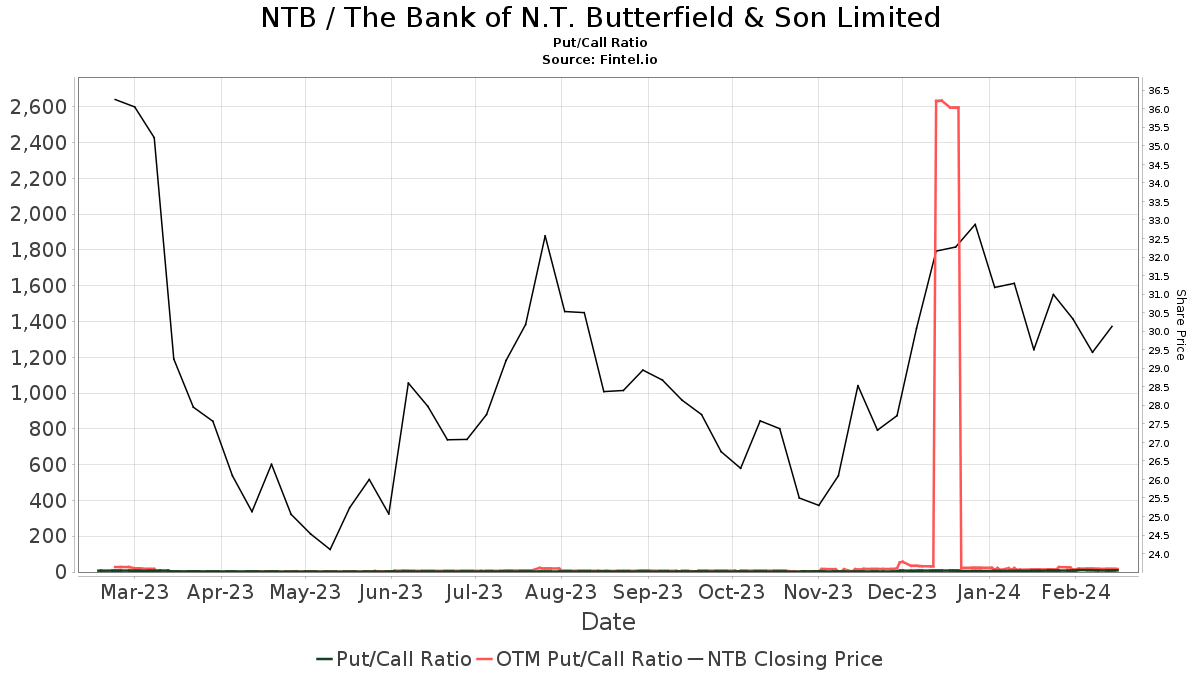

Amid the dividend announcement, a decrease of 99 owners or 26.19% in funds reporting positions in Bank of N.T. Butterfield & Son was observed in the last quarter. However, the average portfolio weight of all funds dedicated to NTB saw a promising increase of 7.26%. It’s imperative to note that the put/call ratio of NTB is at 9.18, signaling a bearish outlook. Meanwhile, analysts are forecasting an impressive 20.24% upside for the company.

Insights into Shareholder Movements

Various institutional investors exhibited interesting dynamics regarding their holdings in the company. Rovida Advisors, Adage Capital Partners Gp, L.l.c., Davis Selected Advisers, Hotchkis & Wiley Capital Management, and Nuveen Asset Management showcased diverse changes in their portfolio allocation, representing a mix of decreases and increases in their ownership percentages.

Journey of The Bank of N.T. Butterfield & Son

The Bank of N.T. Butterfield & Son is a financial force that offers a wide array of banking and wealth management services across several countries and territories. From Bermuda to the Cayman Islands, Guernsey, Jersey, The Bahamas, Switzerland, Singapore, and the United Kingdom, the company’s presence endows it with a unique position in the global financial landscape.

Bank of N.T. Butterfield & Son’s history of providing banking and wealth management solutions to a diverse clientele adds an additional layer to understanding its operations and value in the financial arena.

Undoubtedly, the company’s commitment to its shareholders is mirrored in its consistent engagement and provision of financial insights that yield positive returns. The future lies as an open sea full of various twists and turns, and the company must chart its course with mindfulness and agility to maintain its standing.